Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the answer to be typed on the computer, handwriting is kind of hard for me to read thank you. Part A: Assume that

I need the answer to be typed on the computer, handwriting is kind of hard for me to read thank you.

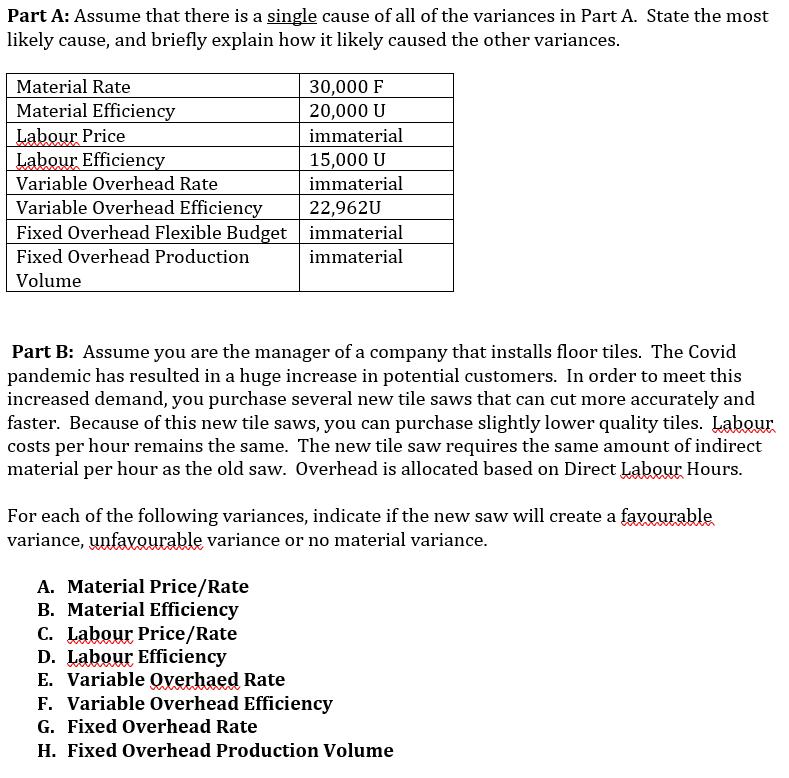

Part A: Assume that there is a single cause of all of the variances in Part A. State the most likely cause, and briefly explain how it likely caused the other variances. Material Rate 30,000 F Material Efficiency 20,000 U Labour Price immaterial Labour Efficiency 15,000 U Variable Overhead Rate immaterial Variable Overhead Efficiency 22,9620 Fixed Overhead Flexible Budget immaterial Fixed Overhead Production immaterial Volume Part B: Assume you are the manager of a company that installs floor tiles. The Covid pandemic has resulted in a huge increase in potential customers. In order to meet this increased demand, you purchase several new tile saws that can cut more accurately and faster. Because of this new tile saws, you can purchase slightly lower quality tiles. Labour costs per hour remains the same. The new tile saw requires the same amount of indirect material per hour as the old saw. Overhead is allocated based on Direct Labour Hours. For each of the following variances, indicate if the new saw will create a favourable variance, unfavourable variance or no material variance. A. Material Price/Rate B. Material Efficiency C. Labour Price/Rate D. Labour Efficiency E. Variable Overhaed Rate F. Variable Overhead Efficiency G. Fixed Overhead Rate H. Fixed Overhead Production VolumeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started