I need the answer of the last two pictures

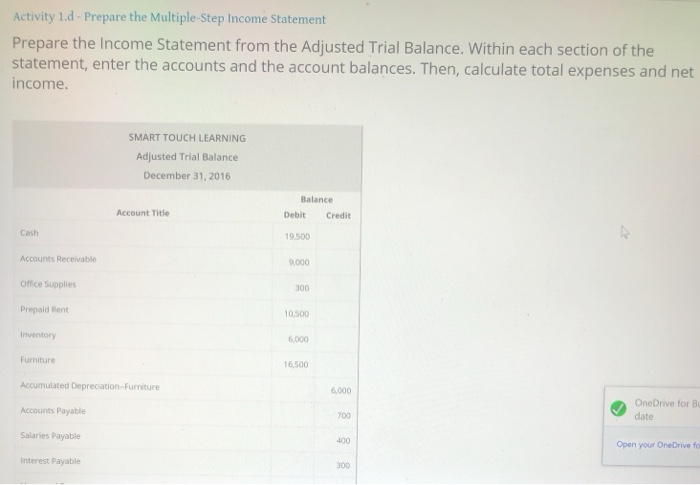

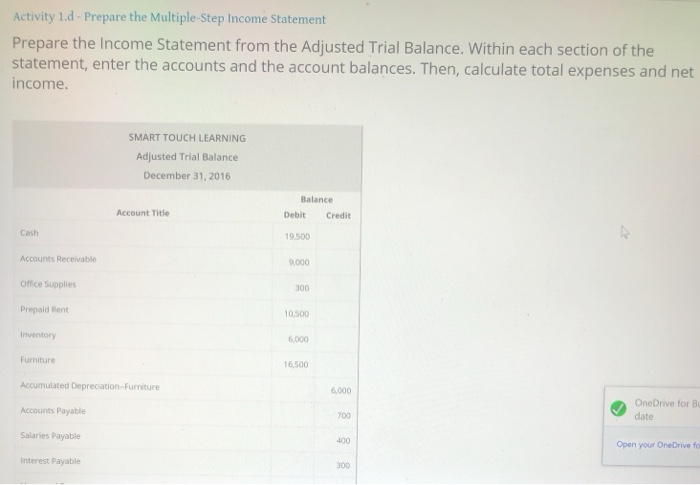

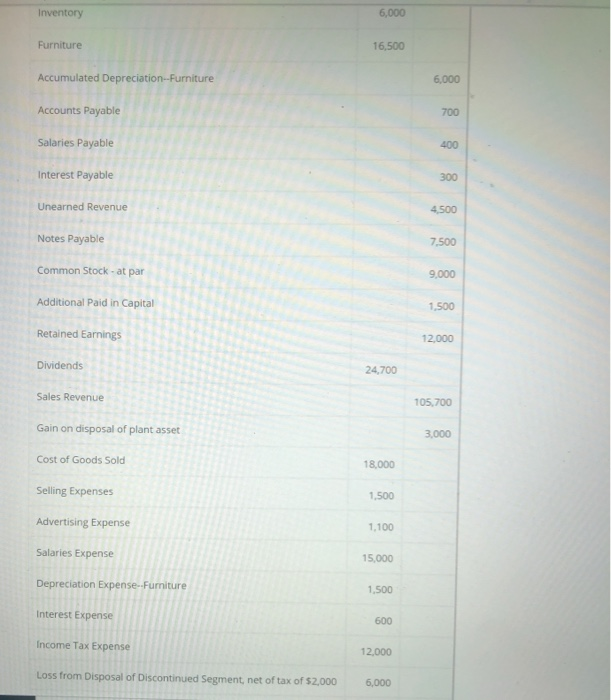

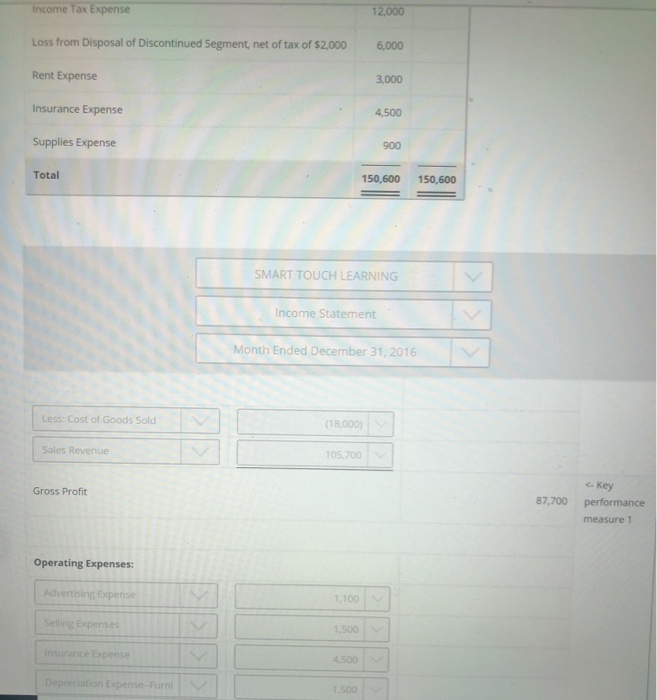

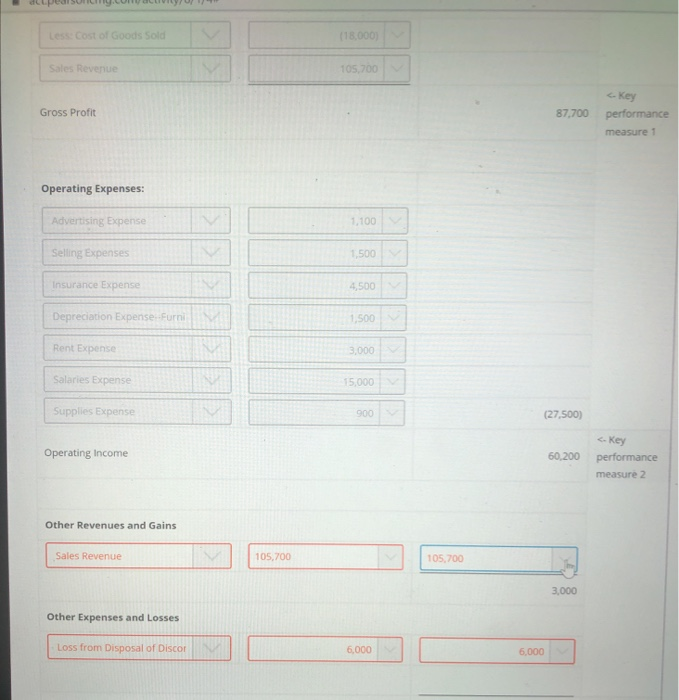

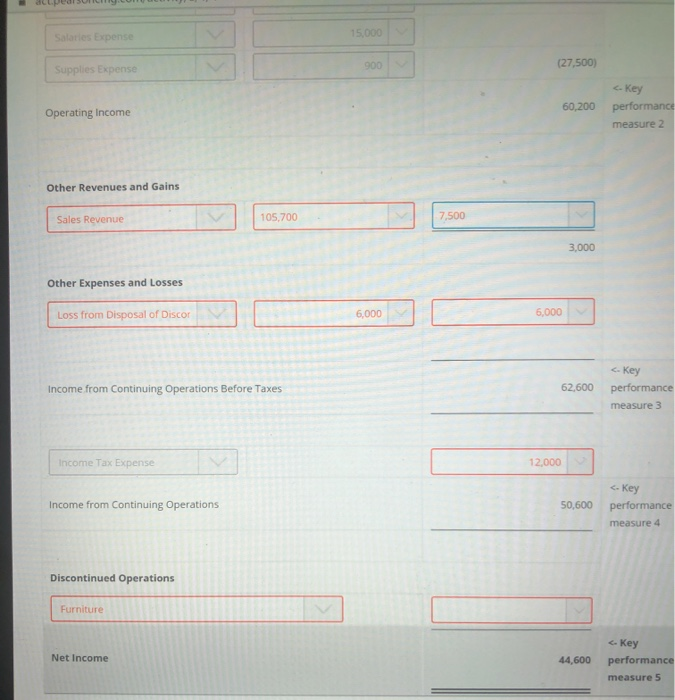

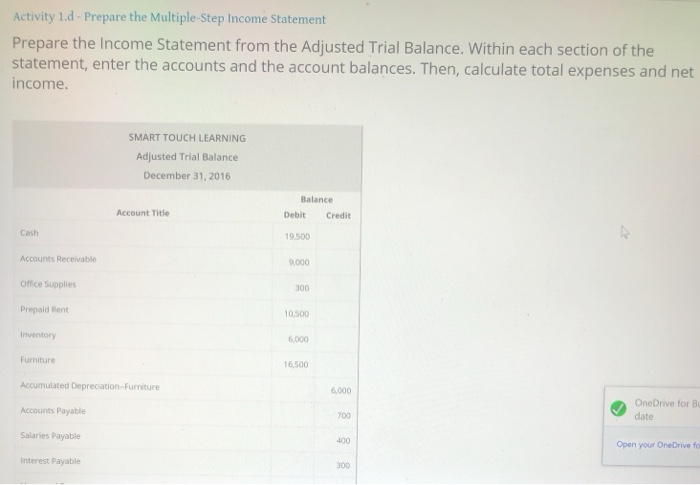

Activity 1.d - Prepare the Multiple-Step Income Statement Prepare the Income Statement from the Adjusted Trial Balance. Within each section of the statement, enter the accounts and the account balances. Then, calculate total expenses and net income. SMART TOUCH LEARNING Adjusted Trial Balance December 31, 2016 Account Title Balance Debit Credit Cash 19.500 Accounts Receivable 9.000 Office Supplies 300 Prepaid Rent 10.500 Inventory 6.000 Furniture 16,500 Accumulated Depreciation Furniture 6,000 Accounts Payable OneDrive for B date 700 Salaries Payable 400 Open your OneDrive fo Interest Payable 300 Inventory 6,000 Furniture 16,500 Accumulated Depreciation--Furniture 6,000 Accounts Payable 700 Salaries Payable 400 Interest Payable 300 Unearned Revenue 4.500 Notes Payable 7,500 Common Stock - at par 9,000 Additional Paid in Capital 1.500 Retained Earnings 12,000 Dividends 24.700 Sales Revenue 105.700 Gain on disposal of plant asset 3,000 Cost of Goods Sold 18,000 Selling Expenses 1.500 Advertising Expense 1.100 Salaries Expense 15,000 Depreciation Expense--Furniture 1,500 Interest Expense 600 Income Tax Expense 12.000 Loss from Disposal of Discontinued Segment, net of tax of $2,000 6,000 Income Tax Expense 12,000 Loss from Disposal of Discontinued Segment, net of tax of $2,000 6,000 Rent Expense 3,000 Insurance Expense 4,500 Supplies Expense 900 Total 150,600 150,600 SMART TOUCH LEARNING Income Statement Month Ended December 31, 2016 Less: Cost of Goods Sold (18.000 Sales Revenue 105.700 Gross Profit 87,700 Key performance measure 1 Operating Expenses: Advertising Expense 1.100 Selling Expenses 1300 Insurance Expense 4,500 Depreciation Expense-Furni 1.500 Less Cost of Goods sold (18.000 Sales Revenue 105.700 Key Gross Profit 87.700 performance measure Operating Expenses: Advertising Expense 1.100 Selling Expenses 1,500 Insurance Expense 4,500 Depreciation Expenses Furni 1,500 Rent Expense 3,000 Salaries Expense 15,000 Supplies Expense 900 (27.500) Operating Income 60,200 key performance measure 2 Other Revenues and Gains Sales Revenue 105,700 105,700 3,000 Other Expenses and Losses Loss from Disposal of Disco 6,000 6.000 Salaries Expense 15.000 Supplies Expense (27,500) c. Key 60,200 Operating Income performance measure 2 Other Revenues and Gains Sales Revenue 105,700 7,500 3.000 Other Expenses and Losses Loss from Disposal of Discor 6,000 6,000 4. Key Income from Continuing Operations Before Taxes 62,600 performance measure 3 Income Tax Expense 12.000