Question

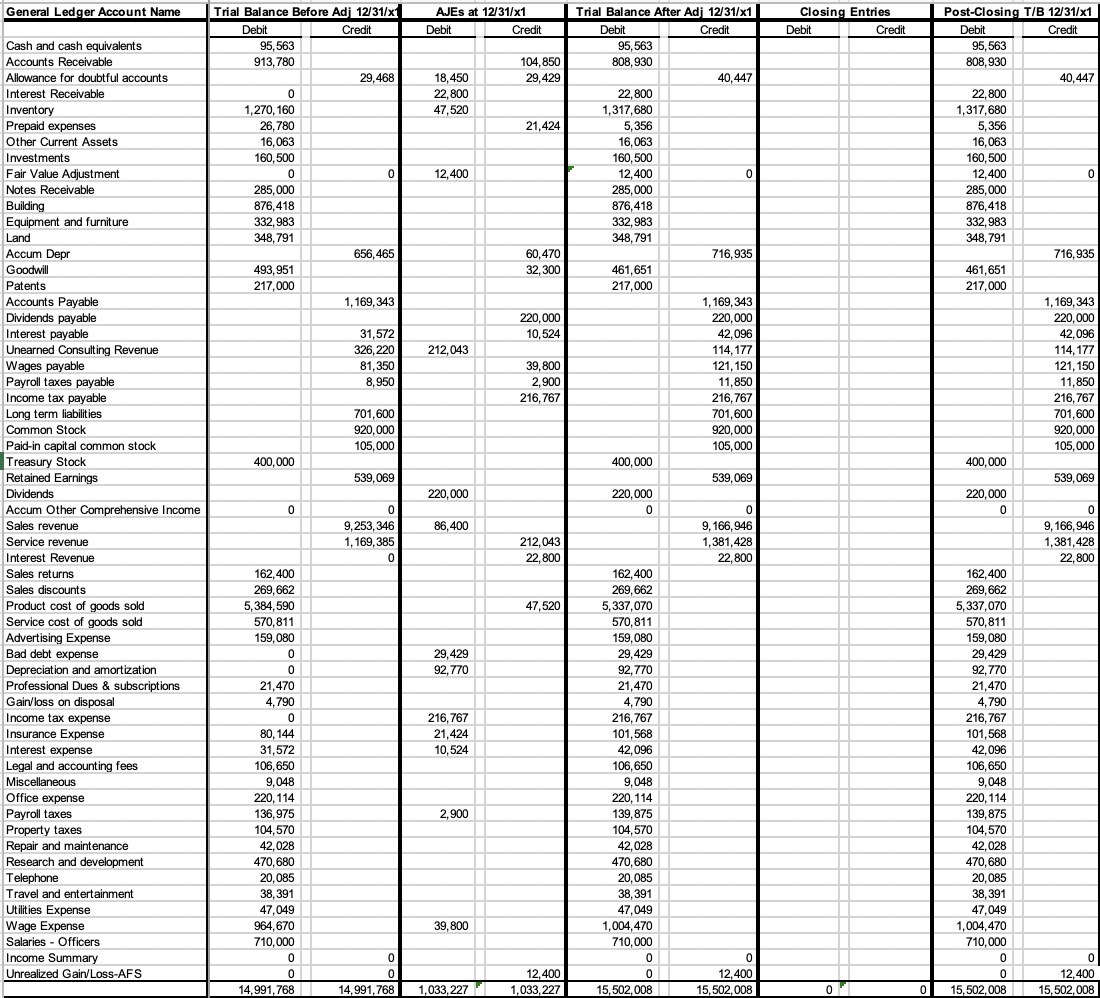

I need the following items answered: Closing Entry #1: Close ALL revenues to Income Summary. The credit to Income Summary will therefore represent Sales Rev

I need the following items answered:

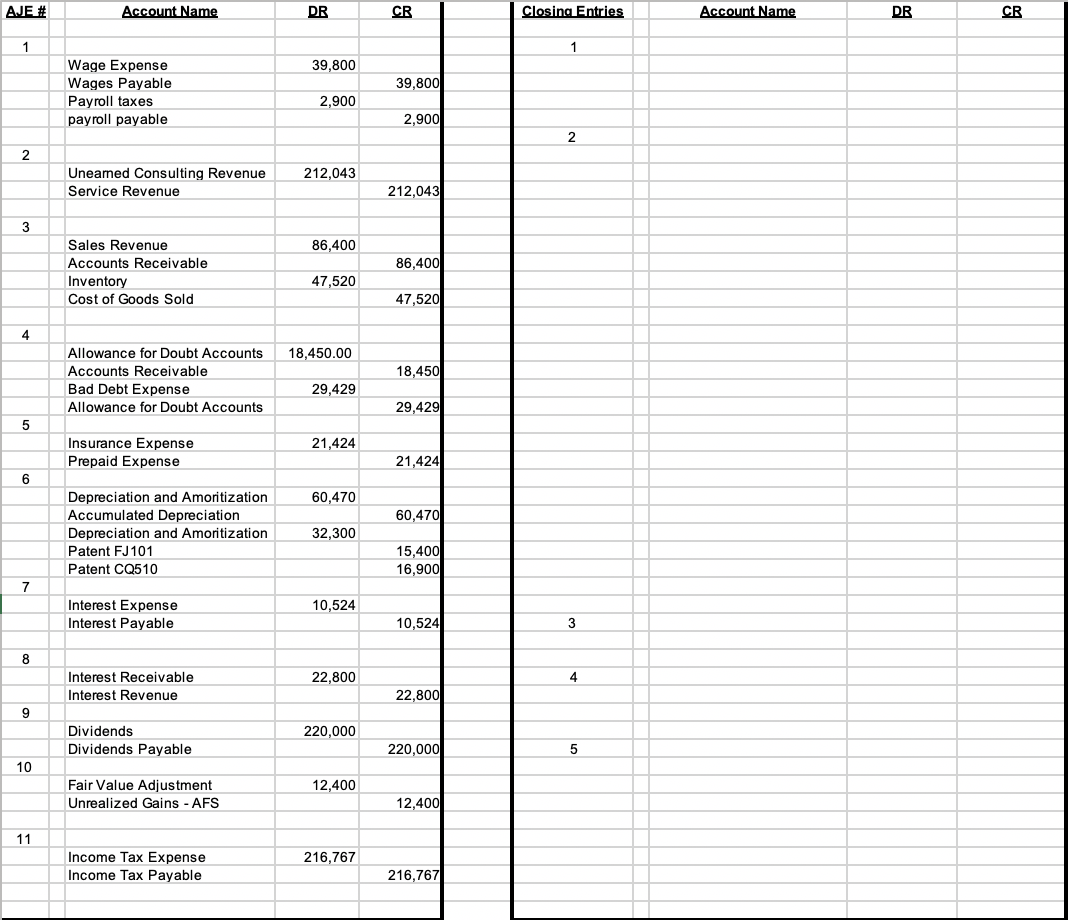

Closing Entry #1: Close ALL revenues to Income Summary. The credit to Income Summary will therefore represent Sales Rev + Service Rev + Interest Rev for the period.

Closing Entry #2: Close ALL expenses to Income Summary. Every individual expense, loss, sales returns & discounts account must be closed out with a credit, and the sum of all expenses/losses/returns & discounts can then be debited to your Income Summary in this entry.

Closing Entry #3: Take the difference between the credit posted to Income Summary (Closing Entry #1) less the debit posted to Income Summary (Closing Entry #2) to close out the Income Summary account and permanently move NI to R.E.

Closing Entry #4: Close out the dividend directly to R.E.

Closing Entry #5: Close the Unrealized Gain-AFS (the account title that appears on your Comprehensive Income Statement) to Accumulated Other Comprehensive Income (the equity account on the balance sheet). This closes out your Other Comprehensive Income (OCI) account & transfers its balance to your permanent Balance Sheet account "Accumulated Other Comprehensive Income". Just like NI is permanently closed into Retained Earnings, your OCI items from the current year also need to be closed out and permanently stored in the Accumulated OCI account under Stockholder's Equity on your Balance Sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started