Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need the answers quickly please RATIONAL EXPECTATIONS-EMH. 130 points) Exercise 4) Answer the following questions: (). Forecasters' predictions of inflation are notoriously inaccurate, so

i need the answers quickly please

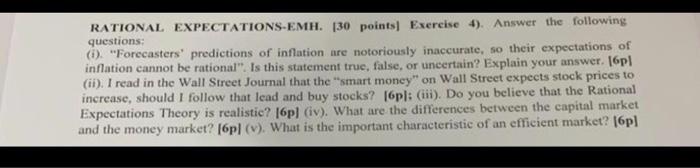

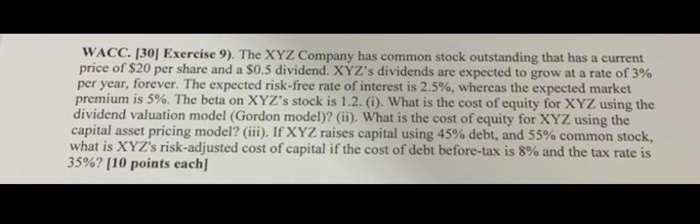

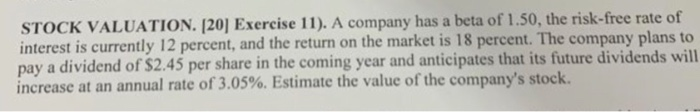

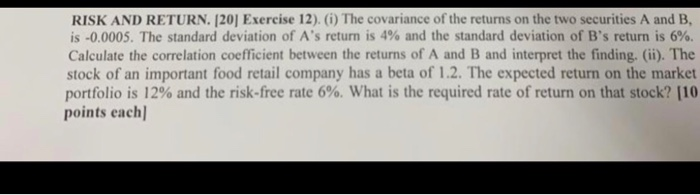

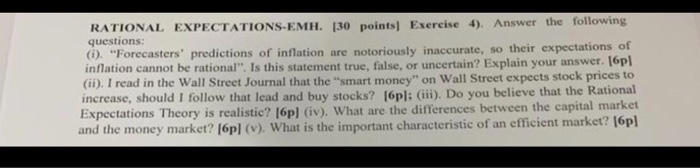

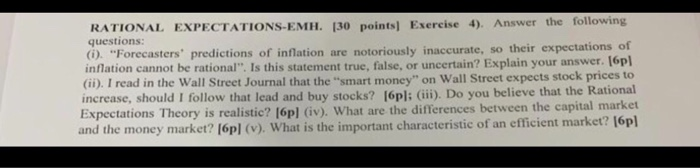

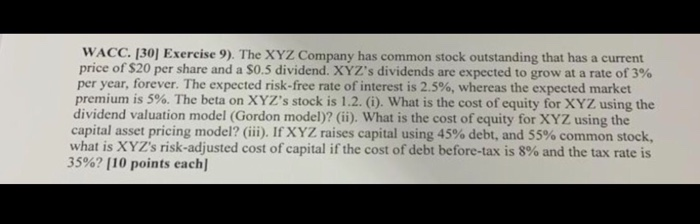

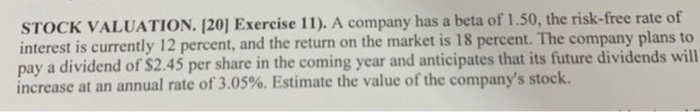

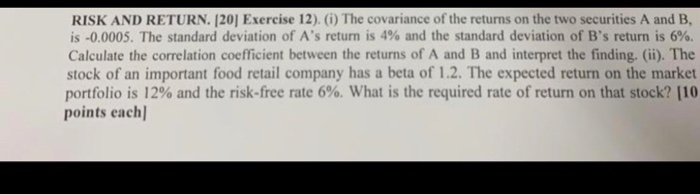

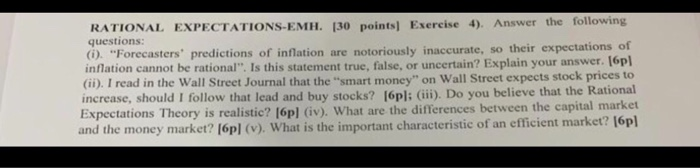

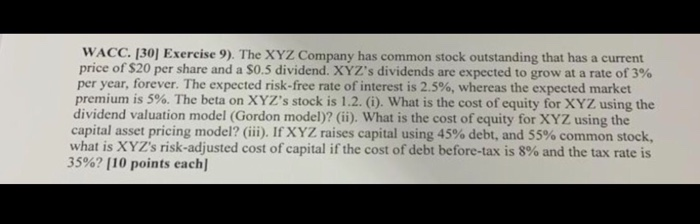

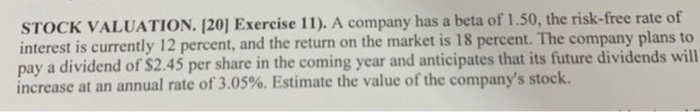

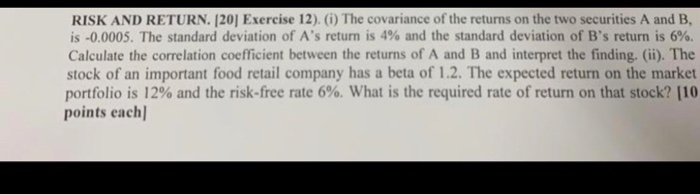

RATIONAL EXPECTATIONS-EMH. 130 points) Exercise 4) Answer the following questions: (). "Forecasters' predictions of inflation are notoriously inaccurate, so their inflation cannot be rational". Is this statement true, false, or uncertain? Explain your ans (Gi). I read in the Wall Street Journal that the "smart money on Wall Street expects increase, should I follow that lead and buy stocks? [6pl: Gii). Do you believe that the Rational Expectations Theory is realistie? (6pl iv). What are the differences between the capital market and the money market? (6pl (v). What is the important characteristic of an efficient market? l6pl stock pric WACC. 130 Exercise 9). The XYZ Company has common stock outstanding that has a current price of $20 per share and a S0.5 dividend. XYZ's dividends are expected to grow at a rate of 3% per year, forever. The expected risk-free rate of interest is 2.5%, whereas the expected market premium, is 5%. The beta on XYZ's stock is 1.2. (i). What is the cost of equity for XYZ using the dividend valuation model (Gordon model)? (ii). What is the cost of equity for XYZ using the capital asset pricing model? (iii). If XYZ raises capital using 45% debt, and 55% common stock, what is XYZ's risk-adjusted cost of capital if the cost of debt before-tax is 8% and the tax rate is 35%? [ 10 points each] STOCK VALUATION. [20] Exercise 11). A company has a beta of 1.50, the risk-free rate of interest is currently 12 percent, and the return on the market is 18 percent. The company plans to pay a dividend of $2.45 per share in the coming year and anticipates that its future dividends will increase at an annual rate of 3.05%. Estimate the value of the company's stock. RISK AND RETURN. 1201 Exercise 12). (i) The covariance of the returns on the two securities A and B, is-00005. The standard deviation of A's return is 4% and the standard deviation of B's return is 6%. Calculate the correlation coefficient between the returns of A and B and interpret the finding. (ii). The stock of an important food retail company has a beta of 1.2. The expected return on the market portfolio is 12% and the risk-free rte 690, what is the required rate of return on that stock? 110 points each] RATIONAL EXPECTATIONS-EMH [30 points] Exercise 4). Answer the following questions (). "Forecasters' predictions of inflation are notoriously inaccurate, so their inflation cannot be rational". Is this statement true, false, or uncertain? Explain your answer. 16pl (ii). I read in the Wall Street Journal that the "smart money" on Wall Street expects stock prices to increase, should I follow that lead and buy stocks? [6pl: Expectations Theory is realistic? (6pl (iv). What are the differences between the capital and the money market? (6pl (v). What is the important characteristic of an efficient market? |6pl (iii). Do you believe that the Rational RATIONAL EXPECTATIONS-EMH [30 points] Exercise 4). Answer the following questions (). "Forecasters' predictions of inflation are notoriously inaccurate, so their inflation cannot be rational". Is this statement true, false, or uncertain? Explain your answer. 16pl (ii). I read in the Wall Street Journal that the "smart money" on Wall Street expects stock prices to increase, should I follow that lead and buy stocks? [6pl: Expectations Theory is realistic? (6pl (iv). What are the differences between the capital and the money market? (6pl (v). What is the important characteristic of an efficient market? |6pl (iii). Do you believe that the Rational WACC. 130 Exercise 9). The XYZ Company has common stock outstanding that has a current price of $20 per share and a S0.5 dividend. XYZ's dividends are expected to grow at a rate of 3% per year, forever. The expected risk-free rate of interest is 2.5%, whereas the expected market premium, is 5%. The beta on XYZ's stock is 1.2. (i). What is the cost of equity for XYZ using the dividend valuation model (Gordon model)? (ii). What is the cost of equity for XYZ using the capital asset pricing model? (iii). If XYZ raises capital using 45% debt, and 55% common stock, what is XYZ's risk-adjusted cost of capital if the cost of debt before-tax is 8% and the tax rate is 35%" [ 10 points each] STOCK VALUATION. 120] Exercise 11). A company has a beta of 1.50, the risk-free rate of interest is currently 12 percent, and the return on the market is 18 percent. The company plans to pay a dividend of $2.45 per share in the coming year and anticipates that its future dividends will increase at an annual rate of 3.05%. Estimate the value of the company's stock. RISK AND RETURN. 1201 Exercise 12). (i) The covariance of the returns on the two securities A and B, is-00005. The standard deviation of A's return is 4% and the standard deviation of B's return is 6%. Calculate the correlation coefficient between the returns of A and B and interpret the finding. (ii). The stock of an important food retail company has a beta of 1.2. The expected return on the market portfolio is 12% and the risk-free rte 6%, what is the required rate of return on that stock? 110 points each

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started