I need the correct answers

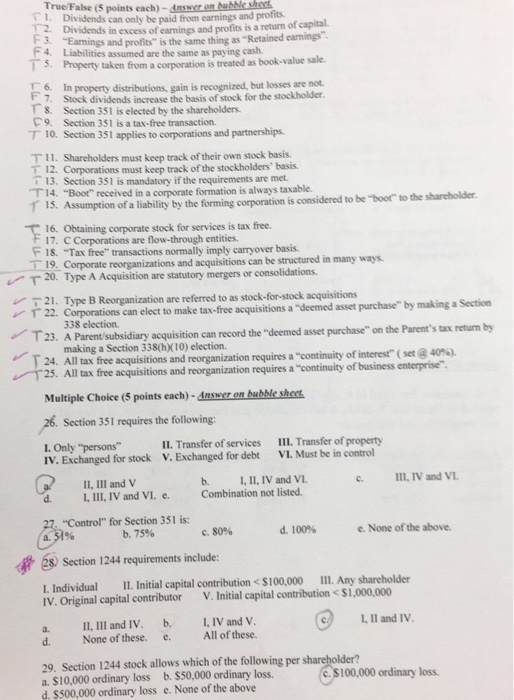

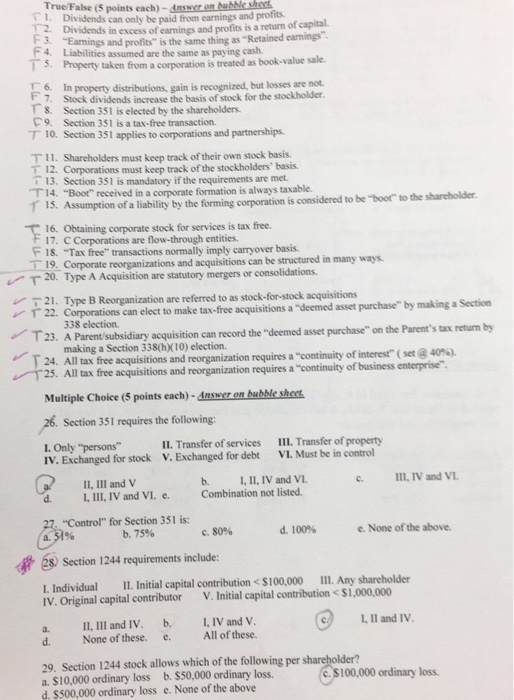

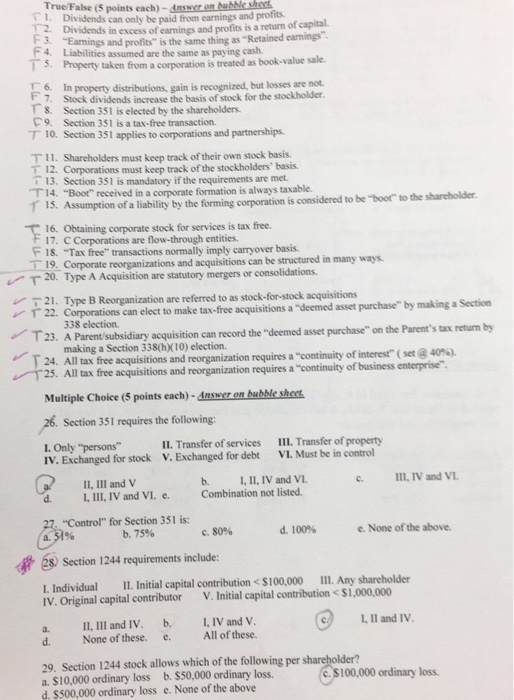

TrueFalse (S points each)- Dividends can only be paid from earnings and profits . Dividends in excess of earnings and profits is a returm of Eamings and profits" is the same thing as "Retained earnings F4. Liabilities assumed are the same as paying cash. 5. Property taken from a corporation is treated as book-value sale. In property distributions, gain is recognized, but losses are not 7 6. Stock dividends increase the basis of stock for the stockholder ?8, C9. Section 351 is elected by the shareholders. Section 351 is a tax-free transaction. 10. Section 351 applies to corporations and partnerships. T I l. Shareholders must keep track oftheir own stock basis. 12. Corporations must keep track of the stockholders' basis 13. Section 351 is mandatory if the requirements are met. T14. Boor" received in a corporate formation is always taxable. T 15. Assumption of a liability by the forming corporation is considered to be "boot" to the shareholder. 16. Obtaining corporate stock for services is tax free. 17. C Corporations are flow-through entities F 1S. "Tax free" transactions normally imply carryover basis. 19 T20. Type A Acquisition are statutory mergers or consolidations 21. Type B Reorganization are referred to as stock-for-stock acquisitions T22. Corporations can elect to make tax-free acquisitions a "deemed asset purchase" by making a Section Corporate reorganizations and acquisitions can be structured in many ways 338 election T23. A Parent/subsidiary acquisition can record the "deemed asset purchase" on the Parent's tax return by making a Section 338(hX10) election. 24. All tax free acquisitions and reorganization requires a continuity ofinterest. (set@40%. 25. All tax free acquisitions and reorganization requires a "continuity of business enterprise Multiple Choice (5 points each)-Answer on bubble sheet 26. Section 351 requires the following IV. Exchanged for stock V. Exchanged for debt VI. Must be in d. L. III, IV and VI. e. Combination not listed. I. Only "persons II. Transfer of services Il. Transfer of property II, IlI and V b. I, I1, IV and VI c. II, IV and VI C. "Control" for Section 351 is: 27. a. b. 75% 80% d, 100% e. None of the above. Section 1244 requirements include I. Individual . Initial capital contribution$100,000 III. Any shareholder IV. Original capital contributor V. Intial capital contribution$1,000,000 a. I1,III and IV. b. IV and V. d. None of these. e. All of these. L, II and IV. 29. Section 1244 stock allows which of the following per shareholder? a. $10,000 ordinary loss b. S50,000 ordinary loss d. $500,000 ordinary loss e. None of the above CS100,000 ordinary loss