Answered step by step

Verified Expert Solution

Question

1 Approved Answer

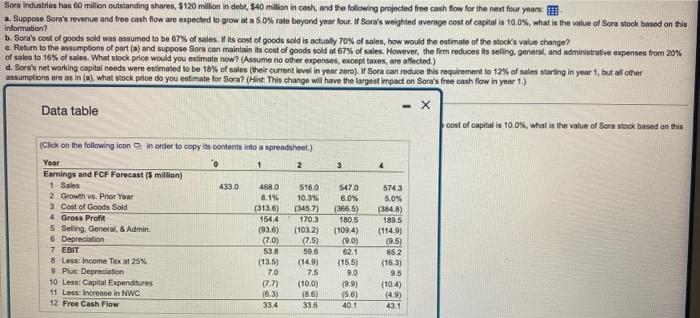

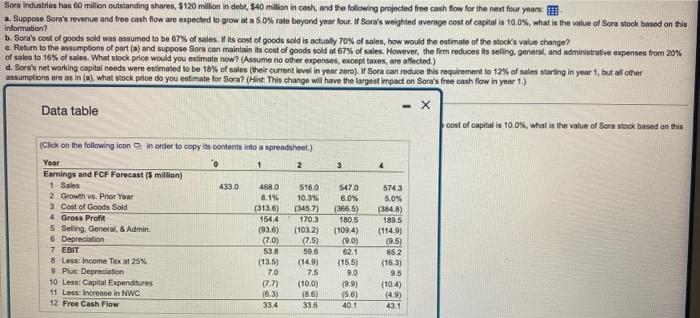

I need the answers please. Will leave a like. Sorn Industries has 60 millicn outstanding shares, $120 milion in debt, $40 milion in cash, and

I need the answers please. Will leave a like. Sorn Industries has 60 millicn outstanding shares, $120 milion in debt, $40 milion in cash, and the following projected free cash flow for the naxt four yeark: information? b. Sora's cost of goods sold was assumed to be 67% of sales. If its post of goods sold is nctuolly 70% of sales, how would the estimate of the atock's value change? of salos to 16% of uales. What stock price would you estimale now? (Assume no other expenses, axcept taxes, are alfected.) assumptions are es in (a), What siock peice do you estirate for Sora? (Hint. This change will have the lagest impact on Sora's free cash flow in year 1. ) Data table cost of capital is 10.0%, what is the value of 500 stock based an this

Sorn Industries has 60 millicn outstanding shares, $120 milion in debt, $40 milion in cash, and the following projected free cash flow for the naxt four yeark: information? b. Sora's cost of goods sold was assumed to be 67% of sales. If its post of goods sold is nctuolly 70% of sales, how would the estimate of the atock's value change? of salos to 16% of uales. What stock price would you estimale now? (Assume no other expenses, axcept taxes, are alfected.) assumptions are es in (a), What siock peice do you estirate for Sora? (Hint. This change will have the lagest impact on Sora's free cash flow in year 1. ) Data table cost of capital is 10.0%, what is the value of 500 stock based an this

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started