Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the consolidated journal entries shown on last photo. Other photos contain the rest of the problem Exercise A8-2: 2-years post, AAP, p% =

I need the consolidated journal entries shown on last photo. Other photos contain the rest of the problem

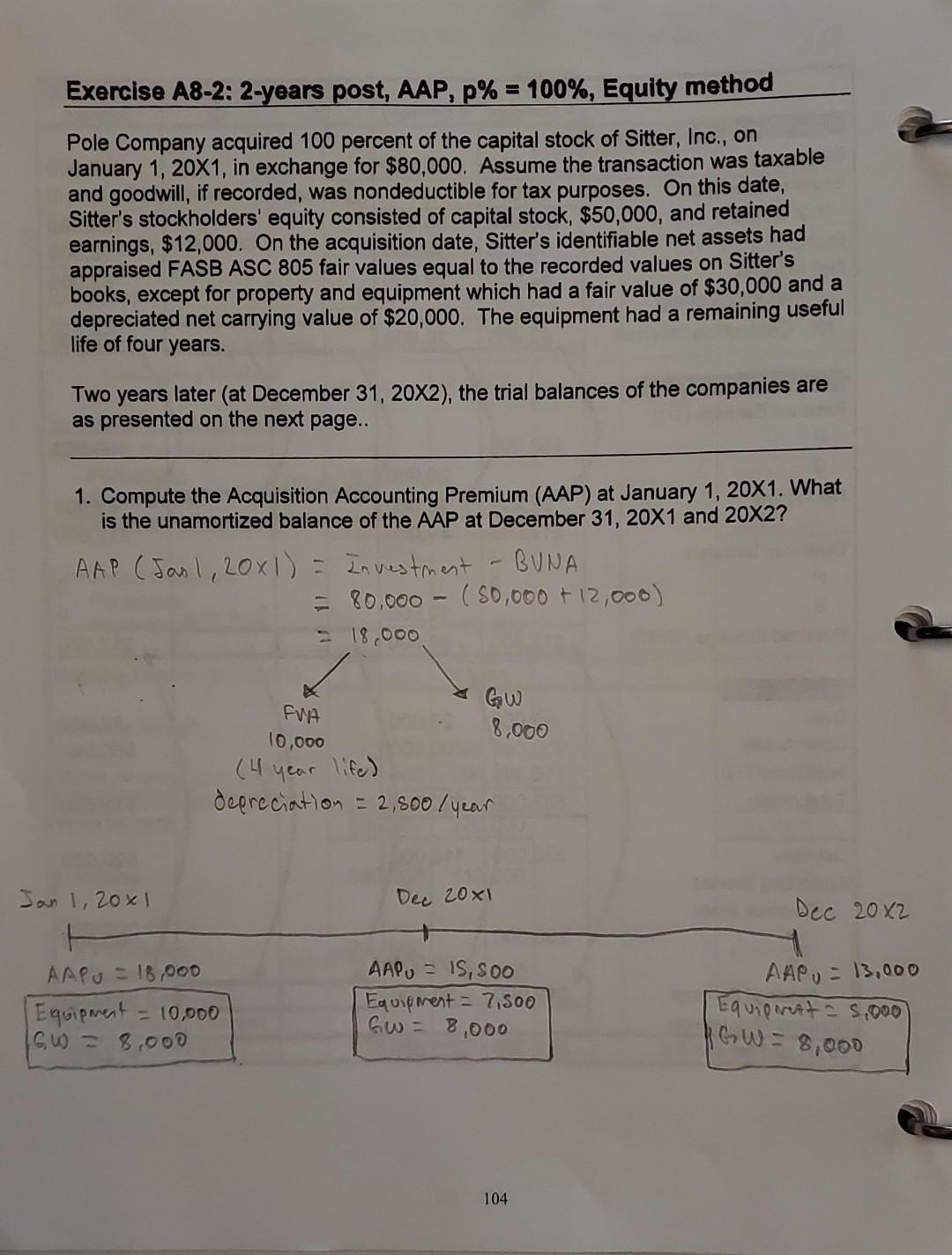

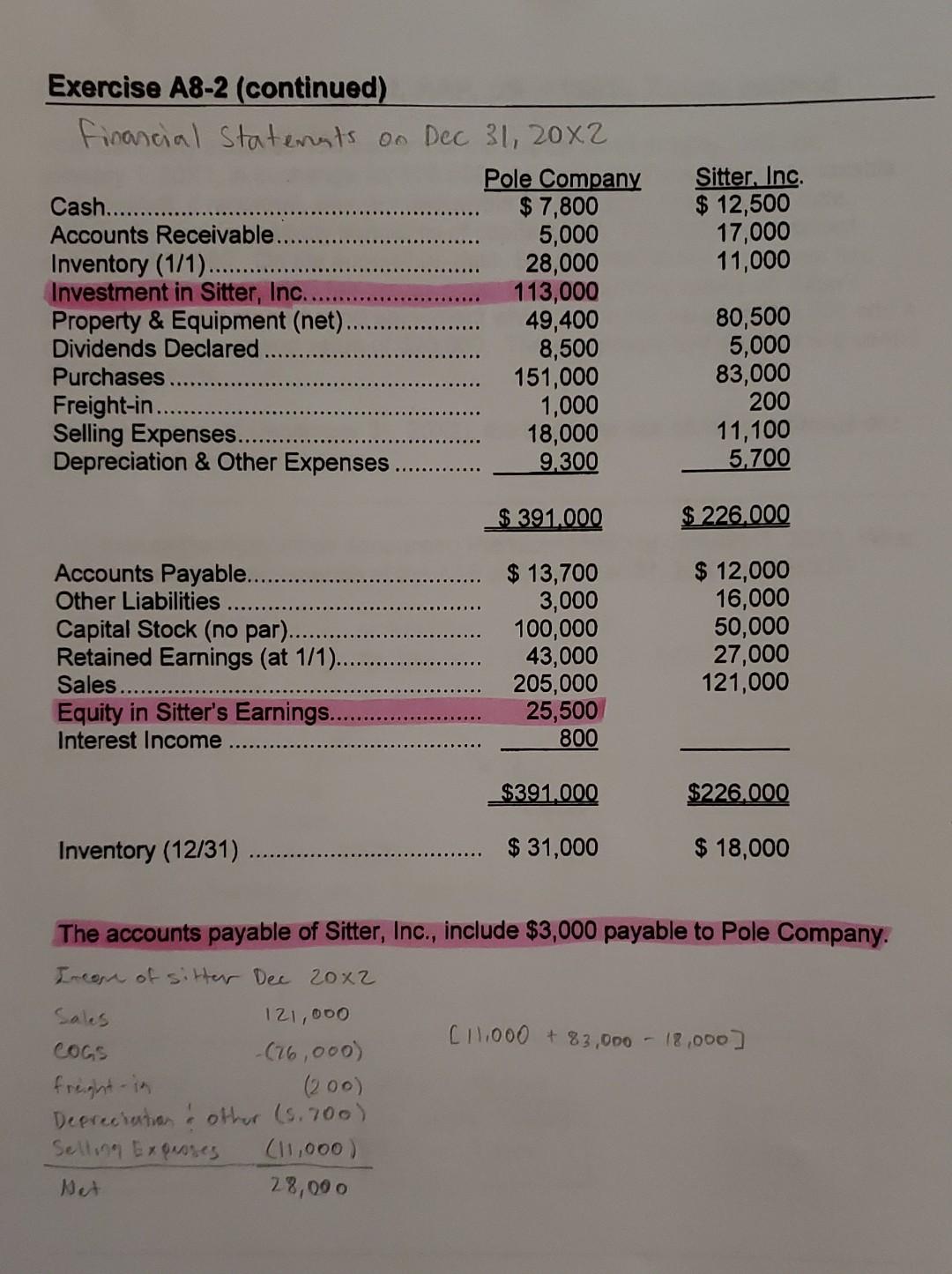

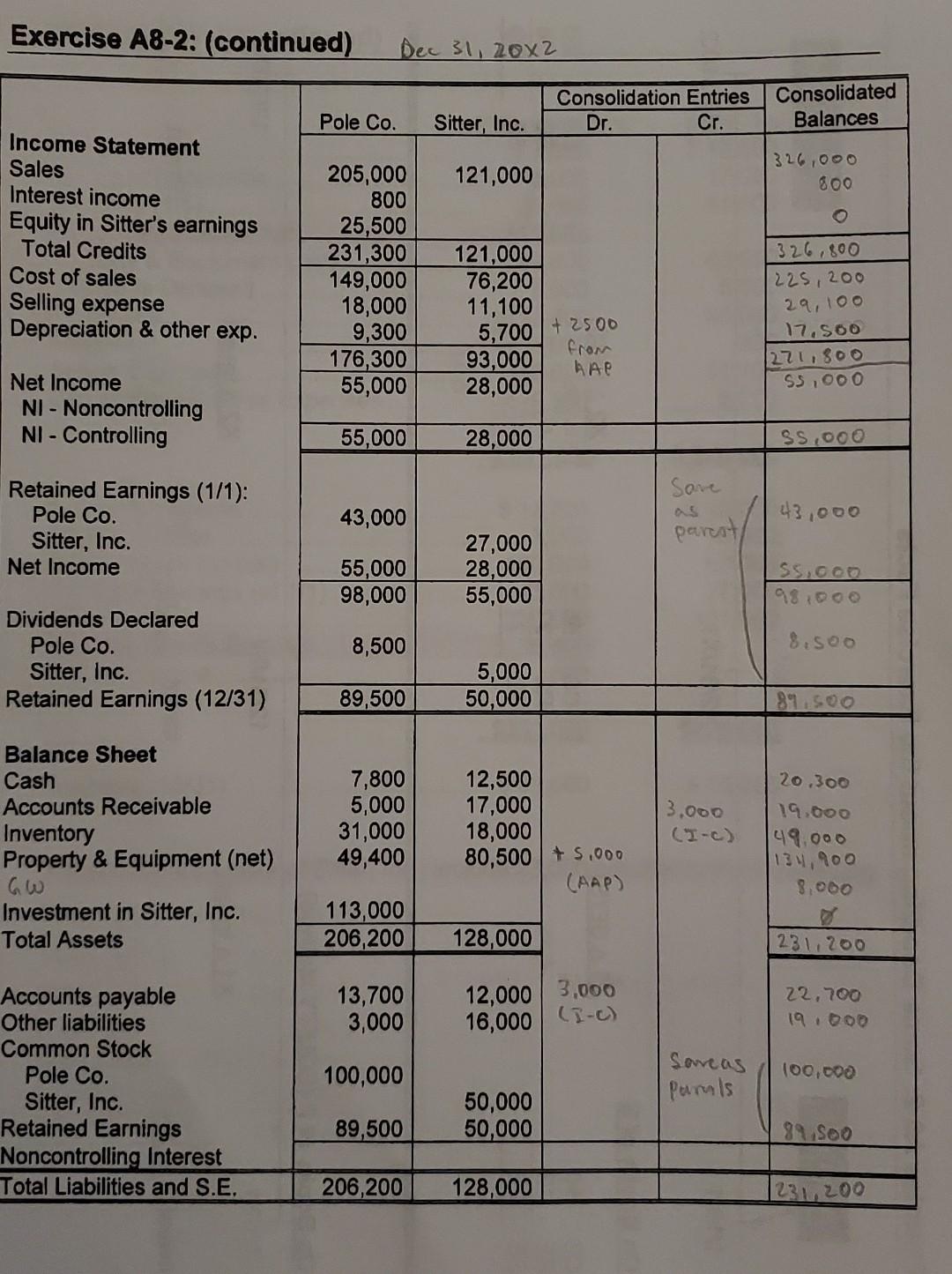

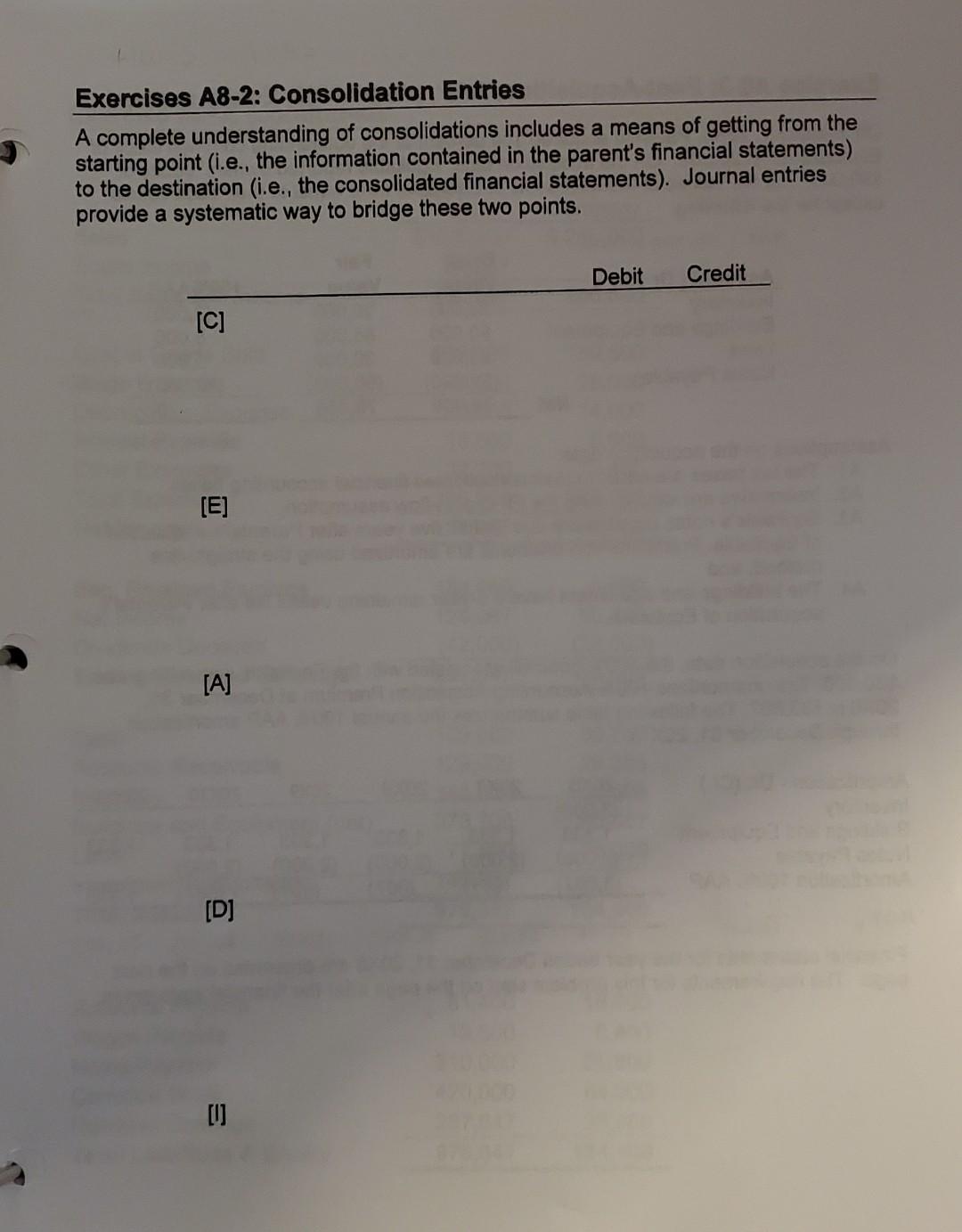

Exercise A8-2: 2-years post, AAP, p% = 100%, Equity method Pole Company acquired 100 percent of the capital stock of Sitter, Inc., on January 1, 20X1, in exchange for $80,000. Assume the transaction was taxable and goodwill , if recorded, was nondeductible for tax purposes. On this date, Sitter's stockholders' equity consisted of capital stock, $50,000, and retained earnings, $12,000. On the acquisition date, Sitter's identifiable net assets had appraised FASB ASC 805 fair values equal to the recorded values on Sitter's books, except for property and equipment which had a fair value of $30,000 and a depreciated net carrying value of $20,000. The equipment had a remaining useful life of four years. Two years later (at December 31, 20X2), the trial balances of the companies are as presented on the next page.. 1. Compute the Acquisition Accounting Premium (AAP) at January 1, 20X1. What is the unamortized balance of the AAP at December 31, 20X1 and 20X2? AAP (Jan 1, 20x1) = Investment BUNA = 80.000 - (50,000 +12,000) 18,000 Gw fra 8,000 10,000 (4 year life) depreciation = 2,500/year Jan 1, 20x1 Dec 20x1 Dec 20x2 AAPU = 13,000 AAPO = 18,000 Equipment = 10,000 IG w = 8,000 AAP - IS, SOO Equipment = 7,500 Gw= Equorette 5.000 8,000 iGW = 8,000 104 Exercise A8-2 (continued) Financial Statensts on Dec 31, 20x2. Pole Company Cash....... $ 7,800 Accounts Receivable. 5,000 Inventory (1/1).... 28,000 Investment in Sitter, Inc.. 113,000 Property & Equipment (net). 49,400 Dividends Declared 8,500 Purchases 151,000 Freight-in... 1,000 Selling Expenses. 18,000 Depreciation & Other Expenses. 9.300 Sitter, Inc. $ 12,500 17,000 11,000 80,500 5,000 83,000 200 11,100 5.700 $ 391.000 $ 226.000 Accounts Payable.. Other Liabilities Capital Stock (no par)... Retained Earnings (at 1/1).. Sales ...... Equity in Sitter's Earnings.. Interest Income .. $ 13,700 3,000 100,000 43,000 205,000 25,500 800 $ 12,000 16,000 50,000 27,000 121,000 $391.000 $226.000 Inventory (12/31) $ 31,000 $ 18,000 The accounts payable of Sitter, Inc., include $3,000 payable to Pole Company. Iroom of sitter Dec 2002 Sales 121,000 11.000 + 83,000 18,000 cogs -(76,000) freight in (200) Depreciation & other (s. 700) Selling Exquoses (11,000) Det 28,000 Exercise A8-2: (continued) Dec 31, 20x2 Consolidation Entries Dr. Cr. Consolidated Balances Pole Co. Sitter, Inc. 320,000 121,000 800 Income Statement Sales Interest income Equity in Sitter's earnings Total Credits Cost of sales Selling expense Depreciation & other exp. 205,000 800 25,500 231,300 149,000 18,000 9,300 176,300 55,000 121,000 76,200 11,100 5,700 + 2500 from 93,000 28,000 326,800 225,200 29,100 17,500 1271,800 S5,000 Net Income NI -Noncontrolling NI - Controlling 55,000 28,000 $5,000 Save Retained Earnings (1/1): Pole Co. Sitter, Inc. Net Income 43,000 43,000 parest/ 55,000 98,000 27,000 28,000 55,000 SS.000 98000 8,500 8.500 Dividends Declared Pole Co. Sitter, Inc. Retained Earnings (12/31) 5,000 50,000 89,500 89.500 Balance Sheet Cash Accounts Receivable Inventory Property & Equipment (net) 7,800 5,000 31,000 49,400 12,500 17,000 18,000 80,500+ 5.000 (AAP) 3.000 (I-C) [ 20,300 19.000 49.000 134,900 8.000 Investment in Sitter, Inc. Total Assets 113,000 206,200 128,000 231,200 13,700 3,000 12,000 3.000 16,000 22,700 19000 100,000 Accounts payable Other liabilities Common Stock Pole Co. Sitter, Inc. Retained Earnings Noncontrolling Interest Total Liabilities and S.E. Sancas Panals 100,000 89,500 50,000 50,000 99 SOO 206,200 128,000 1231, 200 Exercises A8-2: Consolidation Entries A complete understanding of consolidations includes a means of getting from the starting point (i.e., the information contained in the parent's financial statements) to the destination (i.e., the consolidated financial statements). Journal entries provide a systematic way to bridge these two points. Debit Credit [C] [E] [A] [D] 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started