Answered step by step

Verified Expert Solution

Question

1 Approved Answer

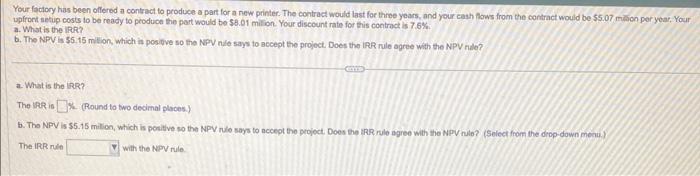

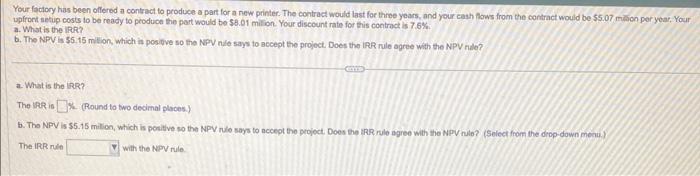

I need the answers fast please. Will leave a like. Your factory has been offered a contract to produce a part for a riew printer.

I need the answers fast please. Will leave a like.

Your factory has been offered a contract to produce a part for a riew printer. The contract would last for three years, and your cash flows from the contract would be $5.07 minion per year, Your upfront sectup costs to be ready to produce the part would be $8.01 milion. Your discount rate for this contract is 7.6%. a. What is the lRR? 6. The NPV is 35.15 milion, which in positve so the NPV n/e says to accept the projoct. Does the irR rule agree with the NPV nile? a. What is the irR? The IRP is 6. (Round to two dedimal places) b. The NPV is $5.15 milion, which is ponitve so the NPV rule says to nccept the project, Does the tRR rule agree with the NPV nilo? (Select from the drop-down meniu.) The IRR rule With the NPV rule

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started