Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the formulas and cell references for information below please, I will attach the directions, the problem, and the answer but I need the

I need the formulas and cell references for information below please, I will attach the directions, the problem, and the answer but I need the with cell references please.

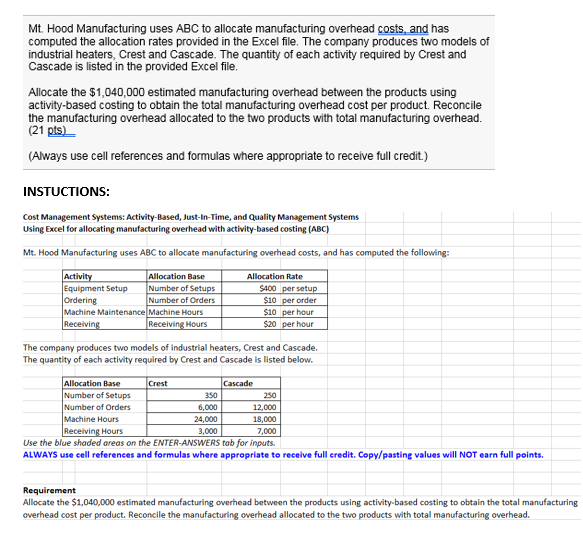

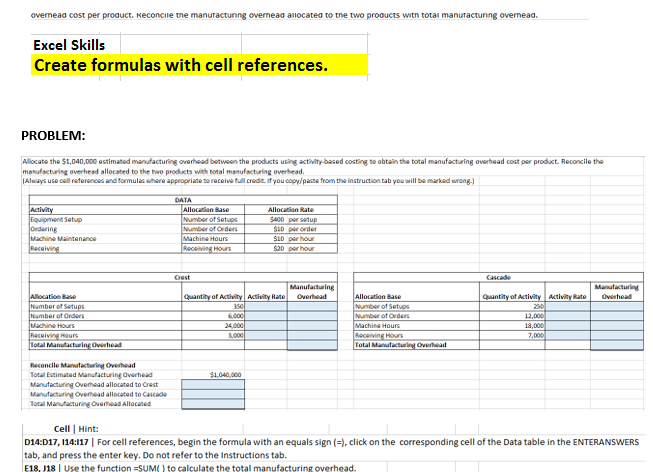

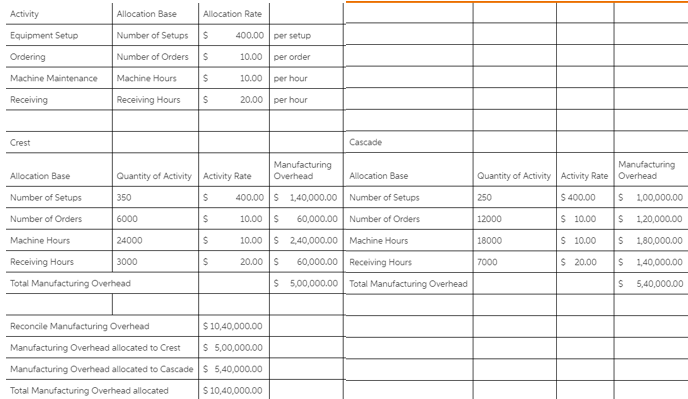

Mt. Hood Manufacturing uses ABC to allocate manufacturing overhead costs, and has computed the allocation rates provided in the Excel file. The company produces two models of industrial heaters, Crest and Cascade. The quantity of each activity required by Crest and Cascade is listed in the provided Excel file. Allocate the $1,040,000 estimated manufacturing overhead between the products using activity-based costing to obtain the total manufacturing overhead cost per product. Reconcile the manufacturing overhead allocated to the two products with total manufacturing overhead. (21 pts) (Always use cell references and formulas where appropriate to receive full credit) INSTUCTIONS: Cost Management Systems: Activity-Based, Just-In-Time, and Quality Management Systems Using Excel for allocating manufacturing overhead with activity-based costing (ABC) Mt. Hood Manufacturing uses ABC to allocate manufacturing overhead costs, and has computed the following: Activity Equipment Setup Ordering Machine Maintenance Machine Hours Receiving Allocation Base Number of Setups Number of Orders Allocation Rate S400 per setup $10 per order $10 per hour Receiving Hours $20 per hour The company produces two models of industrial heaters, Crest and Cascade. The quantity of each activity required by Crest and Cascade is listed below. Allocation Base Number of Setups Number of Orders Machine Hours Receiving Hours Cascade Crest 350 250 6.000 12.000 24,000 18.000 3.000 7,000 Use the blue shaded areas on the ENTER-ANSWERS tab for inputs. ALWAYS use cell references and formulas where appropriate to receive full eredit. Copy/pasting values will NOT earn full points. Requirement Allocate the $1,040,000 estimated manufacturing overhead between the products using activity-based costing to obtain the total manufacturing overhead cost per product. Reconcile the manufacturing overhead allocated to the two products with total manufacturing overhead. oveneaa cost per proauct. Keconcile tne manuracturing ovemeaa allocatea to tne two proaucts witn totai manuractunng overneaa. Excel Skills Create formulas with cell references. PROBLEM: Allocate the $1,040,000 astimated manufacturing overhead between the products using activity-based costing to abtain the total manufacturing overhead cost per product. Reconcile the manufacturing overhead allocated to the two products with total manufacturing overhead Always use celll referances and formulas where appeopriate to receive full credit if you copy/paste from the instruction tab you will be marked wreng.) DATA Allocation Base Activity EQuipment Satup Oedering Machine Maintenance Receiving Allocation Rate $400 per setup S10 0r order Number of Setugs Number of Orders Machina Hours S10 per hour Receiving Hours $20 per hour Crast Cascade Manufacturing Manufacturing Quantity of Activity Allocation Base Number of Setups Number of Orders Machine Hours Allocation Base Overhead Activity Rate Overhead quantity of Activity Activity Rate Number of Setups Number of Orders 3s0 250 6,000 24.000 12.000 13.000 7,000 Machine Hours Racoiving Haurs Total Manufacturing Overhead Receiving Hours Total Manufactuing Overhead 3,000 Reconcile Manufacturing Overhead Total Estimatad Manufacturing Overhead $1040,000 Manufacturing Overmead allocated to Crast Manufacturing Overhead allocated to Cascade Total Manufacturing Overhead Allocated Cell Hint: D14:D17, 114:117 | For cell references, begin the formula with an equals sign (), click on the corresponding cell of the Data table in the ENTERANSWERS tab, and press the enter key. Do not refer to the Instructions tab. E18, J18 | Use the function -SUM( ) to calculate the total manufacturing overhead. Activity Allocation Base Allocation Rate Number of Setups S Equipment Setup 400.00 per setup Ordering 10.00 Number of Orders per order Machine Maintenance Machine Hours 10.00 per hour Receiving Receiving Hours S 20.00 per hour Cascade Crest Manufacturing Overhead Manufacturing Overhead Quantity of Activity Activity Rate Allocation Base Quantity of Activity Activity Rate Allocation Base 400.00 S 1,40,000.00 Number of Setups $400.00 Number of Setups 350 250 1,00,000.00 S 10.00 Number of Orders 6000 10.00 60,000.00 Number of Orders 12000 1,20,000.00 S S 10.00 Machine Hours 24000 10.00 2,40,000.00 Machine Hours 18000 S 1,80,000.00 Receiving Hours $ 20.00 3000 20.00 S 60,000.00 Receiving Hours 7000 1,40,000.00 Total Manufacturing Overhead 5,00,000.00 Total Manufacturing Overhead S 5,40,000.00 Reconcile Manufacturing Overhead $10,40,000.00 S 5,00,000.00 Manufacturing Overhead allocated to Crest Manufacturing Overhead allocated to Cascade 5,40,000.00 Total Manufacturing Overhead allocated $ 10,40.000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started