Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the answers to the blue colored cells. Can you please show me how you would calculate the answers using excel, Thank you so

I need the answers to the blue colored cells.

Can you please show me how you would calculate the answers using excel, Thank you so much! Please answer all parts.

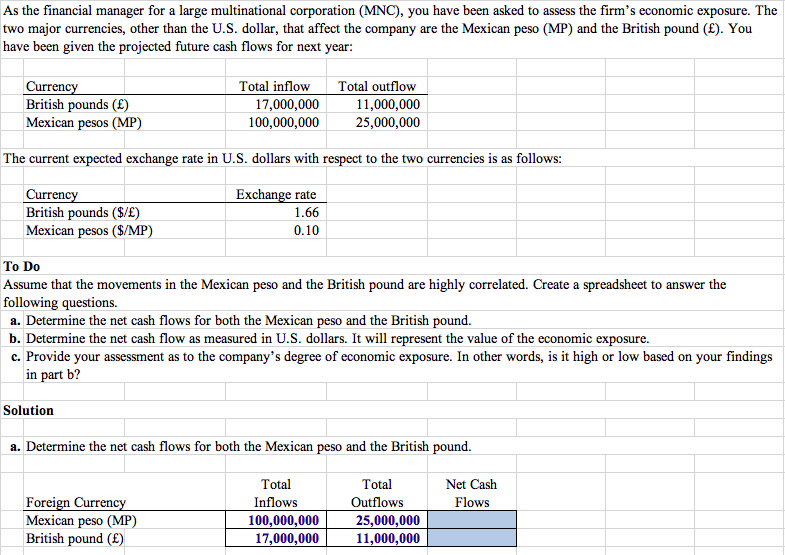

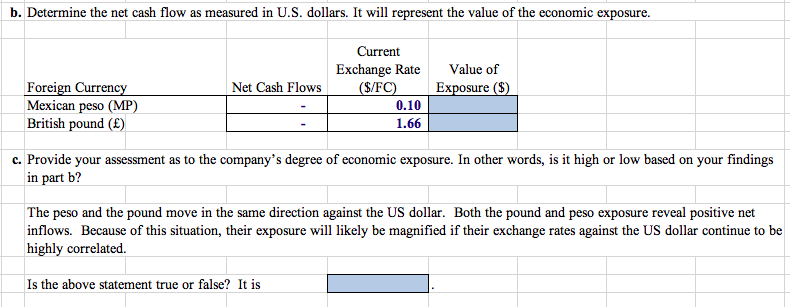

As the financial manager for a large multinational corporation (MNC), you have been asked to assess the firm's economic exposure. The two major currencies, other than the U.S. dollar, that affect the company are the Mexican peso (MP) and the British pound (). You have been given the projected future cash flows for next year: Currency British pounds () Mexican pesos (MP) Total inflow 17,000,000 100,000,000 00000 Total outflow 11,000,000 25,000,000 The current expected exchange rate in U.S. dollars with respect to the two currencies is as follows: Exchange rate Currency British pounds ($/) Mexican pesos ($/MP) 1.66 0.10 To Do Assume that the movements in the Mexican peso and the British pound are highly correlated. Create a spreadsheet to answer the following questions. a. Determine the net cash flows for both the Mexican peso and the British pound. b. Determine the net cash flow as measured in U.S. dollars. It will represent the value of the economic exposure c. Provide your assessment as to the company's degree of economic exposure. In other words, is it high or low based on your findings in part b? Solution a. Determine the net cash flows for both the Mexican peso and the British pound. Net Cash Flows Foreign Currency Mexican peso (MP) British pound () Total Inflows 100,000,000 17,000,000 Total Outflows 25,000,000 11,000,000 b. Determine the net cash flow as measured in U.S. dollars. It will represent the value of the economic exposure. Value of Exposure ($) Net Cash Flows Current Exchange Rate ($/FC) 0.10 1.66 Foreign Currency Mexican peso (MP) British pound () c. Provide your assessment as to the company's degree of economic exposure. In other words, is it high or low based on your findings in part b? The peso and the pound move in the same direction against the US dollar. Both the pound and peso exposure reveal positive net inflows. Because of this situation, their exposure will likely be magnified if their exchange rates against the US dollar continue to be highly correlated. Is the above statement true or false? It isStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started