Answered step by step

Verified Expert Solution

Question

1 Approved Answer

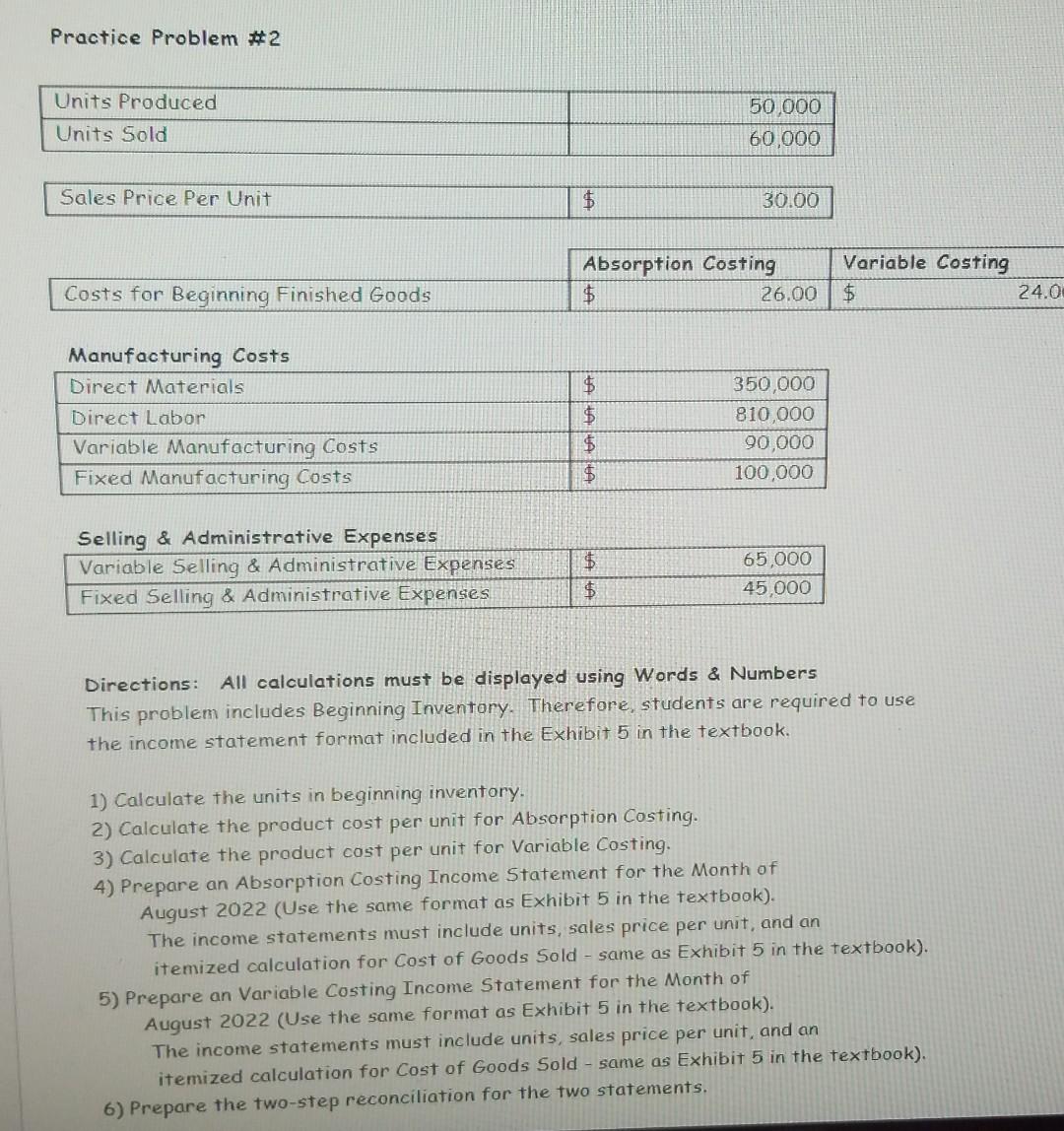

I need the answer to question #6 only since in the other posts they said they couldn't do it so here it is: Practice Problem

I need the answer to question #6 only since in the other posts they said they couldn't do it so here it is:

Practice Problem \#2 Directions: All calculations must be displayed using Words \& Numbers This problem includes Beginning Inventory. Therefore, students are required to use the income statement format included in the Exhibit 5 in the textbook. 1) Calculate the units in beginning inventary. 2) Calculate the product cost per unit for Absorption Costing. 3) Calculate the product cost per unit for Variable Costing. 4) Prepare an Absorption Costing Income Statement for the Month of August 2022 (Use the same format as Exhibit 5 in the textbook). The income statements must include units, sales price per unit, and an itemized calculation for Cost of Goods Sold - same as Exhibit 5 in the textbook). 5) Prepare an Variable Costing Income Statement for the Month of August 2022 (Use the same format as Exhibit 5 in the textbook). The income statements must include units, sales price per unit, and an itemized calculation for Cost of Goods Sold - same as Exhibit 5 in the textbook). 6) Prepare the two-step reconciliation for the two statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started