Answered step by step

Verified Expert Solution

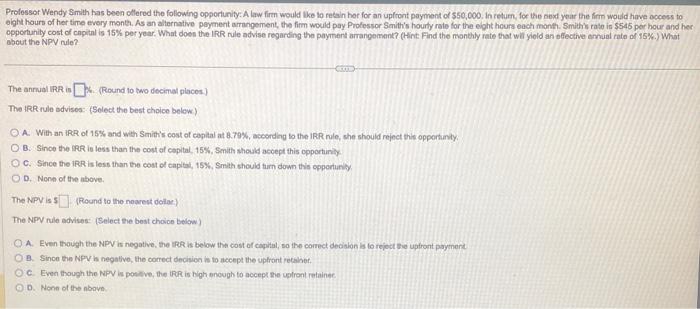

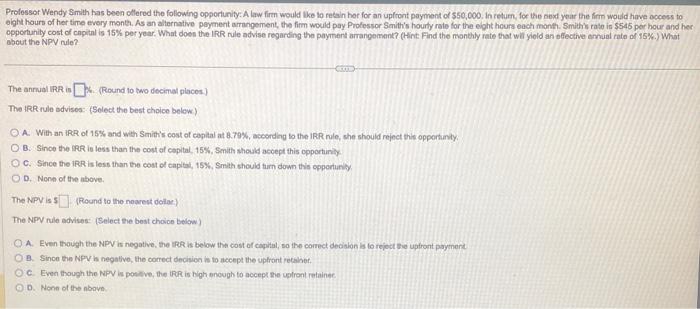

Question

1 Approved Answer

I need the answers fast please. I will leave a like. Prolossor Wendy Smith has been cllered the following oppertunity: A law firm would tke

I need the answers fast please. I will leave a like.

Prolossor Wendy Smith has been cllered the following oppertunity: A law firm would tke to retain hor for an upfront payment of 550,000 . In return, for the next year the firm woild have occess to oight hours of her time evory monts. As an alternative peyment armangement, the firm would pay Protessor Smith's hourty rate for the eight heurs each month. Smith's rato is $545 per hour and her opportunily cost of copital is 15% per year. What doen the IRR nule advise regarding the paymert arrangement? (Hint. Find the nonthly rate that wil ylold an afective omual rate of 15%.) What obout the NPV nule? The annual IRPR is 6. (Round to two decimal plscos) The IRR rule bdvisea: (Solect the best choice belew) A. With an IRR of 15% and weth Smith's cost of capital at 8.79%, accordlad to the IRR nule, she should reject this oppertinty. B. Since the IRR io less than the cost of capital, 15%, Smith should accept this cpportunily C. Since the TRRis less than the cost of capita, 15%, Smith should turn down this opporturify D. Nona of the above. The NPV is 5 (Reund to the noarest dolac) The NPN nile advises: (Select eve best choico beliow) A. Even though the NPV is negative. the trR is below thit cost of capital, so the correct deciaion is to reject sie uptront paymere B. Since the NPV is negative, the correct decision is to accept the upfront rechiset. C. Even though the NPV is positive, the tPRR is bigh eneugh to accept the uptront refainee. D. None of the noman

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started