i need the general journal entries

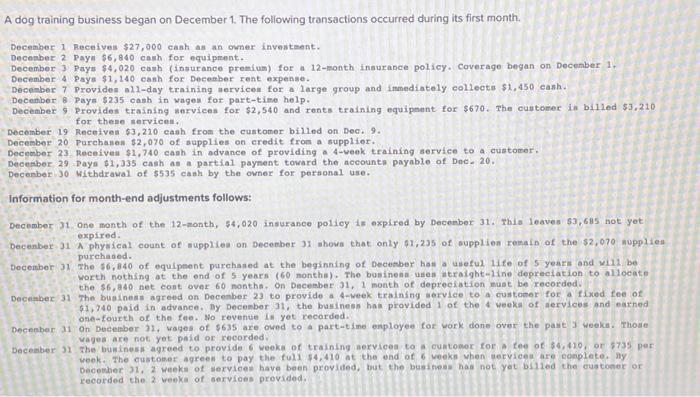

A dog training business began on December 1 . The following transactions occurred during its first month. December 1 Receives $27,000 cash as an owner investant. Decenber 2 Payn $6,840 cash for equipment. December 3 Pays $4,020 canh (insurance premium) for a 12-month insurance policy. Caverage began on Decenber 1 . December 4 Pays $1,240 cash for Decenber rent expense. December 7 providen all-day training wervicen for a large group and immediately collects $1,450 cash. December 8 Pays $235 cash in vages for part-timo help. December 9 . provides training services for $2,540 and rents training equipment for $670. The oustomer in billed $3,210 for these mervicen. December 19 Receives $3,210 eash from the customer billed on Dee. 9 . Decesber 20 purchsineil $2,070 of supplies on eredit from a supplior. December 23 . Receiveal $1,740 cash in advance of providing a 4 -week training service to a customer. Decenber 29 . paya $1,335 cash an a partial paynent toward the aceounts payable of Dee. 20 . Decenber 30 withdraval of $535 canh by the owner for pernonal use. Information for month-end adjustments follows: December 31 , One month of the 12 -zonth, $4,020 insurance poiley is expired by December 31 . This 1 eaves $3,685 not yet expired. Decenber 31A physical count of suppliea on Decenber 31 shows that only $1,235 of supplien remain of the $2,070 nupplies purchased. Jecember 31 the 56,840 of equipent purchaned at the beginning of December han a useful 11fe of 5 years and wili be. worth nothing at the end of 5 years (60 nonths ). The businend unes utraigbt-1ine depreciation to allocete the $6,940 net cost over 60 nonths. On Decesber 31,1 month of depreciation nust be recorded. December 31 the business agreed on Decenber 23 to provide a 4-week training service to a custoner for a fixed fee of $1,240 paid in advance. By Decenber 31 . the basiness has provided 1 of the 4 veeks of aervices and earned one-fourth of the fee. No revenue in yet recorded. Decenber 31 On becenber 32 , wages of $635 are owed to a part-time enployee for work done over the past 3 weeks. Those vages are not yet paid or recorded, Deceaber 31 The buininess agreed to provide 6 weoki of training aervicea to a cuatomor for a tee of 54,410 , or 5735 per weok. The custones agreen to pay the full $4,410 at the end of 6 veeks when servicea are eceplete. ny Decemher 31,2 weeks of services have been provided, but the busineas has not yot bilied the eustoner or. recorded the 2 weeks of services provided. Prepare the required journal entries, adjusting entries, and closing entries