Answered step by step

Verified Expert Solution

Question

1 Approved Answer

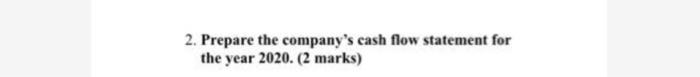

I need the answer quickly 2. Prepare the company's cash flow statement for the year 2020. (2 marks) 1. 1. V... IT. Information for the

I need the answer quickly

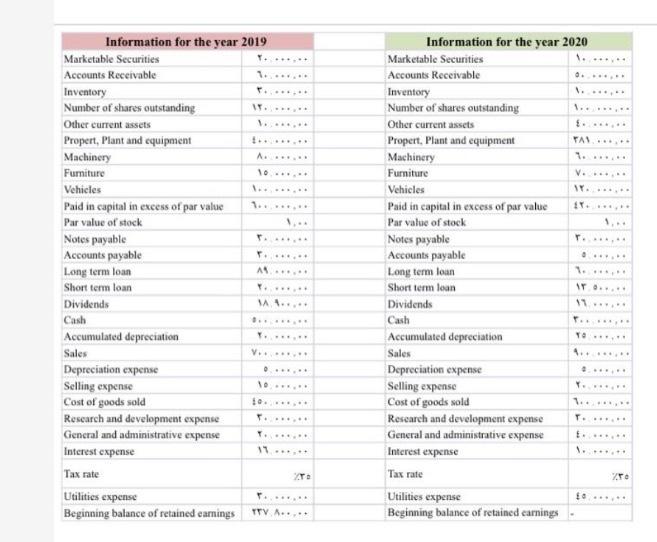

2. Prepare the company's cash flow statement for the year 2020. (2 marks) 1. 1. V... IT. Information for the year 2019 Marketable Securities Accounts Receivable Inventory Number of shares outstanding Other current assets Propert, Plant and equipment Machinery Furniture Vehicles Paid in capital in excess of par value Par value of stock Notes payable Accounts payable Long term loan Short term loan Dividends VA... Cash Accumulated depreciation Sales Depreciation expense Selling expense Cost of goods sold Research and development expense General and administrative expense Interest expense Tax rate Utilities expense Beginning balance of retained earnings Information for the year 2020 Marketable Securities Accounts Receivable Inventory Number of shares outstanding Other current assets Propert, Plant and equipment Machinery Furniture Vehicles Paid in capital in excess of par value Par value of stock Notes payable Accounts payable Long term loan Short term loan Dividends Cash Accumulated depreciation Sales Depreciation expense Selling expense Cost of goods sold Research and development expense General and administrative expense Interest expense Tax rate Utilities expense Beginning balance of retained carnings . V... 1... 17 AT WO TV A++++ answer the following questions, 1. Prepare the company's Balance sheet and Income Statement during 2019 and 2020. (3 marks) 2. Prepare the company's cash flow statement for the year 2020. (2 marks) 3. Calculate the financial ratios for the company in 2019 and 2020. (2 marks) Note: Purchases were %70 of the cost of goods sold in both years. Care De Date Time M MO 4. Analyze the company's overall financial situation from a time series viewpoint. (2 marks) 5. Compile the Pro forma Income statement for the year 2020 using percent of sales method. (1 mark) 2. Prepare the company's cash flow statement for the year 2020. (2 marks) 1. 1. V... IT. Information for the year 2019 Marketable Securities Accounts Receivable Inventory Number of shares outstanding Other current assets Propert, Plant and equipment Machinery Furniture Vehicles Paid in capital in excess of par value Par value of stock Notes payable Accounts payable Long term loan Short term loan Dividends VA... Cash Accumulated depreciation Sales Depreciation expense Selling expense Cost of goods sold Research and development expense General and administrative expense Interest expense Tax rate Utilities expense Beginning balance of retained earnings Information for the year 2020 Marketable Securities Accounts Receivable Inventory Number of shares outstanding Other current assets Propert, Plant and equipment Machinery Furniture Vehicles Paid in capital in excess of par value Par value of stock Notes payable Accounts payable Long term loan Short term loan Dividends Cash Accumulated depreciation Sales Depreciation expense Selling expense Cost of goods sold Research and development expense General and administrative expense Interest expense Tax rate Utilities expense Beginning balance of retained carnings . V... 1... 17 AT WO TV A++++ answer the following questions, 1. Prepare the company's Balance sheet and Income Statement during 2019 and 2020. (3 marks) 2. Prepare the company's cash flow statement for the year 2020. (2 marks) 3. Calculate the financial ratios for the company in 2019 and 2020. (2 marks) Note: Purchases were %70 of the cost of goods sold in both years. Care De Date Time M MO 4. Analyze the company's overall financial situation from a time series viewpoint. (2 marks) 5. Compile the Pro forma Income statement for the year 2020 using percent of sales method. (1 mark) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started