i need the inventory turnover ratio

make you explain it as if you were doing it on an excel sheet. thanks

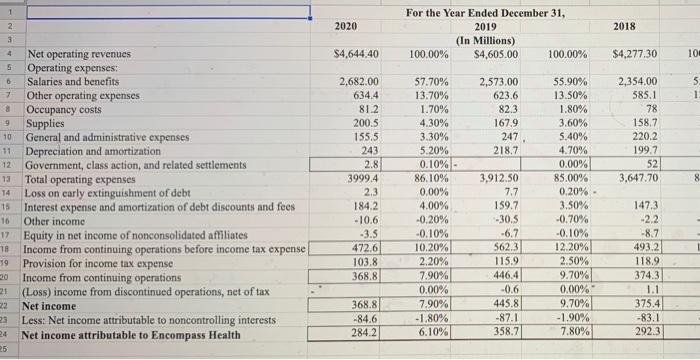

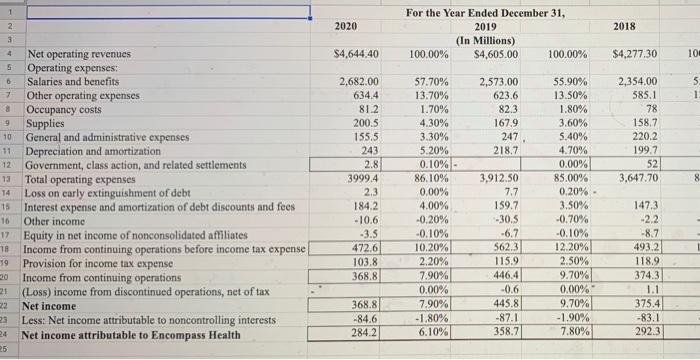

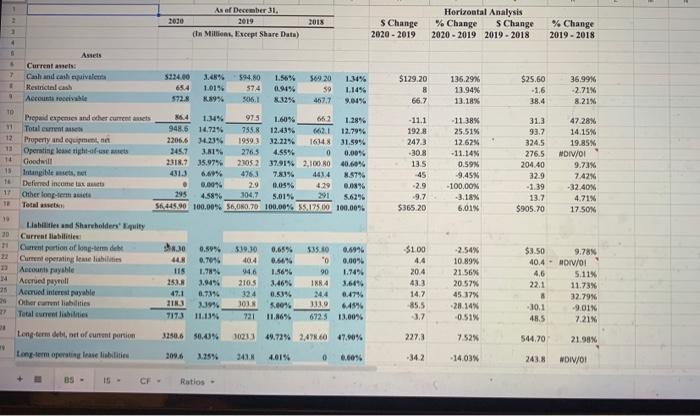

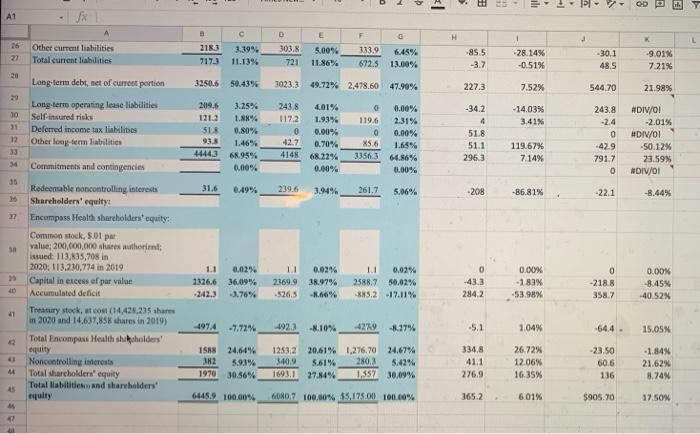

1 2 2020 2018 For the Year Ended December 31, 2019 (in Millions) 100.00% $4.605.00 100.00% 3 4 $4.644.40 $4,277.30 100 5 6 7 5 1 2,573.00 623.6 82.3 167.9 247 218.7 9 2,354,00 585.1 78 158.7 220.2 199.7 52 3,647.70 10 11 12 2,682.00 634.4 81.2 200.5 155.5 243 2.8 3999.4 2.3 184.2 -10.6 -3.5 472.6 103.8 368.8 8 Net operating revenues Operating expenses: Salaries and benefits Other operating expenses Occupancy costs Supplies General and administrative expenses Depreciation and amortization Government, class action, and related settlements Total operating expenses Loss on carly extinguishment of debt Interest expense and amortization of debt discounts and fees 16 Other income 17 Equity in net income of nonconsolidated affiliates Income from continuing operations before income tax expense Provision for income tax expense Income from continuing operations 21 (Loss) income from discontinued operations, net of tax 22 Net income Less: Net income attributable to noncontrolling interests 24 Net income attributable to Encompass Health 13 14 15 57.70% 13.70% 1.70% 4.30% 3.30% 5.20% 0.10%- 86.10% 0.00% 4.00% -0.20% -0.10% 10.20% 2.20% 7.90% 0.00% 7.90% -1.80% 6.10% 55.90% 13.50% 1.80% 3.60% 5.40% 4.70% 0.00% 85.00% 0,20% - 3.50% -0.70% -0.10% 12.20% 2.50% 9.70% 0.00% 9.70% -1.90% 7.80% 3,912.50 7.7 159.7 -30.5 -6.7 562.3 115.9 446.4 -0.6 445.8 -87.1 358.7 18 19 147.3 -2.2 -8.7 493.2 118.9 374.3 1.1 375.4 -83.1 292.3 20 23 368.8 -84.6 284.2 25 As of December 31. 2019 Millices, Except Share Data) 2018 s Change 2020 - 2019 Horizontal Analysis % Change s Change 2020 - 2019 2019-2018 % Change 2019-2018 4 7 Assets Current and Cash and cash valet Restrictal cash Account to 3124.00 654 572.8 1.48% 1.01% 3.89% 594.80 574 596.1 1.56% 0.91% 56920 59 467.7 1.34% 114% $129.20 8 667 135.29% 13.94% 13.18% $25.60 -1.6 38.4 36.99% -2.71% 8.21% TO T! 12 11 Prepaid expenses and other currentes Totale Property and equipment, Operating and tight-of-useet Goodwill Intangible mit Deferred income tax Other long-termas Total 4.4 1.14% 975 160% 662 1.28% 948.6 14714 755.8 12.43% 6621 12.79% 22066 3.23% 19393 32.21% 16148 31.5996 3457 3.8194 2765 4.55% 0 0.00% 2318.7 35.97% 23052 37.912,100 80 40.60% 4313 6.6% 4763 783% 4414 8.57% 00 29 11,05% 4.29 0,08% 295 4.58% 304,7 5.01% 56,445,90 100.00% 56,080.70 100.00% 5.125.00 100.00% - 11.1 1928 2473 -30.8 135 45 -29 -9.7 $365 20 -11 38% 25.51% 12.62% -11.14% 0.59% -9.45% -100.00% -3.18% 6.01% 31.3 93.7 324.5 276.5 204.40 32.9 139 13.7 $905.70 47 28% 14.15% 19.85% NDIV/01 9.73% 7.42% -32.40N 4.71% 17 50% 15 TE 17 10 3D 0.65% 22 23 Liabilities and Shareholders' Equity Current liabilities Current portion of longe det Current operating and liabilities Accounts payable Accrued payroll Accrual interest Nyable Other current liabidities Total reisites 30 0.595 44 0.7046 115 1.78 250 3.9496 47.1 0.73% IN3 3.39 7173 11.139 319.30 40.4 94,6 2105 324 303 721 335.10 0.6994 0 0.00% 90 1.7494 IR 4 3.604 244 0.47% 30 49% 672.5 13.00% 1.56% 3.46% 0.53% K00 11.16% $1.00 44 20.4 433 147 85.5 2.54% 10.89% 21.56 20.57% 45.17% 28.14 0.51% $3.50 9.78 404 - ADIV/01 4,6 5.11% 22.1 11.73% 8 32.79% 30.1 -9.01% 48.5 7.21% 25 12 28 Long-term deline of current portion 32506 50.0 1023349.72% 2,478.0 47.90% 227.3 7.52% 544.70 21.98% Long-term operating na libi 209.6 341 4.0196 0 0.00% -342 -14.03% 243.8 WDIV/01 BS - CF - Ratios - 13 . = OD A1 x B D E F H 26 27 2183 3038 Other current liabilities Total current liabilities 3.39% 11.1395 5.00% 11.86% 7173 721 333.9 6.45% 672.5 13.00% -85.5 -3.7 28.14% -0.51% -30.1 48.5 -9.01% 7.21% 20 Long-term debt, net of current portion 3250.6 50.439 3023.3 49.72% 2,478.60 47.90% 227.3 7.52% 544.70 21.98% 10 Long-term operating lease liabilities Self insured risks Deferred income tax liabilities Other long-term liabilities -14.03% 3.41% 30 209.6 1213 51 5 93.8 44443 3.25% 1.88% 0.80% 1.469 68.95% 0.00% 12 2438 401% 117.2 1.93% 0 0.00% 42.7 0.70% 4148 68.31% 0.00% 0 0.00% 119.6 0 0.00% X5.6 1.65% 3356.3 66.86% 0.00% -342 4 51.8 51.1 296.3 243.8 -2.4 0 42.9 791.7 0 #DIV/01 -2.01% #DIV/01 -50.12% 23.59% #DIV/01 119.67% 7.14% 34 35 31.6 0.49% 239.6 3.94% 261.7 5.06% -208 -86.81% -22.1 -8.44% 27 30 0.02% 20 Commitments and contingencies Redeemable no controlling interests Shareholders' equity Encompass Health shareholders' equity: Common stock, 5.01 par value: 200,000,000 share authorim; issued 113.835,708 in 2020: 113.230.774 in 2019 Capital in excess of par value Accumulated deficit Treasury stock, etcom (14,420.235 shares in 2020 and 14,637,858 shares in 2019) Total Encompass Health shholders' equity Noncontrolling interest Total shareholders equity Total liabilities and shareholders 1.1 1326.6 -2423 0.0256 36,09% -3.76% LI 23699 38.97% 526.5 -1.66% 11 0.02% 2588.750,02% 885.2 -17.11% 0 -43.3 284.2 0.00 -1.83% 53.98% -2188 3527 0.00% -8.45% 40.52N 41 -4974 -7.72% 492.2 -8.10% -4279 -8.2796 5.1 104% -64.4 15.05 1588 24.6496 32 5.9.1% 1253.2 20.61% 1,276,70 24.67% 340.9 5.6196 280,3 543% 1693.127.94% 1.357 30.09% 334,8 41.1 276.9 26.72% 12.06% 16.35% -23.50 60.6 136 -1.84N 21.62N 8.74 4 1970 30.56% 6445.9 100.00% 60807 100.00% 55.175.00 100.00% 365.2 6.01% $905.70 17.50W