i need the calculation of interest section

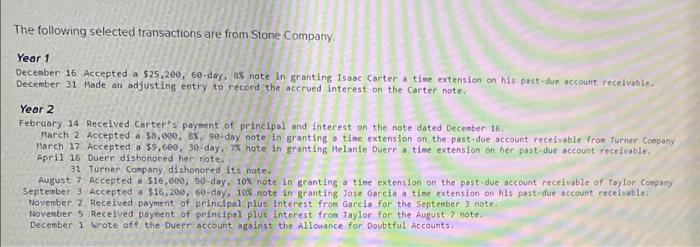

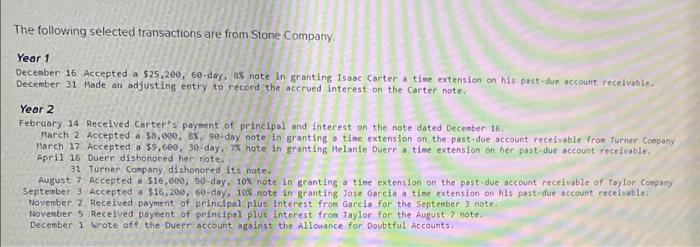

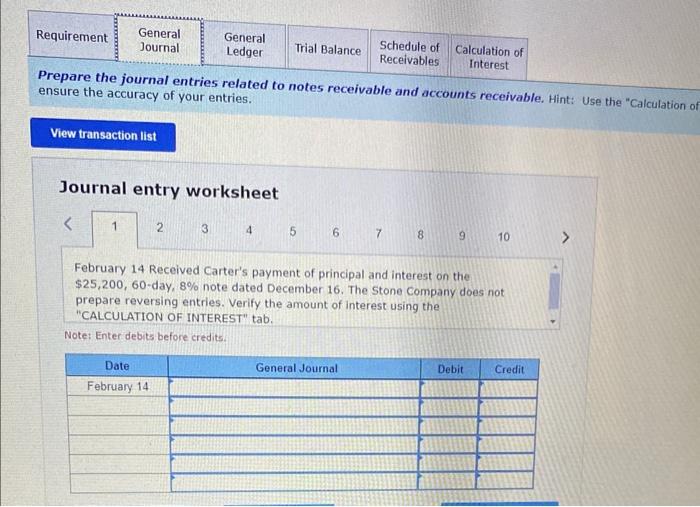

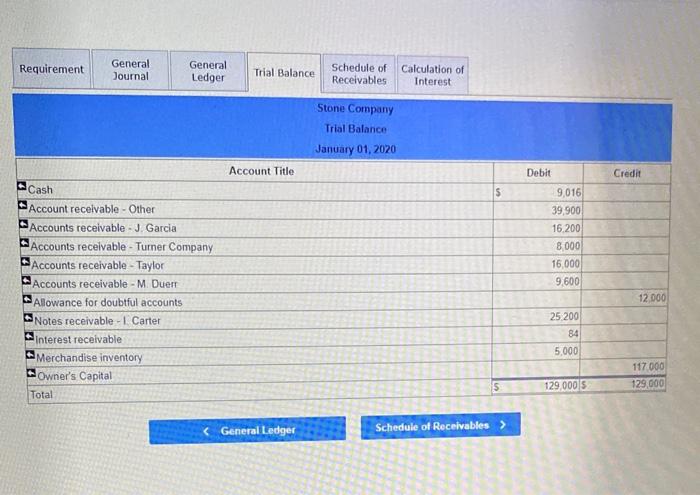

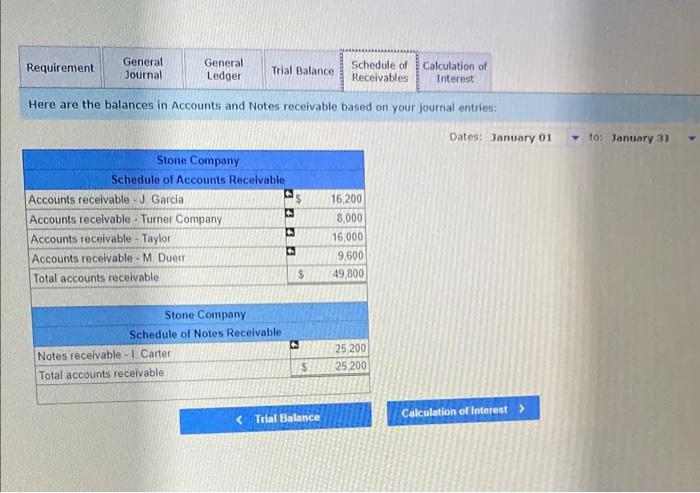

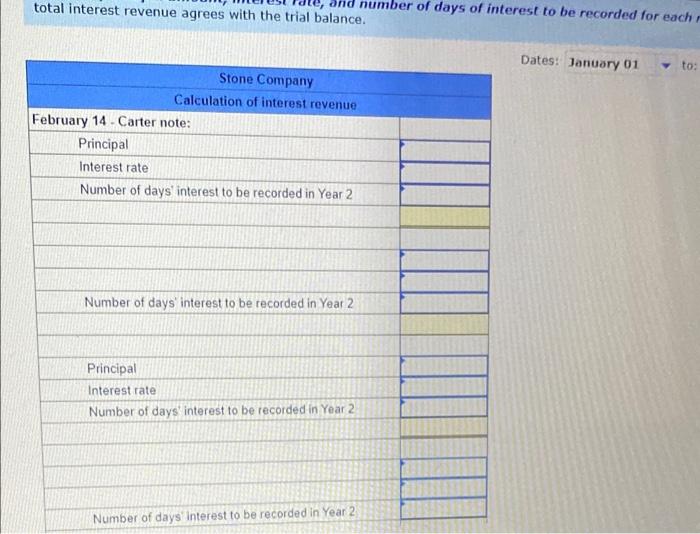

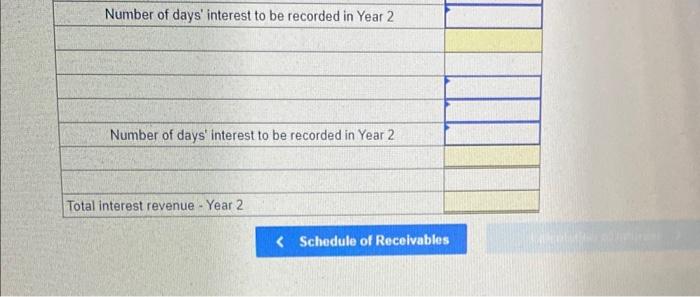

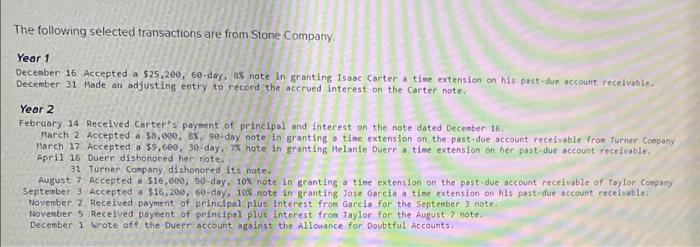

The following selected transactions are from Stone Company Year 1 Deceaber 16 Accepted a $25,200,60-day, a\$ note in granting isaac Carter a tive extension an his past-due account recelvable. December 31 Made an adjusting entry to record the accrued interest on the Carter note. Year 2 February 14 Received Carter's paynent of principal and interest on the note dated December 16. March 2 Accepted a $3,990,0x,90 day note in granting o time extenslon on the past-due account recefvable froe Turner Coepany March 17 Accepted a $9,600,30-day, 7$ note in granting Melanie Duerr a time extension on her past-due account recelvable. April 16 Duerr distonored her note. 32 Turner Company dishonored its note. August 7 Accepted a $16,600,90-day, 10x note in granting a tine extension on the past-due account recelvable of Toylor coopany September 3 Accepted a $16,200,60-doy, 105 note in granting jose Garclo a tine extensfon on hifs past-due account recelvable. Novenber 2 Recelved payment of principol plus interest from Garcfa for the Septenber 3 note. Novenber 5 Recelved poyeent of prinetpol plus interest from Taylor for the August 7 note. December 1 Wrote off the Dueer account against the Allowance for Doubtful Accounts. Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation o ensure the accuracy of your entries. Journal entry worksheet February 14 Received Carter's payment of principal and interest on the $25,200,60-day, 8% note dated December 16 . The Stone Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. Note: Enter debits before credits. \begin{tabular}{|l||l|l|} \hline Requirement & General Journal & General Ledger \\ \hline \end{tabular} \begin{tabular}{|c||c|c|} \hline \multirow{2}{*}{ Trial Balance } & Schedule of Receivables & Calculation of Interest \\ \hline \end{tabular} Stone Company Trial Balance January 01, 2020 Here are the balances in Accounts and Notes recelvable based on your journal entries: total interest revenue agrees with the trial balance. \begin{tabular}{|l|l|} \hline Number of days' interest to be recorded in Year 2 \\ \hline & \\ \hline & \\ \hline Number of days' interest to be recorded in Year 2 \\ \hline \end{tabular} \& Schedule of Receivables