Answered step by step

Verified Expert Solution

Question

1 Approved Answer

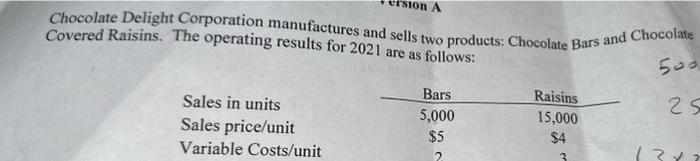

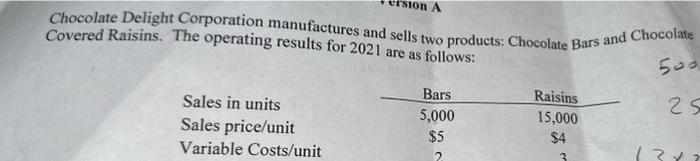

i need the answer for 7,8,9,10 fixed cost is $75000 Chocolate Delight Corporation manufactures and sells two products: Chocolate Bars and Chocolate Covered Raisins. The

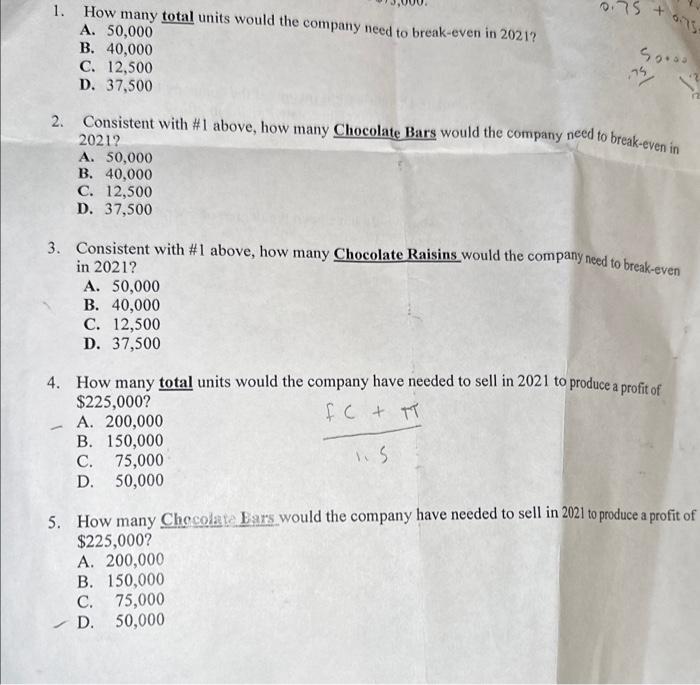

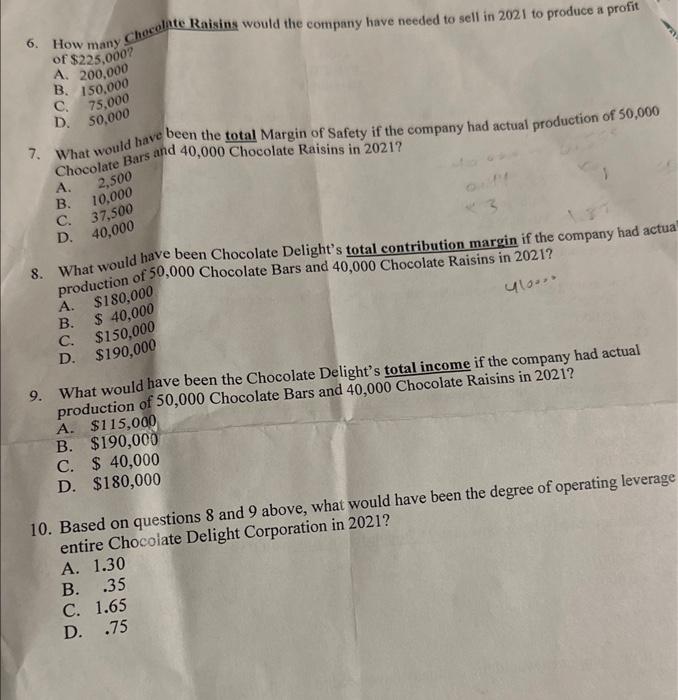

i need the answer for 7,8,9,10

fixed cost is $75000

Chocolate Delight Corporation manufactures and sells two products: Chocolate Bars and Chocolate Covered Raisins. The operating results for 2021 are as follows: 1. How many total units would the company need to break-even in 2021? A. 50,000 B. 40,000 C. 12,500 D. 37,500 2. Consistent with #1 above, how many Chocolate Bars would the company need to break-even in 2021? A. 50,000 B. 40,000 C. 12,500 D. 37,500 3. Consistent with #1 above, how many Chocolate Raisins would the company need to break-even in 2021? A. 50,000 B. 40,000 C. 12,500 D. 37,500 4. How many total units would the company have needed to sell in 2021 to produce a profit of $225,000 ? A. 200,000 B. 150,000 C. 75,000 D. 50,000 5. How many Checolate Ears. would the company have needed to sell in 2021 to produce a profit of $225,000? A. 200,000 B. 150,000 C. 75,000 D. 50,000 6. How many checelate Raisins would the company have needed to sell in 2021 to produce a profit of $225,0007 A. 200,000 B. 150,000 C. 75,000 7. What would have been the total Margin of Safety if the company had actual production of 50,000 Chocolate Bars and 40,000 Chocolate Raisins in 2021? A. 2,500 B. 10,000 C. 37,500 8. What would have been Chocolate Delight's total contribution margin if the company had actu production of 50,000 Chocolate Bars and 40,000 Chocolate Raisins in 2021? A. $180,000 B. $40,000 C. $150,000 D. $190,000 9. What would have been the Chocolate Delight's total income if the company had actual production of 50,000 Chocolate Bars and 40,000 Chocolate Raisins in 2021 ? A. $115,000 B. $190,000 C. $40,000 D. $180,000 10. Based on questions 8 and 9 above, what would have been the degree of operating leverag entire Chocolate Delight Corporation in 2021? A. 1.30 B. .35 C. 1.65 D. .75 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started