Answered step by step

Verified Expert Solution

Question

1 Approved Answer

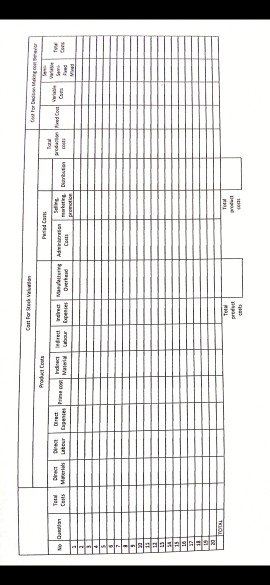

i need the answer for question a,b,c,d,e by using the table(pic 3) No, Question, Direct material, direct labour, direct expenses, prime cost, indirect material, indirect

i need the answer for question a,b,c,d,e by using the table(pic 3)

No, Question, Direct material, direct labour, direct expenses, prime cost, indirect material, indirect labour, indirect expenses, manufacturing overhead, administration cost, selling marketing promotion, distribution, total production costs, fixed cost, variable costs, semi-variable semi-fixed mixed costs, total costs

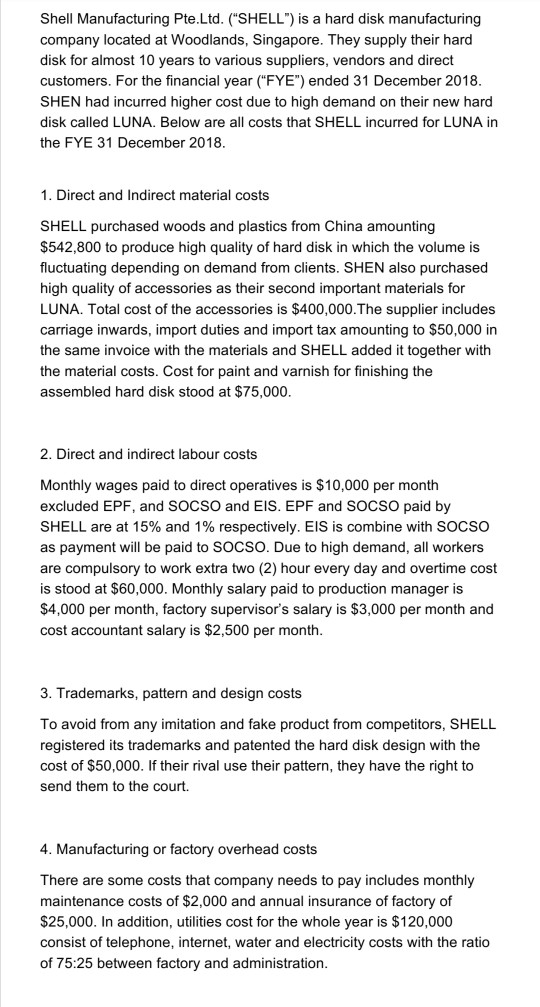

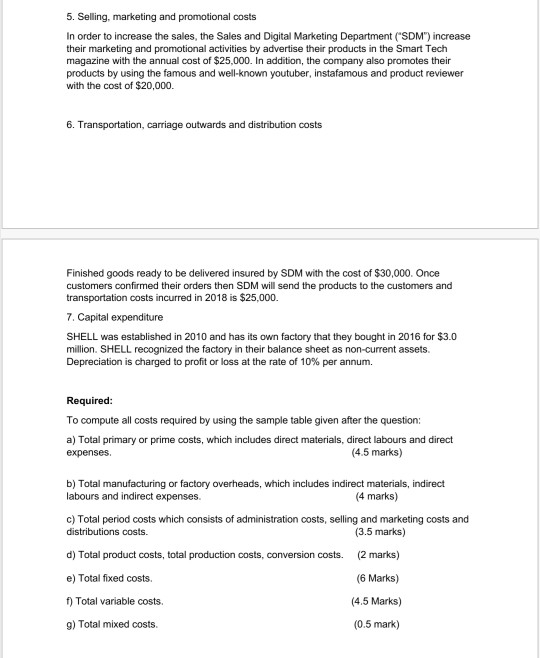

Shell Manufacturing Pte.Ltd. ("SHELL") is a hard disk manufacturing company located at Woodlands, Singapore. They supply their hard disk for almost 10 years to various suppliers, vendors and direct customers. For the financial year ("FYE") ended 31 December 2018. SHEN had incurred higher cost due to high demand on their new hard disk called LUNA. Below are all costs that SHELL incurred for LUNA in the FYE 31 December 2018. 1. Direct and Indirect material costs SHELL purchased woods and plastics from China amounting $542,800 to produce high quality of hard disk in which the volume is fluctuating depending on demand from clients. SHEN also purchased high quality of accessories as their second important materials for LUNA. Total cost of the accessories is $400,000. The supplier includes carriage inwards, import duties and import tax amounting to $50,000 in the same invoice with the materials and SHELL added it together with the material costs. Cost for paint and varnish for finishing the assembled hard disk stood at $75,000. 2. Direct and indirect labour costs Monthly wages paid to direct operatives is $10,000 per month excluded EPF, and SOCSO and EIS. EPF and SOCSO paid by SHELL are at 15% and 1% respectively. EIS is combine with SOCSO as payment will be paid to SOCSO. Due to high demand, all workers are compulsory to work extra two (2) hour every day and overtime cost is stood at $60,000. Monthly salary paid to production manager is $4,000 per month, factory supervisor's salary is $3,000 per month and cost accountant salary is $2,500 per month. 3. Trademarks, pattern and design costs To avoid from any imitation and fake product from competitors, SHELL registered its trademarks and patented the hard disk design with the cost of $50,000. If their rival use their pattern, they have the right to send them to the court. 4. Manufacturing or factory overhead costs There are some costs that company needs to pay includes monthly maintenance costs of $2,000 and annual insurance of factory of $25,000. In addition, utilities cost for the whole year is $120,000 consist of telephone, internet, water and electricity costs with the ratio of 75:25 between factory and administration. 5. Selling, marketing and promotional costs In order to increase the sales, the Sales and Digital Marketing Department ("SDM") increase their marketing and promotional activities by advertise their products in the Smart Tech magazine with the annual cost of $25,000. In addition, the company also promotes their products by using the famous and well-known youtuber instafamous and product reviewer with the cost of $20,000 6. Transportation, carriage outwards and distribution costs Finished goods ready to be delivered insured by SDM with the cost of $30,000. Once customers confirmed their orders then SDM will send the products to the customers and transportation costs incurred in 2018 is $25,000. 7. Capital expenditure SHELL was established in 2010 and has its own factory that they bought in 2016 for $3.0 million. SHELL recognized the factory in their balance sheet as non-current assets. Depreciation is charged to profit or loss at the rate of 10% per annum. Required: To compute all costs required by using the sample table given after the question: a) Total primary or prime costs, which includes direct materials, direct labours and direct expenses. (4.5 marks) b) Total manufacturing or factory overheads, which includes indirect materials, indirect labours and indirect expenses. (4 marks) c) Total period costs which consists of administration costs, selling and marketing costs and distributions costs. (3.5 marks) d) Total product costs, total production costs, conversion costs. (2 marks) e) Total fixed costs. (6 Marks) f) Total variable costs. (4.5 Marks) 9) Total mixed costs. (0.5 mark) Cart For Who Product Coats V Now Total Cents Direct Miel Direct Indirect Mall Pied Cars rect Indirect Me Adres Seling Labour perses Own ne Durbu Coats promotion Towe Labour women Wired Cool Verte Sources 2 11 13 19 16 17 11 22 TOTAL TOM pro wellStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started