Answered step by step

Verified Expert Solution

Question

1 Approved Answer

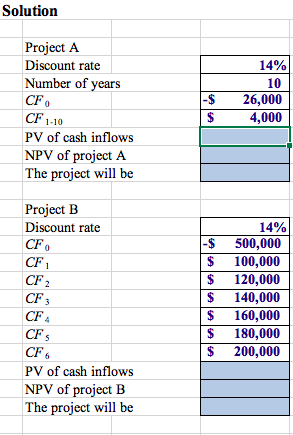

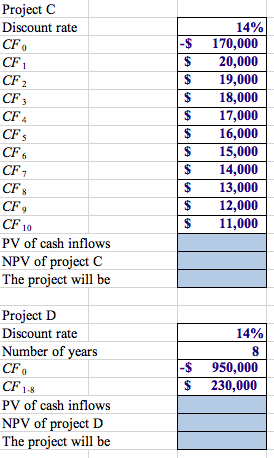

I need the answers to the blue colored cells. Can you please show me how you would calculate the answers using excel, Thank you so

I need the answers to the blue colored cells.

Can you please show me how you would calculate the answers using excel, Thank you so much!

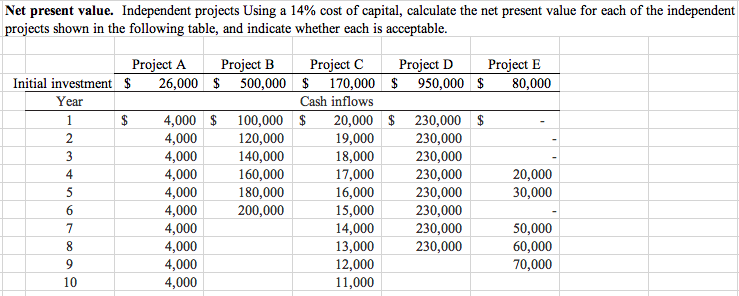

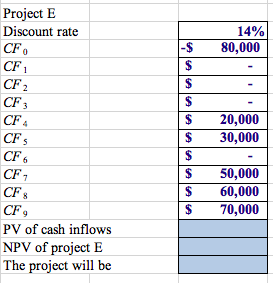

Net present value. Independent projects Using a 14% cost of capital, calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. Project D Project E $ 950,000 $ 80,000 $ $ $ 4.000 4,000 Project A Project B Initial investment $ 26,000 $ 500,000 Year 4,000 $ 100,000 120,000 4,000 140,000 4,000 160,000 4,000 180,000 4,000 200,000 4,000 4,000 4,000 4,000 Project $ 170,000 Cash inflows $ 20,000 19,000 18,000 17,000 16,000 15,000 14,000 13,000 12,000 11,000 230,000 230,000 230,000 230,000 230,000 230,000 230,000 230,000 20,000 30,000 50,000 60,000 70,000 Solution 14% 10 Project A Discount rate Number of years CFO CF 1-10 PV of cash inflows NPV of project A The project will be -$ $ 26,000 4,000 Project B Discount rate CF CF CF CF -$ $ $ $ $ $ $ 14% 500,000 100,000 120,000 140,000 160,000 180,000 200,000 CF CF CF6 PV of cash inflows NPV of project B The project will be Project C Discount rate CF CF - $ $ S 14% 170,000 20,000 19,000 18,000 17,000 16,000 15,000 14,000 13,000 12,000 11,000 CF, CF 10 PV of cash inflows NPV of project C The project will be 14% -$ Project D Discount rate Number of years CF CF 1-8 PV of cash inflows NPV of project D The project will be 950,000 230,000 $ Project E Discount rate CF 14% 80,000 I-S CF CF2 20,000 30,000 CFS CF CF CF 50,000 60,000 70,000 CF, PV of cash inflows NPV of project E The project will beStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started