Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need the answer for question a untill g. explanation too. Lysa Manufacturing Pte Ltd LM is a facemask manufacturing company located at Lost Angeles.

i need the answer for question a untill g. explanation too.

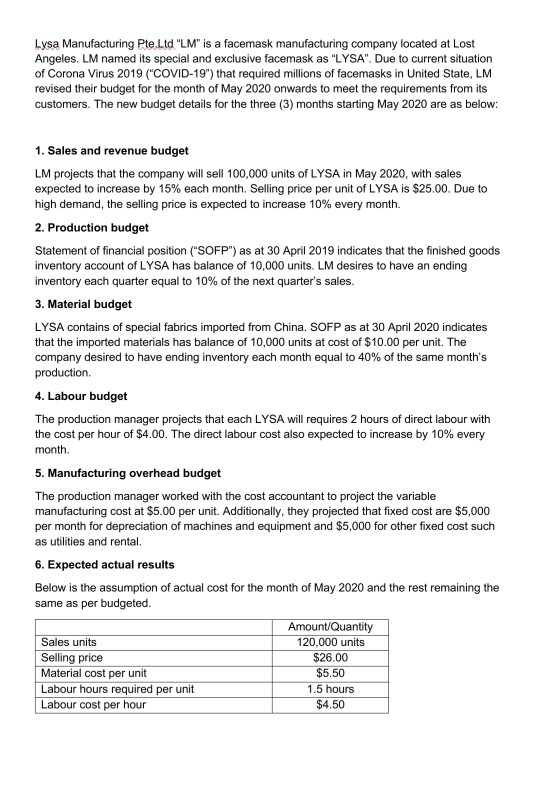

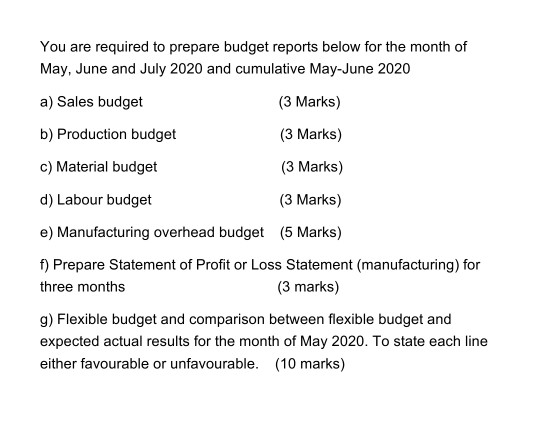

Lysa Manufacturing Pte Ltd "LM" is a facemask manufacturing company located at Lost Angeles. LM named its special and exclusive facemask as "LYSA". Due to current situation of Corona Virus 2019 ("COVID-19") that required millions of facemasks in United State, LM revised their budget for the month of May 2020 onwards to meet the requirements from its customers. The new budget details for the three (3) months starting May 2020 are as below: 1. Sales and revenue budget LM projects that the company will sell 100,000 units of LYSA in May 2020, with sales expected to increase by 15% each month. Selling price per unit of LYSA is $25.00. Due to high demand, the selling price is expected to increase 10% every month. 2. Production budget Statement of financial position ("SOFP") as at 30 April 2019 indicates that the finished goods inventory account of LYSA has balance of 10,000 units. LM desires to have an ending inventory each quarter equal to 10% of the next quarter's sales. 3. Material budget LYSA contains of special fabrics imported from China. SOFP as at 30 April 2020 indicates that the imported materials has balance of 10,000 units at cost of $10.00 per unit. The company desired to have ending inventory each month equal to 40% of the same month's production 4. Labour budget The production manager projects that each LYSA will requires 2 hours of direct labour with the cost per hour of $4.00. The direct labour cost also expected to increase by 10% every month 5. Manufacturing overhead budget The production manager worked with the cost accountant to project the variable manufacturing cost at $5.00 per unit. Additionally, they projected that fixed cost are $5,000 per month for depreciation of machines and equipment and $5,000 for other fixed cost such as utilities and rental 6. Expected actual results Below is the assumption of actual cost for the month of May 2020 and the rest remaining the same as per budgeted. Amount/Quantity Sales units 120,000 units Selling price $26.00 Material cost per unit $5.50 Labour hours required per unit 1.5 hours Labour cost per hour $4.50 You are required to prepare budget reports below for the month of May, June and July 2020 and cumulative May-June 2020 a) Sales budget (3 Marks) (3 Marks) b) Production budget c) Material budget d) Labour budget (3 Marks) (3 Marks) e) Manufacturing overhead budget (5 Marks) f) Prepare Statement of Profit or Loss Statement (manufacturing) for three months (3 marks) g) Flexible budget and comparison between flexible budget and expected actual results for the month of May 2020. To state each line either favourable or unfavourable. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started