Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need the cash flow Additional Financial Reporting The comparative helance sheets for 2015 and 2017 and the statement of income for 2018 1266 SECTION

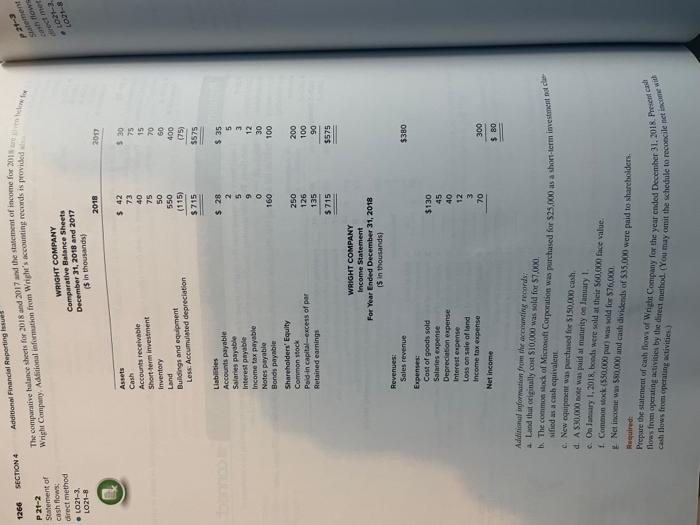

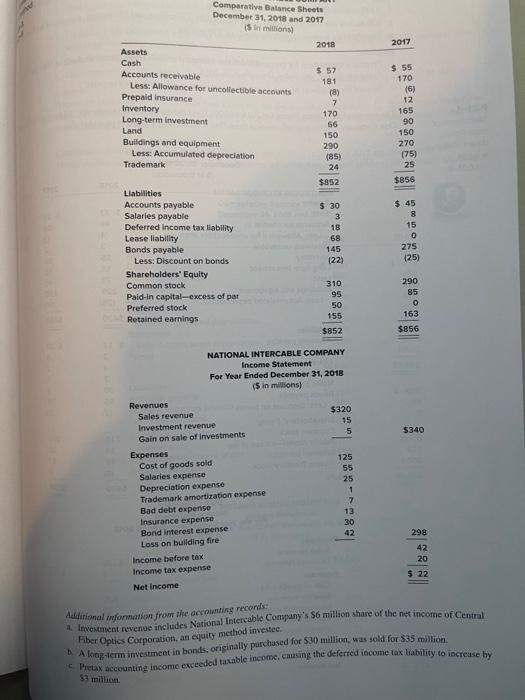

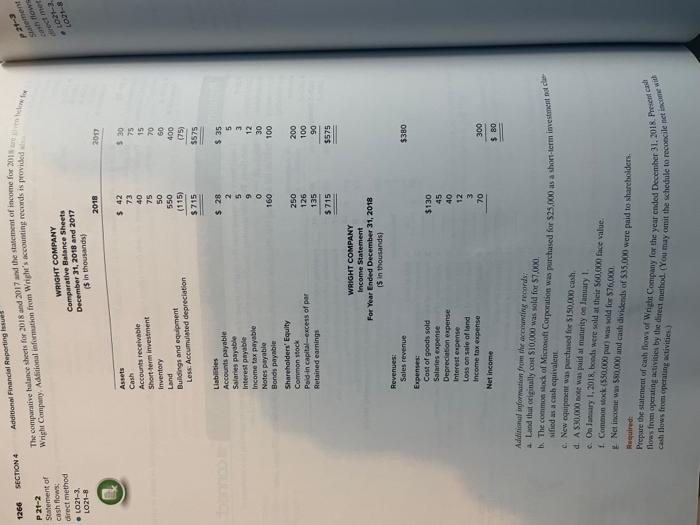

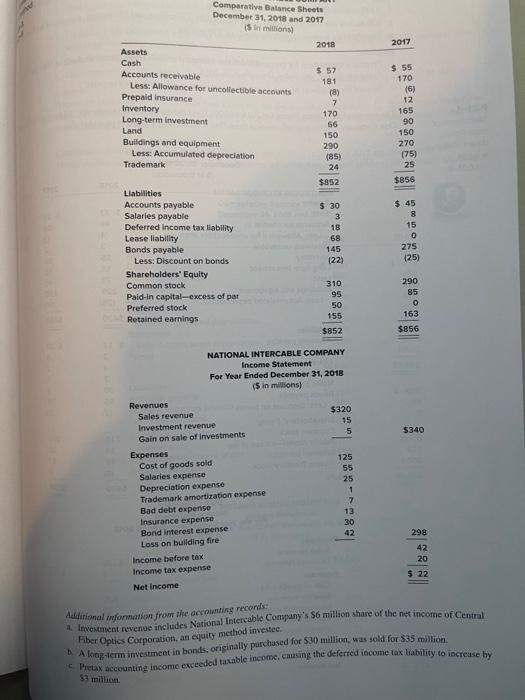

i need the cash flow

Additional Financial Reporting The comparative helance sheets for 2015 and 2017 and the statement of income for 2018 1266 SECTION 4 Wright Company. Additional information from Wrighe's accounting meconds is provided P21-3 Statement chows P 21-2 Statement of cash flows: direct method 1021-3 LO21-8 2012 LO71-8 WRIGHT COMPANY Comparative Balance Sheets December 31, 2018 and 2017 (5 in thousands 2018 2017 Assets Cash Accounts receivable Short-term investment Inventory Land Buildings and equipment Less Accumulated depreciation $ 42 73 40 75 50 550 (115) $715 $ 30 75 15 10 60 400 (75) 5575 $ 28 2 $ 35 Liabilities Accounts payable Salaries payable Interest payable Income tax payable Notes payable Bonds payable Shareholders' Equity Common stock Poid.in capital excess of par Retained earnings 572mm MWS|| 9 O 160 3 12 30 100 250 126 200 100 90 135 $ 715 $575 $380 WRIGHT COMPANY Income Statement For Year Ended December 31, 2018 (5 in thousands) Revenues Sales revenue Expenses Cost of goods sold $130 Salaries expense 45 Depreciation expense 40 Interest expense 12 Loss on sale of land 3 Income tax expense 70 Net income 300 $ 80 Adilinimal information from the coming records, Land that originally cost $10,000 was sold for $7.000, b. The common of MicroCorpoco was purchased for $25 as a short-term investment Nified as a cash equivalent New equipment was purchased for 5150,000 cash d. A $30.000 was paid at maturity on lanuary ! On lauary 1, 2018, bonds were sold at their 560.000 face value 1 Commock (550.000 pur) was sold for 576,000 Net net was 580,000 and cash dividends of $35.000 were paid to shareholders Required: Prepare the statement of cah now of Wigh Company for the year ended December 31, 2018 Press tout paties by the direct metod. TOTO the schedule to reconcile net cash flows from operating activities) Comparative Balance Sheets December 31, 2018 and 2017 islomi 2018 2017 Assets Cash Accounts receivable Less: Allowance for uncollectible accounts Prepaid Insurance Inventory Long-term investment Land Buildings and equipment Less: Accumulated depreciation Trademark $ 57 181 (8) 7 170 66 150 290 (85) 24 $ 55 170 (6) 12 165 90 150 270 (75) 25 $856 $952 Liabilities Accounts payable Salaries payable Deferred income tax liability Lease liability Bonds payable Less: Discount on bonds Shareholders' Equity Common stock Paid-in capital-excess of par Preferred stock Retained earnings $ 30 3 18 68 145 (22) $ 45 8 15 0 275 (25) 310 95 50 155 290 85 O 163 $852 $856 $340 NATIONAL INTERCABLE COMPANY Income Statement For Year Ended December 31, 2018 ($ in millions) Revenues Sales revenue $320 Investment revenue 15 Gain on sale of investments 5 Expenses Cost of goods sold 125 55 Salaries expense 25 Depreciation expenso 1 Trademark amortization expense 7 Bad debt expense 13 Insurance expense 30 Bond interest expense 42 Loss on building fire Income before tax Income tax expense 298 42 20 $ 22 Net Income Additional information from the accounting records: * Investment revenue includes National Intercable Company's S6 million share of the net income of Central Fiber Optics Corporation, an equity method investee A long-term investment in bonds, originally purchased for 530 million, was sold for $35 million Pretax accounting income exceeded taxable income, musing the deferred income tax liability to increase by $1 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started