Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need the answer for question a,b,c,d and explaination also. tq Fans Electric Motor Pte. Ltd. manufactures electric motors for commercial use. The company produces

i need the answer for question a,b,c,d and explaination also. tq

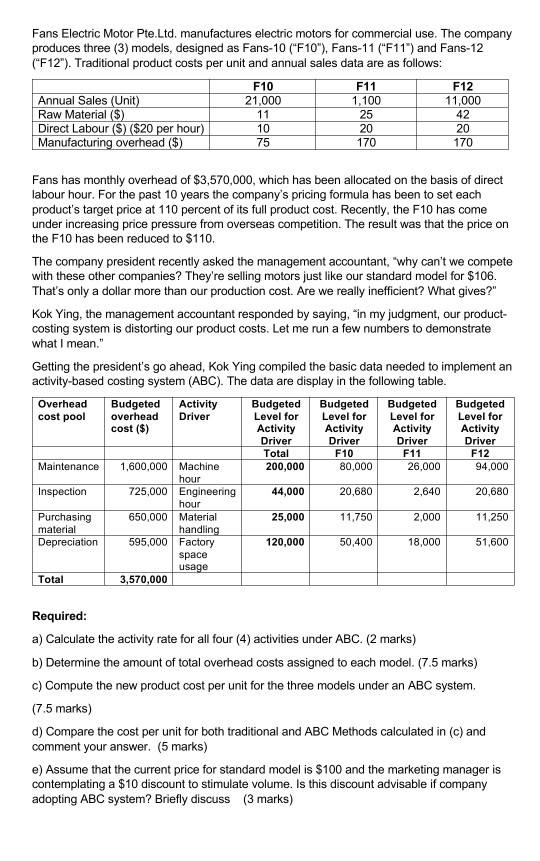

Fans Electric Motor Pte. Ltd. manufactures electric motors for commercial use. The company produces three (3) models, designed as Fans-10 ("F10"), Fans-11 ("F11") and Fans-12 ("F12"). Traditional product costs per unit and annual sales data are as follows: F10 F11 F12 Annual Sales (Unit) 21,000 1,100 11,000 Raw Material ($) 11 25 42 Direct Labour ($) ($20 per hour) 10 20 20 Manufacturing overhead ($) 75 170 170 Fans has monthly overhead of $3,570,000, which has been allocated on the basis of direct labour hour. For the past 10 years the company's pricing formula has been to set each product's target price at 110 percent of its full product cost. Recently, the F10 has come under increasing price pressure from overseas competition. The result was that the price on the F10 has been reduced to $110. The company president recently asked the management accountant, "why can't we compete with these other companies? They're selling motors just like our standard model for $106. That's only a dollar more than our production cost. Are we really inefficient? What gives?" Kok Ying, the management accountant responded by saying, in my judgment, our product- costing system is distorting our product costs. Let me run a few numbers to demonstrate what I mean." Getting the president's go ahead, Kok Ying compiled the basic data needed to implement an activity-based costing system (ABC). The data are display in the following table. Overhead Budgeted Activity Budgeted Budgeted Budgeted Budgeted cost pool overhead Driver Level for Level for Level for Level for cost ($) Activity Activity Activity Activity Driver Driver Driver Driver Total F10 F11 F12 Maintenance 1,600,000 Machine 200,000 80,000 26,000 94,000 hour Inspection 725,000 Engineering 44,000 20,680 2,640 20,680 hour Purchasing 650,000 Material 25,000 11,750 2,000 11.250 material handling Depreciation 595,000 Factory 120,000 50,400 18,000 51,600 space usage Total 3,570,000 Required: a) Calculate the activity rate for all four (4) activities under ABC. (2 marks) b) Determine the amount of total overhead costs assigned to each model. (7.5 marks) c) Compute the new product cost per unit for the three models under an ABC system. (7.5 marks) d) Compare the cost per unit for both traditional and ABC Methods calculated in (c) and comment your answer. (5 marks) e) Assume that the current price for standard model is $100 and the marketing manager is contemplating a $10 discount to stimulate volume. Is this discount advisable if company adopting ABC system? Briefly discussStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started