Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the answer very fast , please help me , I only have 15 minutes ELE 35 minutes remaining X 1 OF 1 QUESTIONS

I need the answer very fast , please help me , I only have 15 minutes

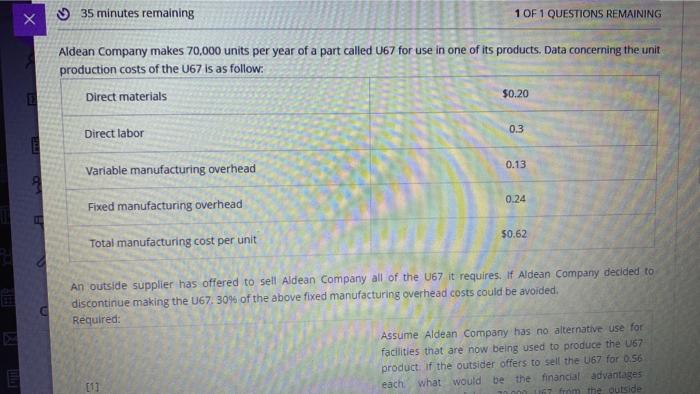

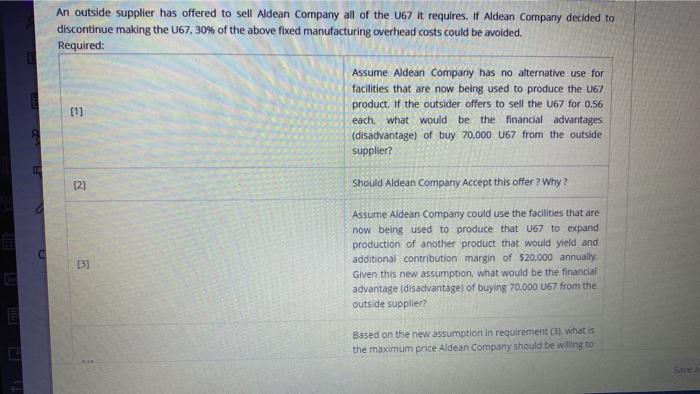

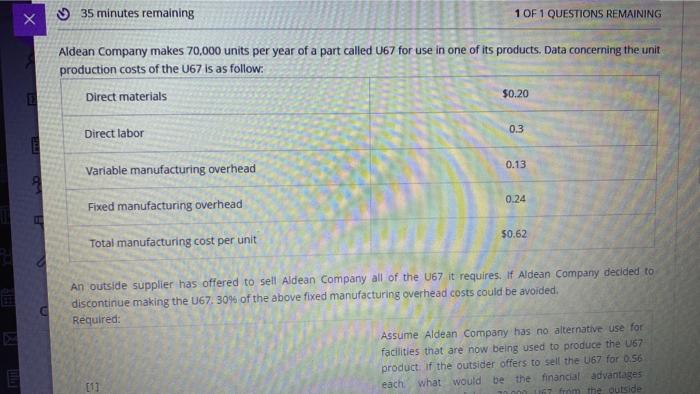

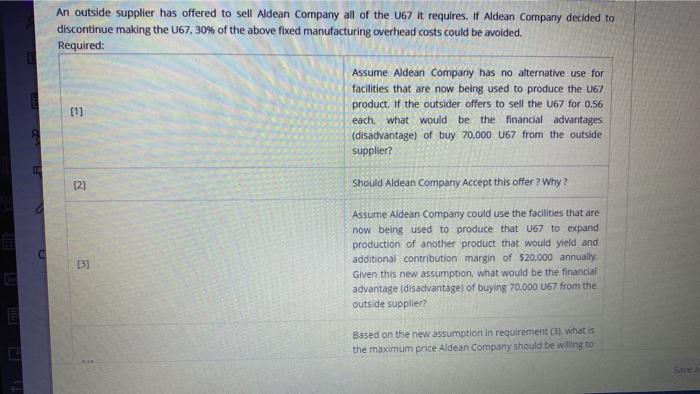

ELE 35 minutes remaining X 1 OF 1 QUESTIONS REMAINING Aldean Company makes 70,000 units per year of a part called U67 for use in one of its products. Data concerning the unit production costs of the U67 is as follow: E Direct materials $0.20 Direct labor 0.3 0.13 Variable manufacturing overhead 0.24 Fixed manufacturing overhead $0.62 Total manufacturing cost per unit An outside supplier has offered to sell Aldean Company all of the U67 it requires. If Aldean Company decided to discontinue making the U67. 30% of the above fixed manufacturing overhead costs could be avoided. Required: Assume Aldean Company has no alternative use for facilities that are now being used to produce the U67 product if the outsider offers to sell the U67 for 0.56 each what would be the financial advantages 70.000 1167 from the outside [1] E L C An outside supplier has offered to sell Aldean Company all of the U67 it requires. If Aldean Company decided to discontinue making the U67, 30% of the above fixed manufacturing overhead costs could be avoided. Required: [1] Assume Aldean Company has no alternative use for facilities that are now being used to produce the U67 product. If the outsider offers to sell the U67 for 0.56 each, what would be the financial advantages (disadvantage) of buy 70.000 U67 from the outside supplier? Should Aldean Company Accept this offer? Why? Assume Aldean Company could use the facilities that are now being used to produce that U67 to expand production of another product that would yield and additional contribution margin of $20,000 annually. Given this new assumption, what would be the financial advantage (disadvantage) of buying 70.000 U67 from the outside supplier? Based on the new assumption in requirement (3), what is the maximum price Aldean Company should be willing to [2] [3] Save a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started