Answered step by step

Verified Expert Solution

Question

1 Approved Answer

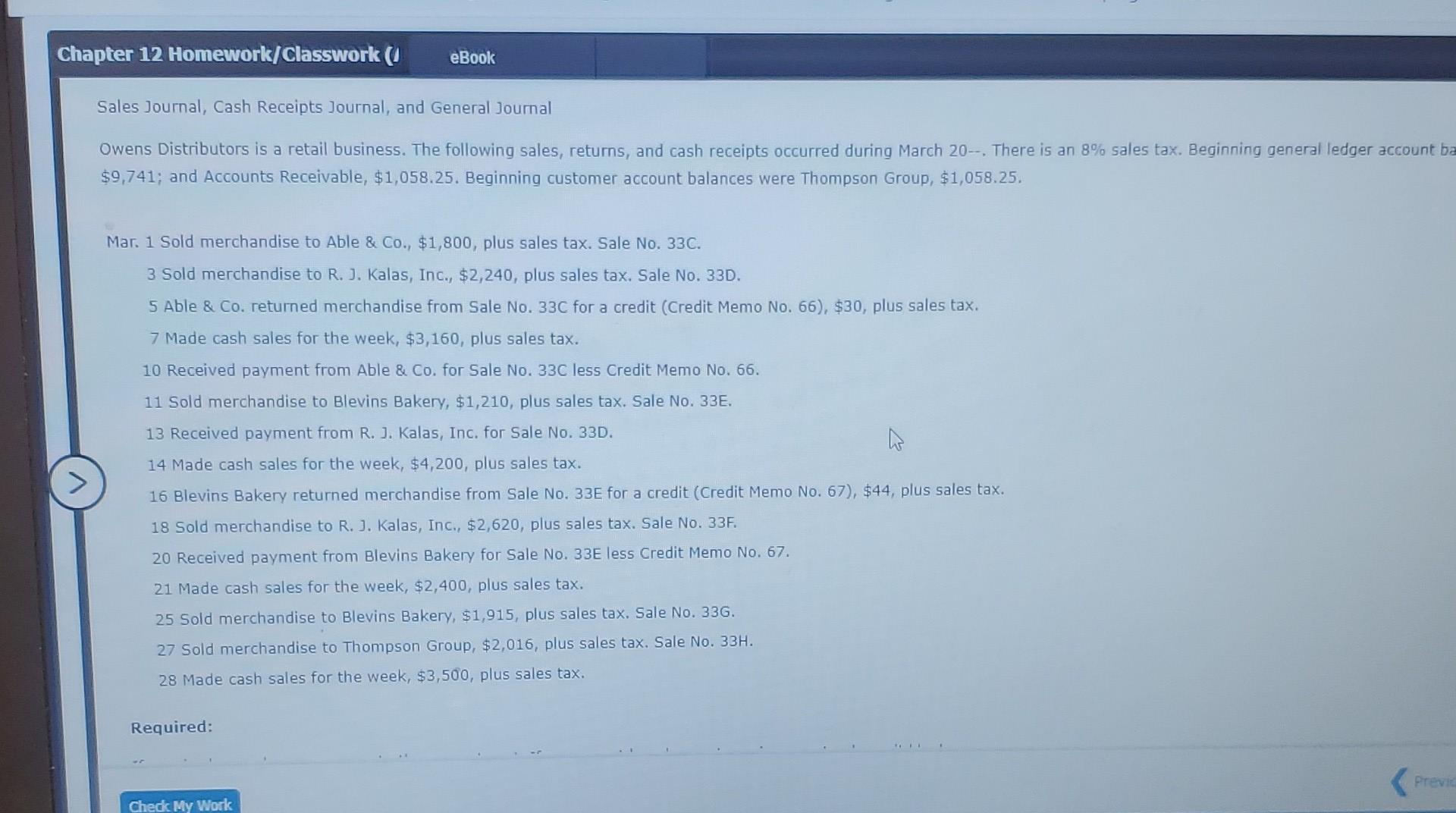

I need the correct answers Sales Journal, Cash Receipts Journal, and General Journal Owens Distributors is a retail business. The following sales, returns, and cash

I need the correct answers

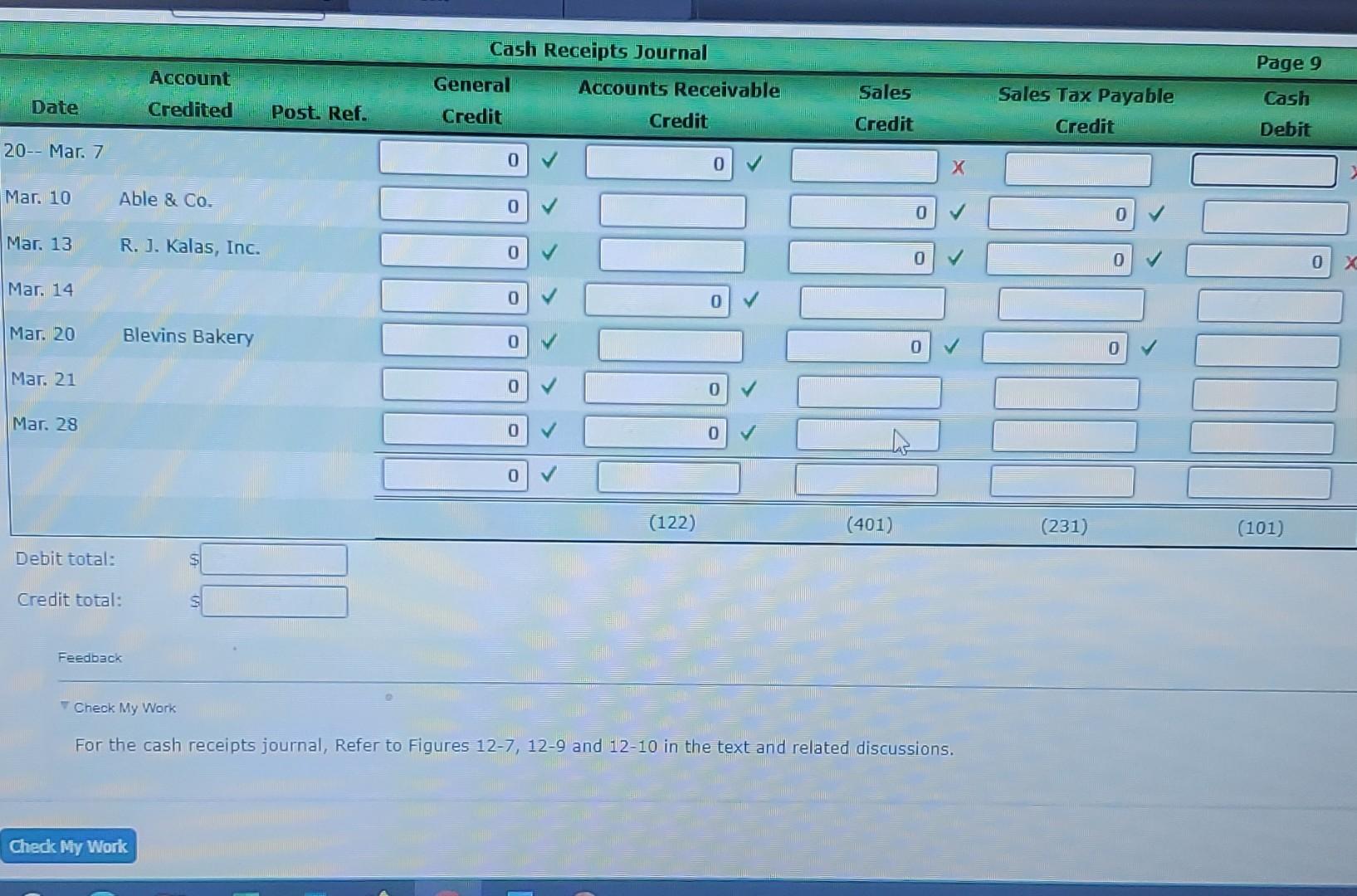

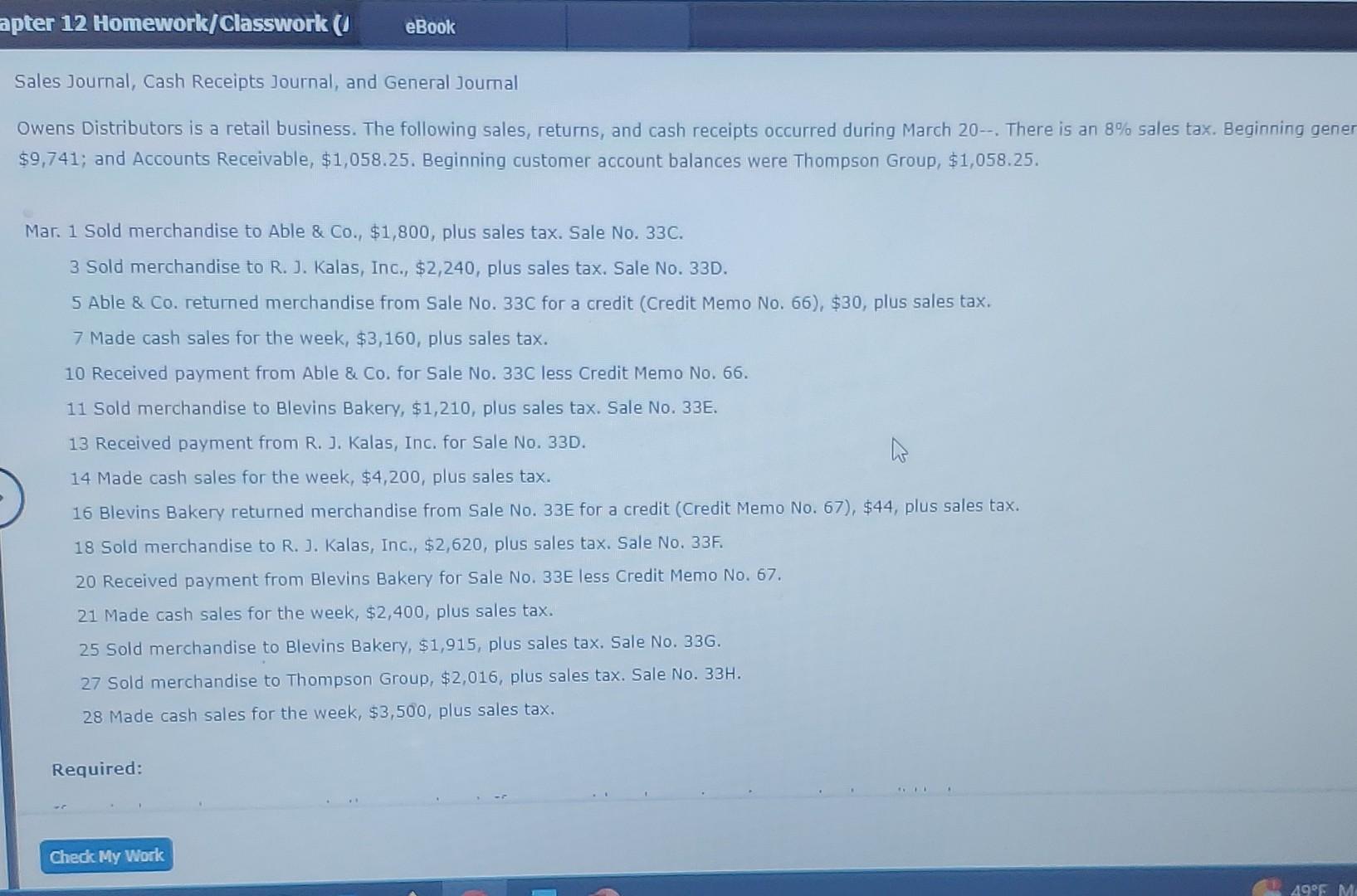

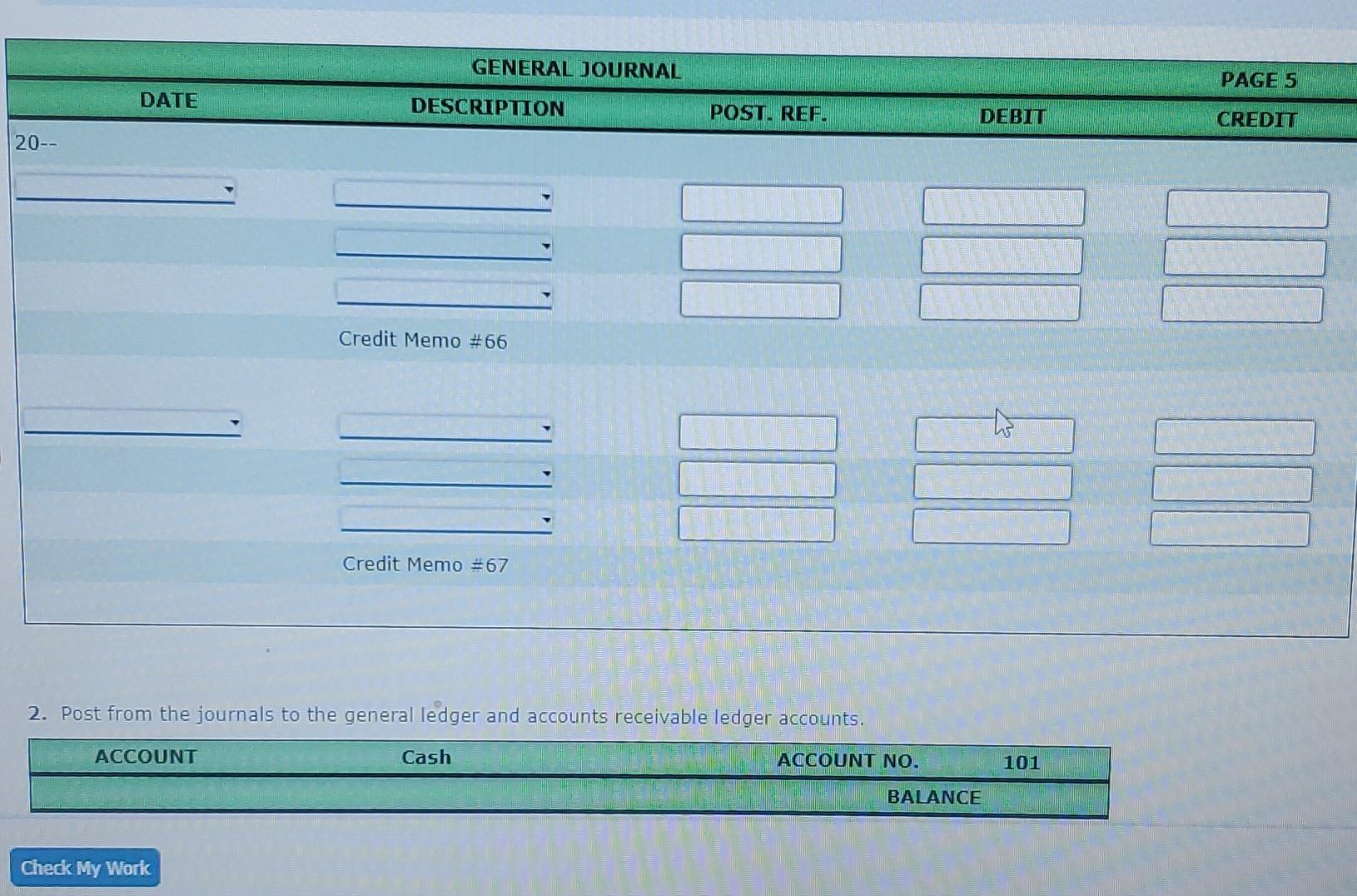

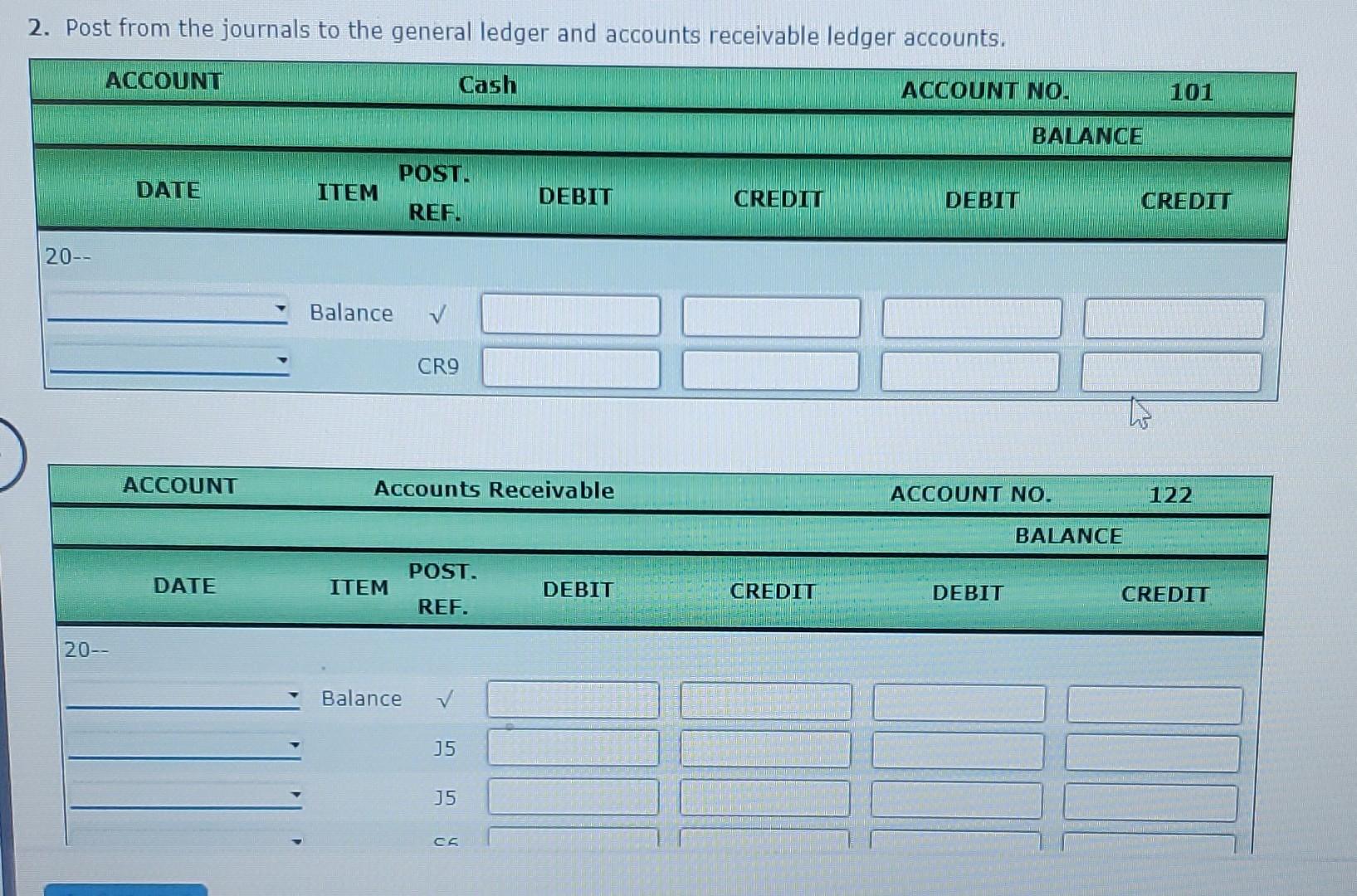

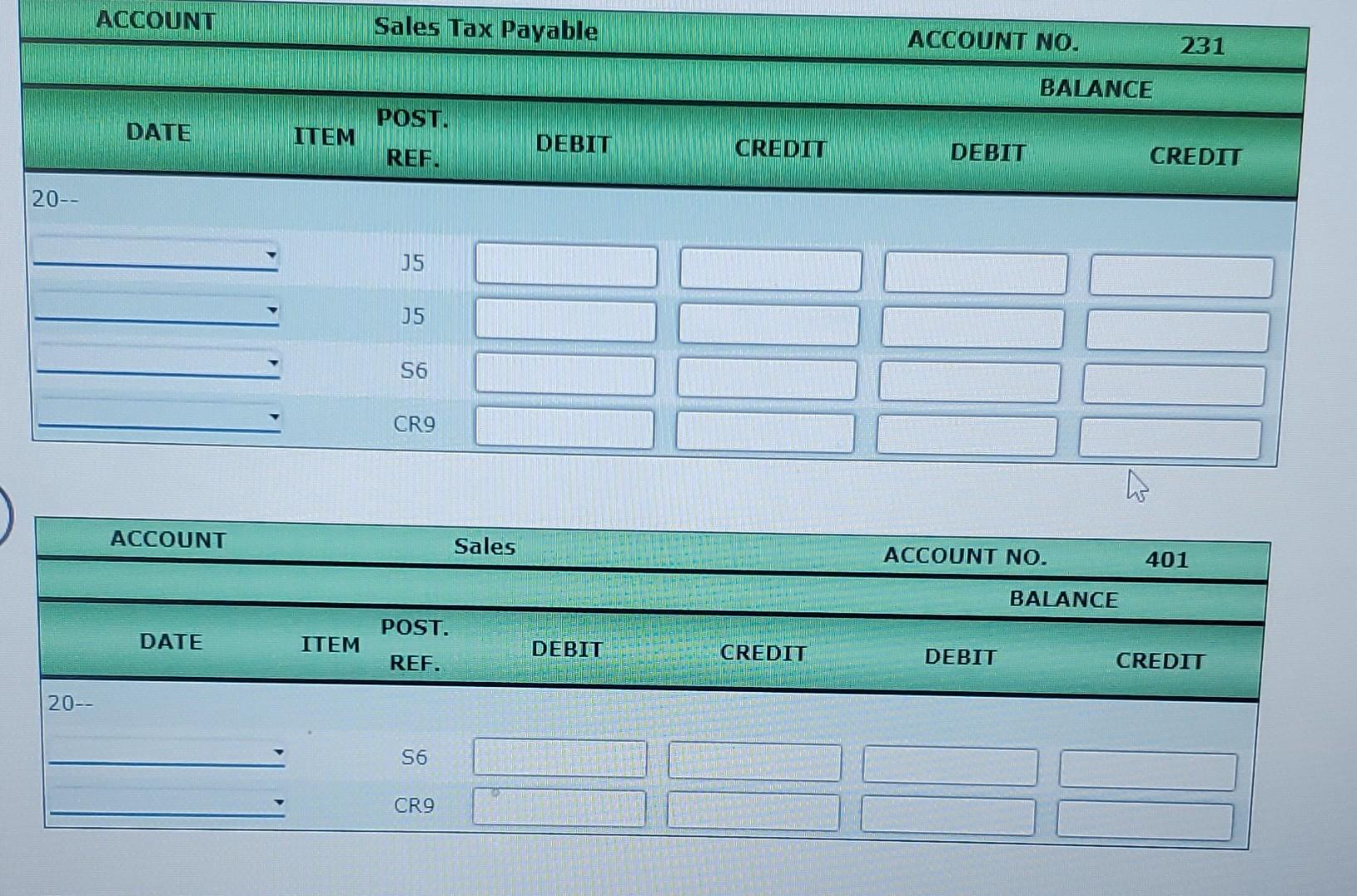

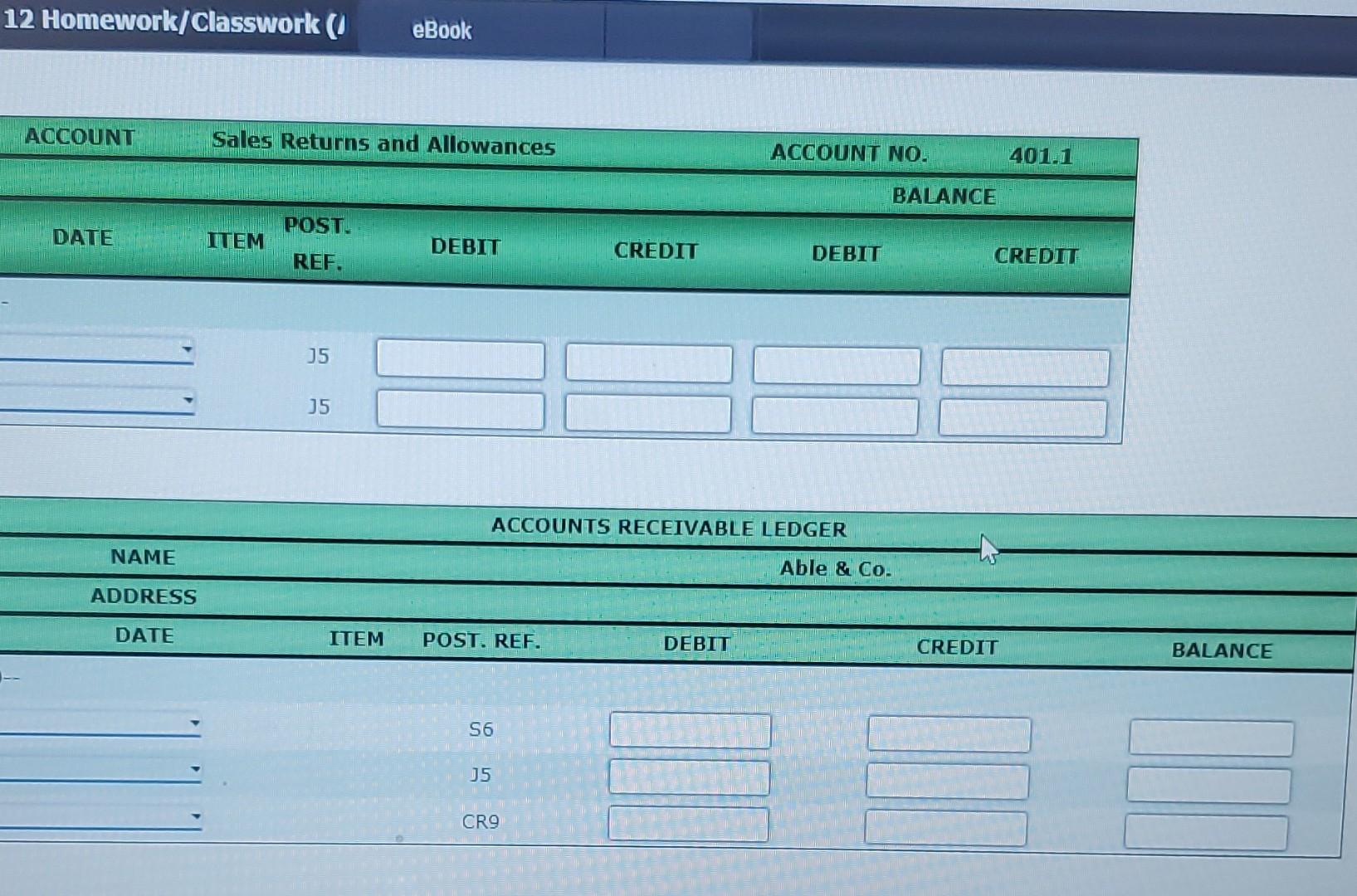

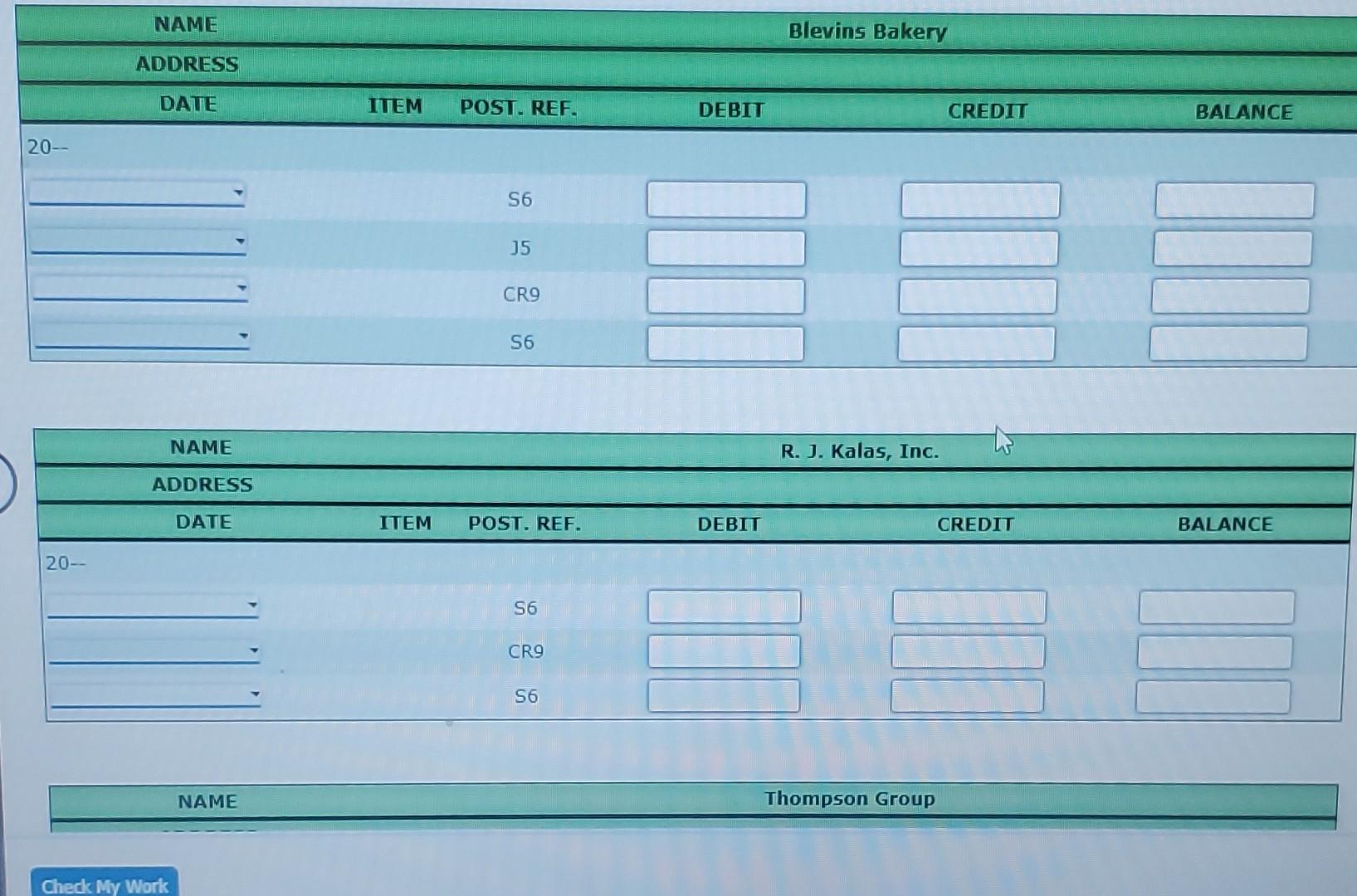

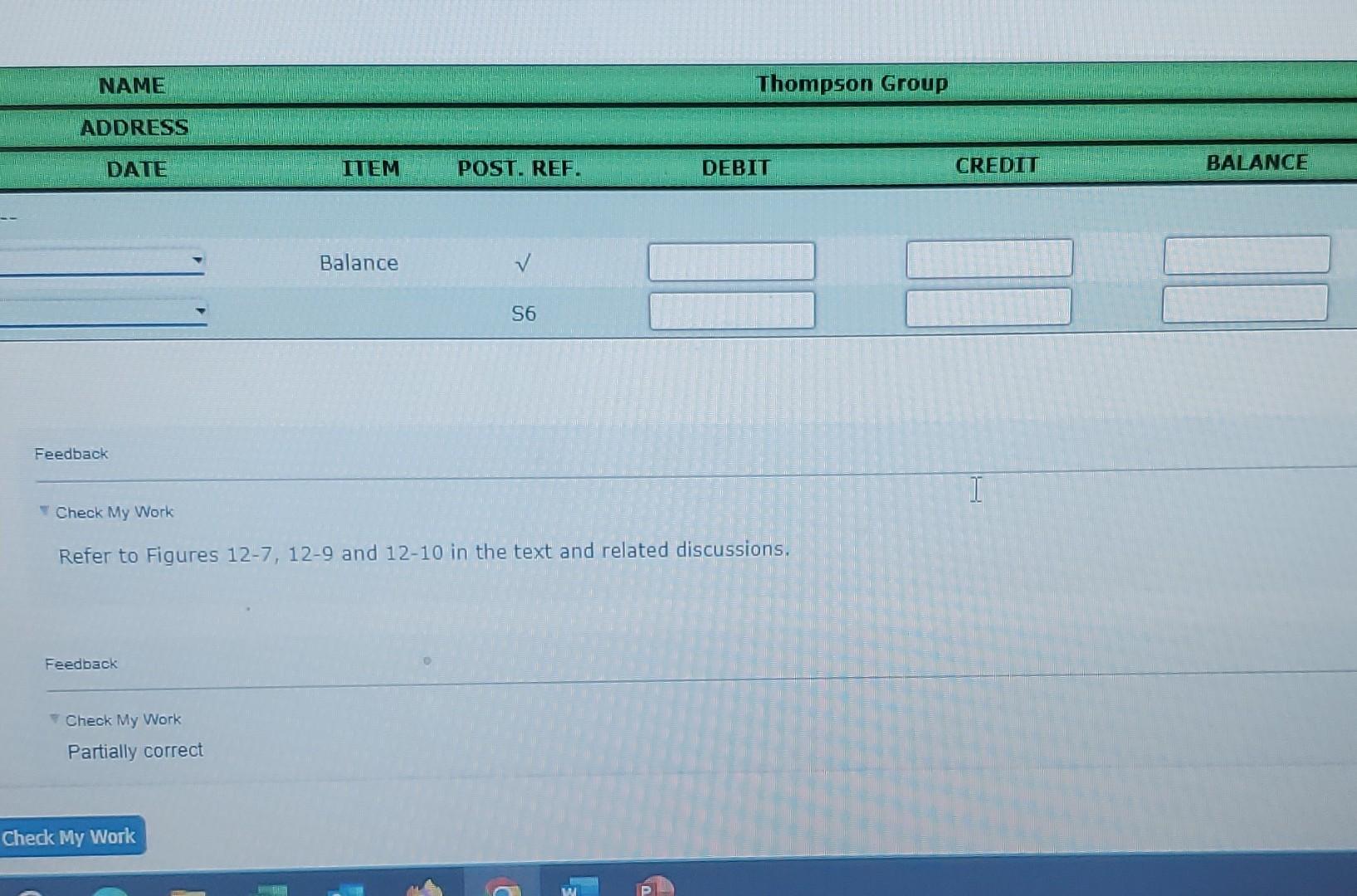

Sales Journal, Cash Receipts Journal, and General Journal Owens Distributors is a retail business. The following sales, returns, and cash receipts occurred during March 20. There is an 8% sales tax. Beginning gener $9,741; and Accounts Receivable, \$1,058.25. Beginning customer account balances were Thompson Group, \$1,058.25. Mar. 1 Sold merchandise to Able \& Co., \$1,800, plus sales tax. Sale No. 33C. 3 Sold merchandise to R. J. Kalas, Inc., \$2,240, plus sales tax. Sale No. 33D. 5 Able \& Co. returned merchandise from Sale No. 33C for a credit (Credit Memo No. 66), \$30, plus sales tax. 7 Made cash sales for the week, $3,160, plus sales tax. 10 Received payment from Able \& Co. for Sale No. 33C less Credit Memo No. 66. 11 Sold merchandise to Blevins Bakery, $1,210, plus sales tax. Sale No. 33E. 13 Received payment from R. J. Kalas, Inc. for Sale No. 33D. 14 Made cash sales for the week, \$4,200, plus sales tax. 16 Blevins Bakery returned merchandise from Sale No. 33E for a credit (Credit Memo No. 67), \$44, plus sales tax. 18 Sold merchandise to R. J. Kalas, Inc., $2,620, plus sales tax. Sale No. 33F. 20 Received payment from Blevins Bakery for Sale No. 33E less Credit Memo No, 67. 21 Made cash sales for the week, $2,400, plus sales tax. 25 Sold merchandise to Blevins Bakery, \$1,915, plus sales tax. Sale No. 336. 27 Sold merchandise to Thompson Group, $2,016, plus sales tax. Sale No. 33H. 28 Made cash sales for the week, $3,500, plus sales tax. For the cash receipts journal, Refer to Figures 127,129 and 12-10 in the text and related discussions. 2. Post from the journals to the general ledger and accounts receivable ledger accounts. Sales Journal, Cash Receipts Journal, and General Journal Owens Distributors is a retail business. The following sales, returns, and cash receipts occurred during March 20, There is an 8% sales tax. Beginning general ledger account b $9,741; and Accounts Receivable, \$1,058.25. Beginning customer account balances were Thompson Group, \$1,058.25. Mar. 1 Sold merchandise to Able \& Co., $1,800, plus sales tax. Sale No. 33C. 3 Sold merchandise to R. J. Kalas, Inc., \$2,240, plus sales tax. Sale No. 33D. 5 Able \& Co. returned merchandise from Sale No. 33C for a credit (Credit Memo No. 66), \$30, plus sales tax. 7 Made cash sales for the week, $3,160, plus sales tax. 10 Received payment from Able \& Co. for Sale No. 33C less Credit Memo No. 66. 11 Sold merchandise to Blevins Bakery, \$1,210, plus sales tax. Sale No. 33E. 13 Received payment from R. J. Kalas, Inc. for Sale No. 33D. 14 Made cash sales for the week, $4,200, plus sales tax. 16 Blevins Bakery returned merchandise from Sale No. 33E for a credit (Credit Memo No. 67), \$44, plus sales tax. 18 Sold merchandise to R. J. Kalas, Inc., $2,620, plus sales tax. Sale No. 33F. 20 Received payment from Blevins Bakery for Sale No. 33E less Credit Memo No. 67. 21 Made cash sales for the week, $2,400, plus sales tax. 25 Sold merchandise to Blevins Bakery, \$1,915, plus sales tax. Sale No. 336 . 27 Sold merchandise to Thompson Group, $2,016, plus sales tax. Sale No. 33H. 28 Made cash sales for the week, $3,500, plus sales tax. Required: 2. Post from the journals to the general ledger and accounts receivable ledger accounts. 12 Homework/Classwork ( ) eBook \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & Sales & Return & Allowance & & ACCOUNT NO. & 401.1 \\ \hline \multirow[b]{2}{*}{ DATE } & \multirow[b]{2}{*}{ IIEM } & \multirow[b]{2}{*}{\begin{tabular}{l} POST. \\ REF. \end{tabular}} & \multirow[b]{2}{*}{ DEBIT } & \multirow[b]{2}{*}{ CREDIT } & \multicolumn{2}{|c|}{ BALANCE } \\ \hline & & & & & DEBIT & CREDIT \\ \hline & & J5 & & & & \\ \hline & = & 35 & & & & \\ \hline \end{tabular} ACCOUNTS RECEIVABLE LEDGER \begin{tabular}{|c|c|c|c|c|c|} \hline NAME & \multicolumn{5}{|c|}{ Able \& Co. } \\ \hline \multicolumn{6}{|l|}{ ADDRESS } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & BALANCE \\ \hline & & S6 & & & \\ \hline & & 35 & & & \\ \hline & & CR9 & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline NAME & \multicolumn{5}{|c|}{ Blevins Bakery } \\ \hline \multicolumn{6}{|l|}{ ADDRESS } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDII & BALANCE \\ \hline \multicolumn{6}{|l|}{20} \\ \hline & & S6 & & & \\ \hline & & J5 & & & \\ \hline & & CR9 & & & \\ \hline & & S6 & & & \\ \hline NAME & \multicolumn{5}{|c|}{ R. J. Kalas, Inc. } \\ \hline \multicolumn{6}{|l|}{ ADDRESS } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & BALANCE \\ \hline \multicolumn{6}{|l|}{20} \\ \hline & & S6 & & & \\ \hline & & CR9 & & & \\ \hline & & S6 & & & \\ \hline NAME & \multicolumn{5}{|c|}{ Thompson Group } \\ \hline \end{tabular} Check My Work Check My Work Refer to Figures 12-7, 12-9 and 12-10 in the text and related discussions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started