i need the answers from question 6 through 12

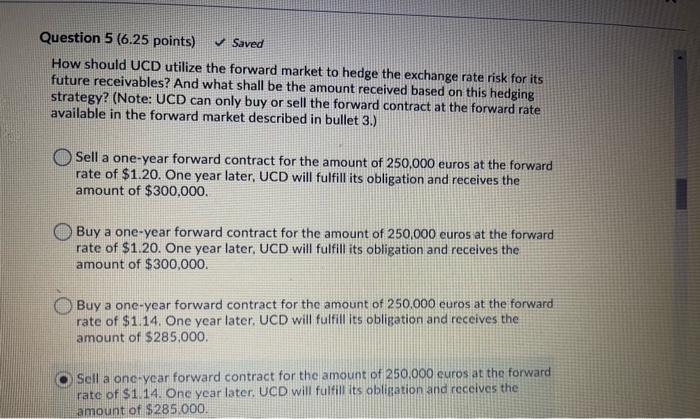

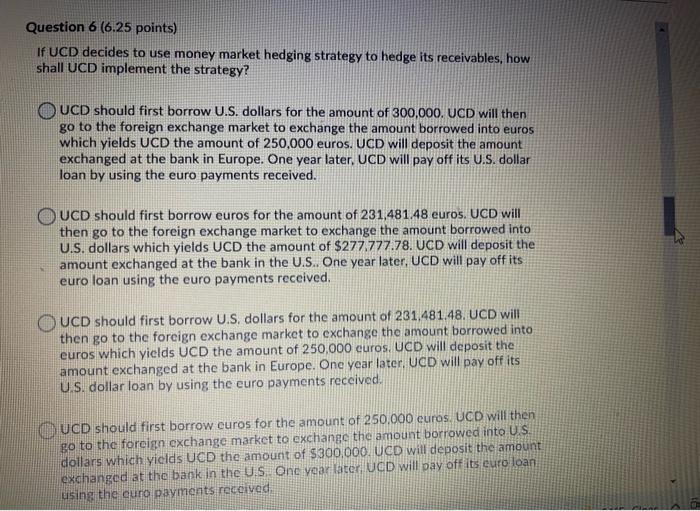

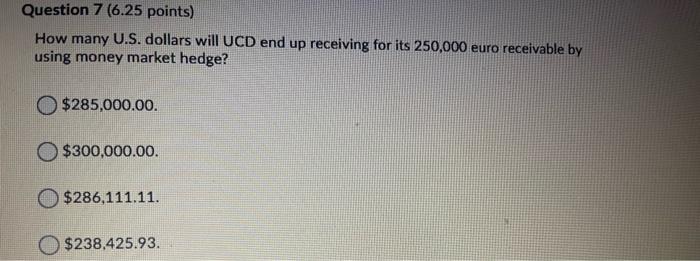

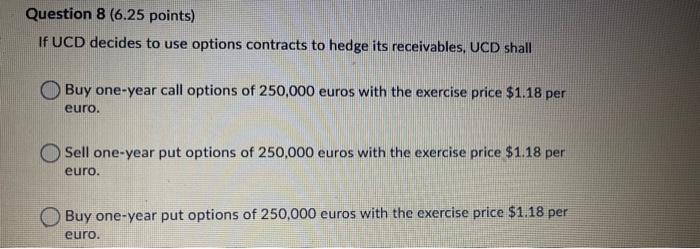

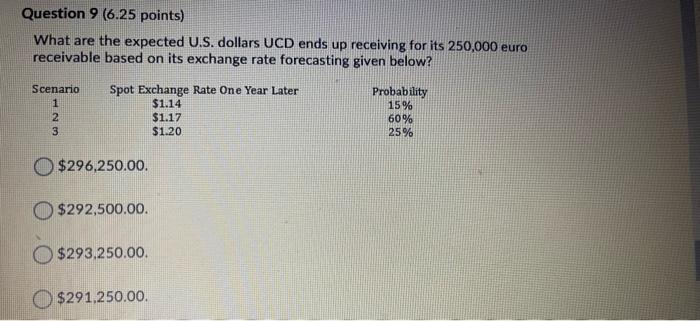

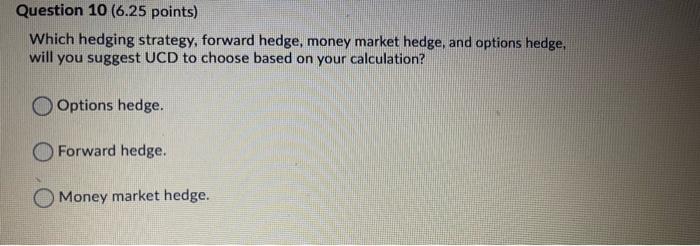

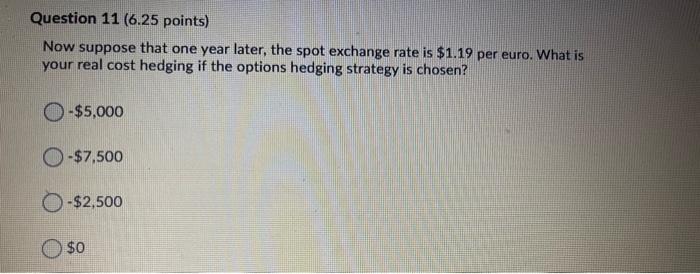

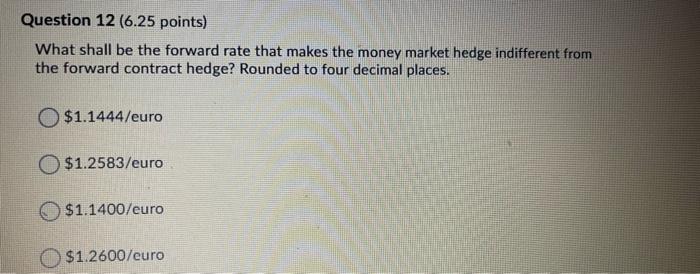

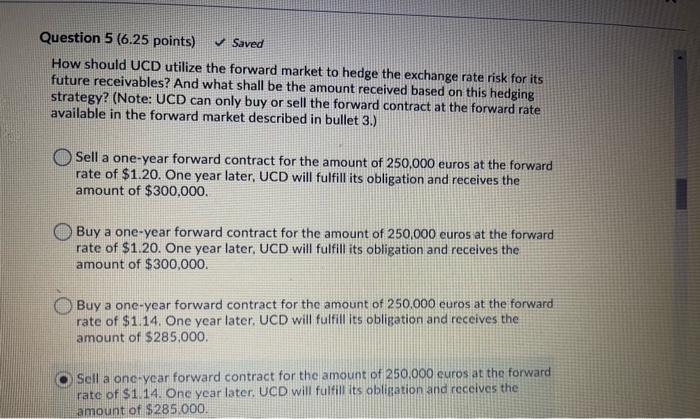

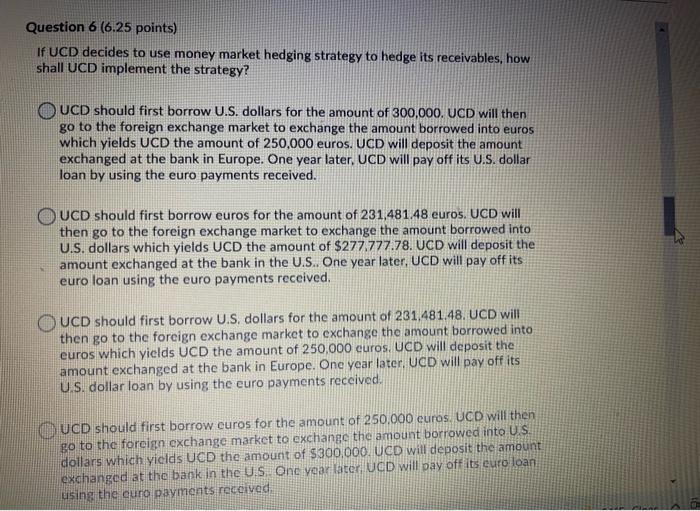

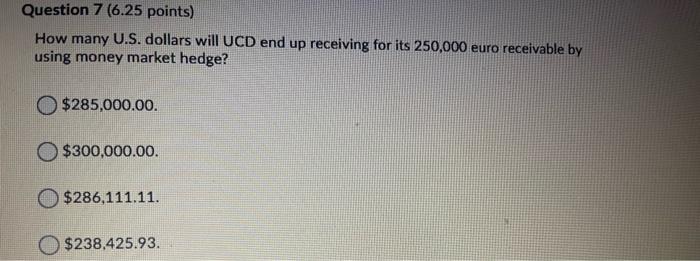

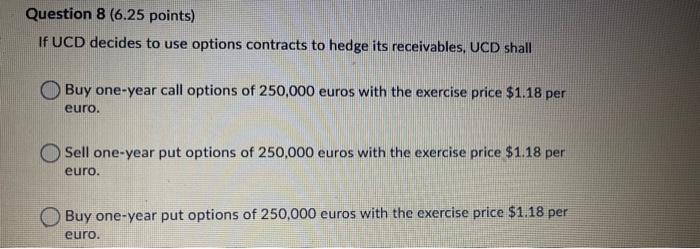

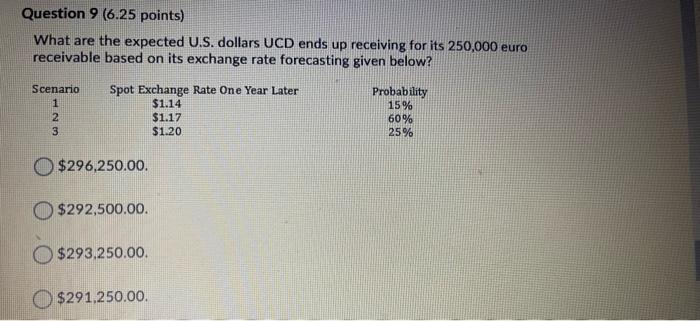

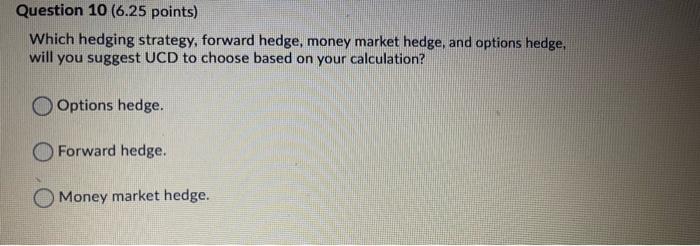

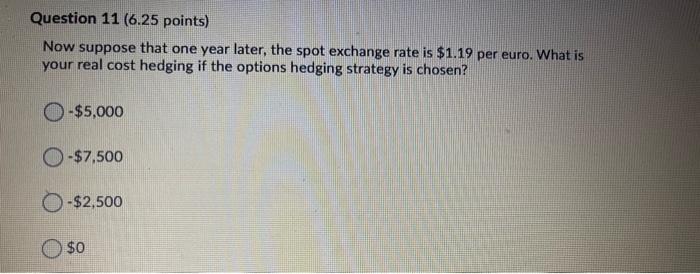

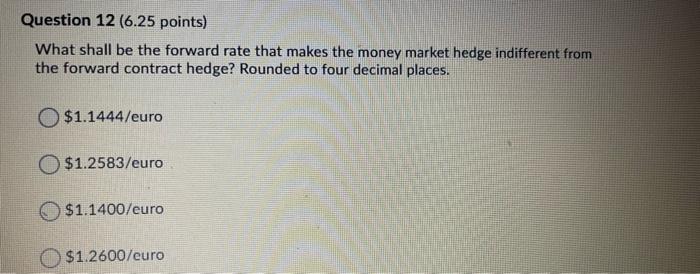

Question 5 (6.25 points) Saved How should UCD utilize the forward market to hedge the exchange rate risk for its future receivables? And what shall be the amount received based on this hedging strategy? (Note: UCD can only buy or sell the forward contract at the forward rate available in the forward market described in bullet 3.) Sell a one-year forward contract for the amount of 250.000 euros at the forward rate of $1.20. One year later, UCD will fulfill its obligation and receives the amount of $300,000. Buy a one-year forward contract for the amount of 250,000 euros at the forward rate of $1.20. One year later, UCD will fulfill its obligation and receives the amount of $300,000. Buy a one-year forward contract for the amount of 250.000 euros at the forward rate of $1.14. One year later. UCD will fulfill its obligation and receives the amount of $285,000. Sell a one-year forward contract for the amount of 250.000 euros at the forward rate of $1.14. One year later. UCD will fulfill its obligation and receives the amount of $285.000. Question 6 (6.25 points) If UCD decides to use money market hedging strategy to hedge its receivables, how shall UCD implement the strategy? UCD should first borrow U.S. dollars for the amount of 300,000. UCD will then go to the foreign exchange market to exchange the amount borrowed into euros which yields UCD the amount of 250,000 euros. UCD will deposit the amount exchanged at the bank in Europe. One year later, UCD will pay off its U.S. dollar loan by using the euro payments received. UCD should first borrow euros for the amount of 231.481.48 euros. UCD will then go to the foreign exchange market to exchange the amount borrowed into U.S. dollars which yields UCD the amount of $277.777.78. UCD will deposit the amount exchanged at the bank in the U.S.. One year later, UCD will pay off its euro loan using the euro payments received, UCD should first borrow U.S. dollars for the amount of 231.481.48. UCD will then go to the foreign exchange market to exchange the amount borrowed into euros which yields UCD the amount of 250.000 euros. UCD will deposit the amount exchanged at the bank in Europe. One year later, UCD will pay off its U.S. dollar loan by using the euro payments received. UCD should first borrow euros for the amount of 250.000 euros. UCD will then go to the foreign exchange market to exchange the amount borrowed into U.S. dollars which yields UCD the amount of $300,000. UCD will deposit the amount exchanged at the bank in the US One year later. UCD will pay offats euro loan using the cure payments received, Question 7 (6.25 points) How many U.S. dollars will UCD end up receiving for its 250,000 euro receivable by using money market hedge? $285,000.00 $300,000.00 $286,111.11. $238.425.93. Question 8 (6.25 points) If UCD decides to use options contracts to hedge its receivables, UCD shall Buy one-year call options of 250,000 euros with the exercise price $1.18 per euro. Sell one-year put options of 250.000 euros with the exercise price $1.18 per euro. Buy one-year put options of 250,000 euros with the exercise price $1.18 per euro. Question 9 (6.25 points) What are the expected U.S. dollars UCD ends up receiving for its 250,000 euro receivable based on its exchange rate forecasting given below? Scenario 1 2 3 Spot Exchange Rate One Year Later $1.14 $1.17 $1.20 Probability 15% 60% 25% O $296,250.00 $292,500.00 $293,250.00 $291,250.00 Question 10 (6.25 points) Which hedging strategy, forward hedge, money market hedge, and options hedge, will you suggest UCD to choose based on your calculation? Options hedge. Forward hedge. Money market hedge. Question 11 (6.25 points) Now suppose that one year later, the spot exchange rate is $1.19 per euro. What is your real cost hedging if the options hedging strategy is chosen? -$5,000 O-$7,500 -$2,500 $0 Question 12 (6.25 points) What shall be the forward rate that makes the money market hedge indifferent from the forward contract hedge? Rounded to four decimal places. $1.1444/euro $1.2583/euro $1.1400/euro $1.2600/euro