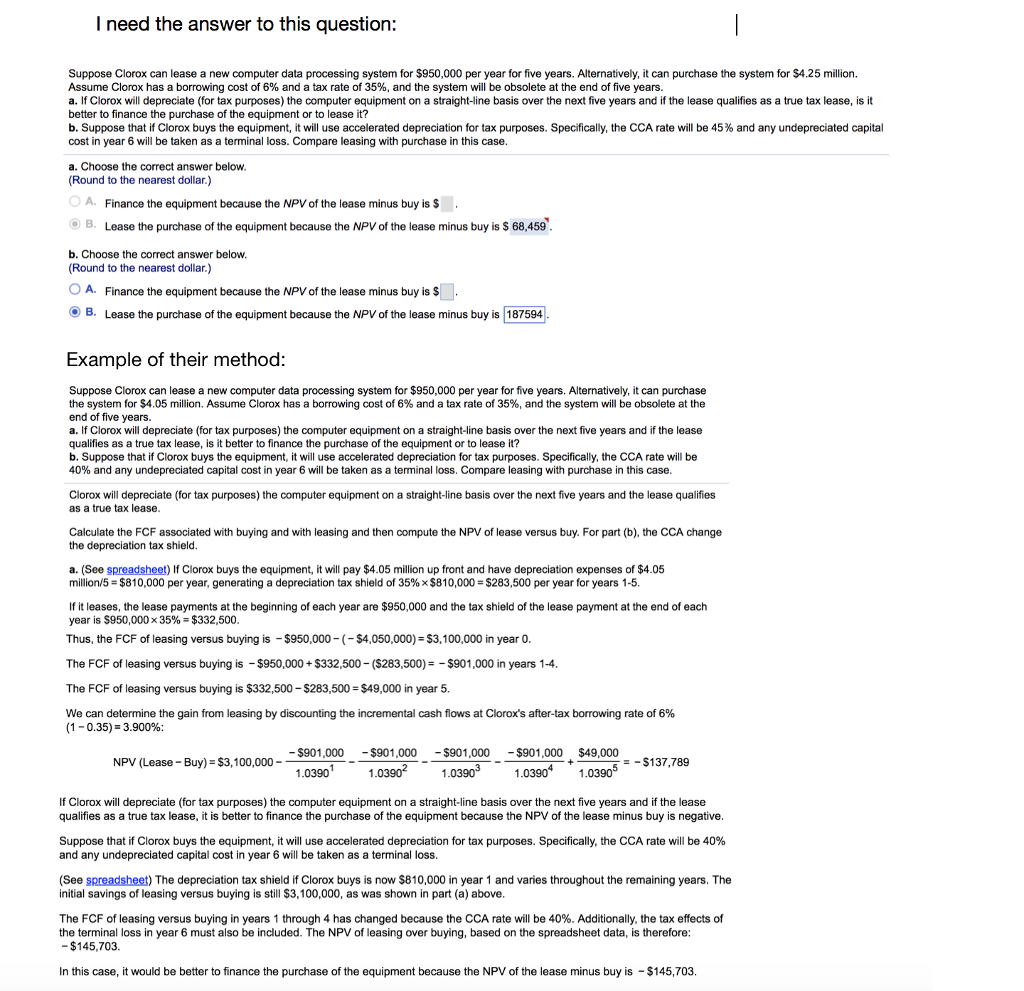

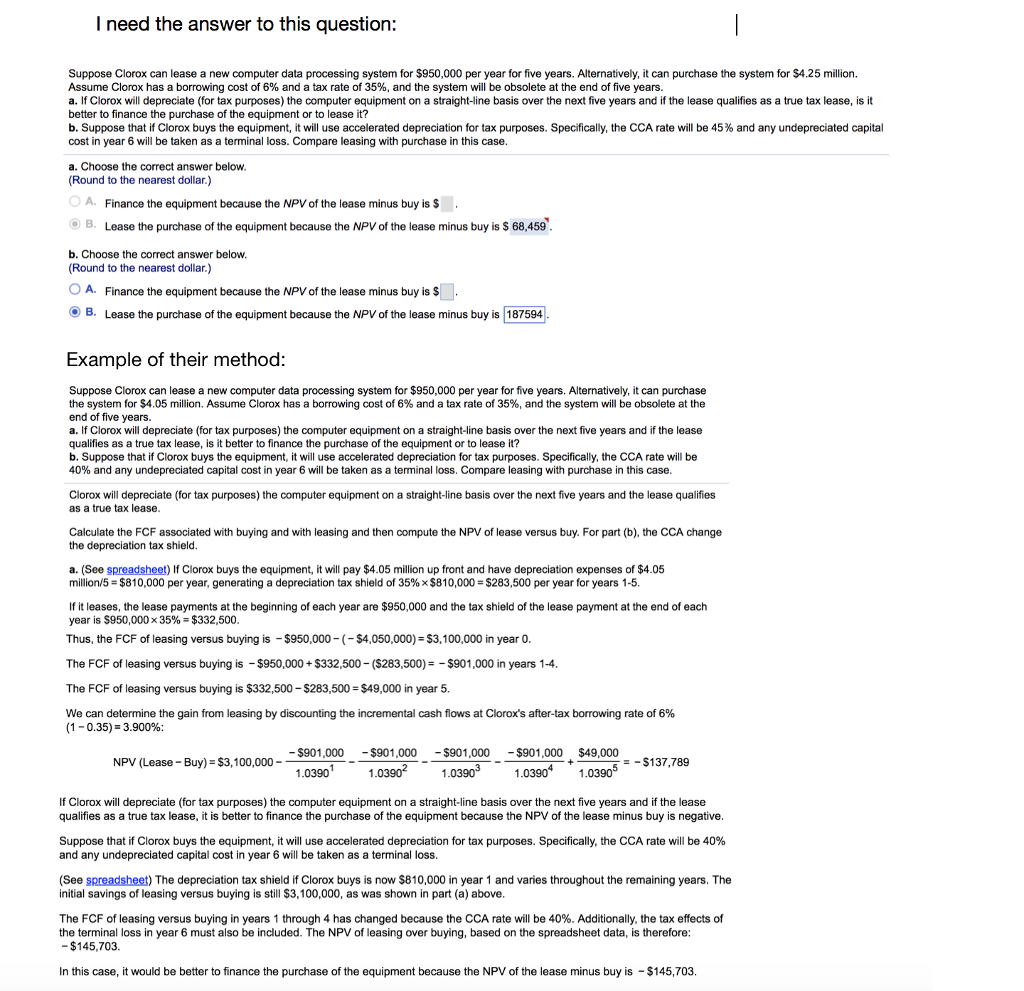

I need the answer to this question Suppose Clorox can lease a new computer data processing system for $950,000 per year for five years. Alternatively, it can purchase the system for $4.25 million. Assume Clorox has a borrowing cost of 6% and a tax rate of 35%, and the system will be obsolete at the end of five years. a. If Clorox will depreciate (for tax purposes) the computer equipment on a straight-line basis over the next five years and if the lease qualifies as a true tax lease, is it better to finance the purchase of the equipment or to lease it? b. Suppose that if Clorox buys the equipment, it will use accelerated depreciation for tax purposes. Specifically, the CCA rate will be 45% and any undepreciated capital cost in year 6 will be taken as a terminal loss. Compare leasing with purchase in this case a. Choose the correct answer below (Round to the nearest dollar.) OA. Finance the equipment because the NPV of the lease minus buy is $ B. Lease the purchase of the equipment because the NPV of the lease minus buy is S 68,459 b. Choose the correct answer below (Round to the nearest dollar.) O A. B. Finance the equipment because the NPV of the lease minus buy is $ Lease the purchase of the equipment because the NPV of the lease minus buy is 187594 Example of their method Suppose Clorox can lease a new computer data processing system for $950,000 per year for five years. Alternatively, it can purchase the system for $4.05 million. Assume Clorox has a borrowing cost of 6% and a tax rate of 35%, and the system will be obsolete at the end of five years. a. If Clorox will depreciate (for tax purposes) the computer equipment on a straight-line basis over the next five years and if the lease qualifies as a true tax lease, is it better to finance the purchase of the equipment or to lease it? b. Suppose that if Clorox buys the equipment, it will use accelerated depreciation for tax purposes. Specifically, the CCA rate will be 40% and any undepreciated capital cost in year 6 will be taken as a terminal loss. Compare leasing with purchase in this case Clorox will depreciate (for tax purposes) the computer equipment on a straight-line basis over the next five years and the lease qualifies as a true tax lease Calculate the FCF associated with buying and with leasing and then compute the NPV of lease versus buy. For part (b), the CCA change the depreciation tax shield a. (See spreadsheet) If Clorox buys the equipment, it will pay $4.05 million up front and have depreciation expenses of $4.05 millions-$810,000 per year, generating a depreciation tax shield of 35% $810,000 = $283,500 per year for years 1-5 If it leases, the lease payments at the beginning of each year are $950,000 and the tax shield of the lease payment at the end of each year is S950.000 x 35%-$332,500 Thus, the FCF of leasing versus buying is -$950,000- $4,050,000) $3,100,000 in year 0 The FCF of leasing versus buying is $950,000+$332,500 ($283,500)$901,000 in years 1-4. The FCF of leasing versus buying is $332,500 $283,500 $49,000 in year 5. We can determine the gain from leasing by discounting the incremental cash flows at Clorox's after-tax borrowing rate of 6% (1-0.35)-3.900% - $901,000$901,000 $901,000 $901,000 $49,000 0390 1.03902 033 0390 1039 NPV (Lease Buy) $3,100,000- =-$137,789 If Clorox will depreciate (for tax purposes) the computer equipment on a straight-line basis over the next five years and if the lease qualifies as a true tax lease, it is better to finance the purchase of the equipment because the NPV of the lease minus buy is negative Suppose that if Clorox buys the equipment, it will use accelerated depreciation for tax purposes. Specifically, the CCA rate will be 40% and any undepreciated capital cost in year 6 will be taken as a terminal loss (See spreadsheet) The depreciation tax shield if Clorox buys is now $810,000 in year 1 and varies throughout the remaining years. The initial savings of leasing versus buying is still $3,100,000, as was shown in part (a) above The FCF of leasing versus buying in years 1 through 4 has changed because the CCA rate will be 40%. Additionally, the tax effects of the terminal loss in year 6 must also be included. The NPV of leasing over buying, based on the spreadsheet data, is therefore: -$145,703 In this case, it would be better to finance the purchase of the equipment because the NPV of the lease minus buy is $145,703