Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the answer of ci and cii thx (i) Stock K had just paid a dividend of $5 per share this morning. The plowback

I need the answer of ci and cii thx

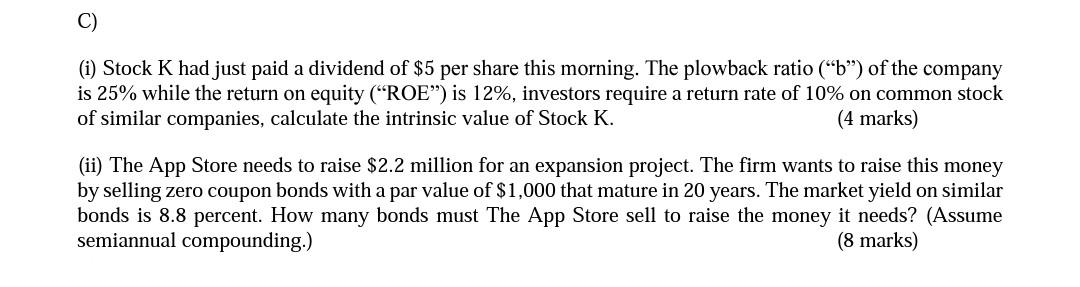

(i) Stock K had just paid a dividend of $5 per share this morning. The plowback ratio ("b") of the company is 25% while the return on equity ("ROE") is 12%, investors require a return rate of 10% on common stock of similar companies, calculate the intrinsic value of Stock K. (4 marks) (ii) The App Store needs to raise $2.2 million for an expansion project. The firm wants to raise this money by selling zero coupon bonds with a par value of $1,000 that mature in 20 years. The market yield on similar bonds is 8.8 percent. How many bonds must The App Store sell to raise the money it needs? (Assume semiannual compounding.) (8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started