Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the journal entries and adjustments, a visual T account sheet, a income statement, statement of equity, and a balance sheet. please put each

I need the journal entries and adjustments, a visual T account sheet, a income statement, statement of equity, and a balance sheet. please put each separate and make it easy to read each individual part. if this is all not separate and clear then I will give a thumbs down like the last guy.

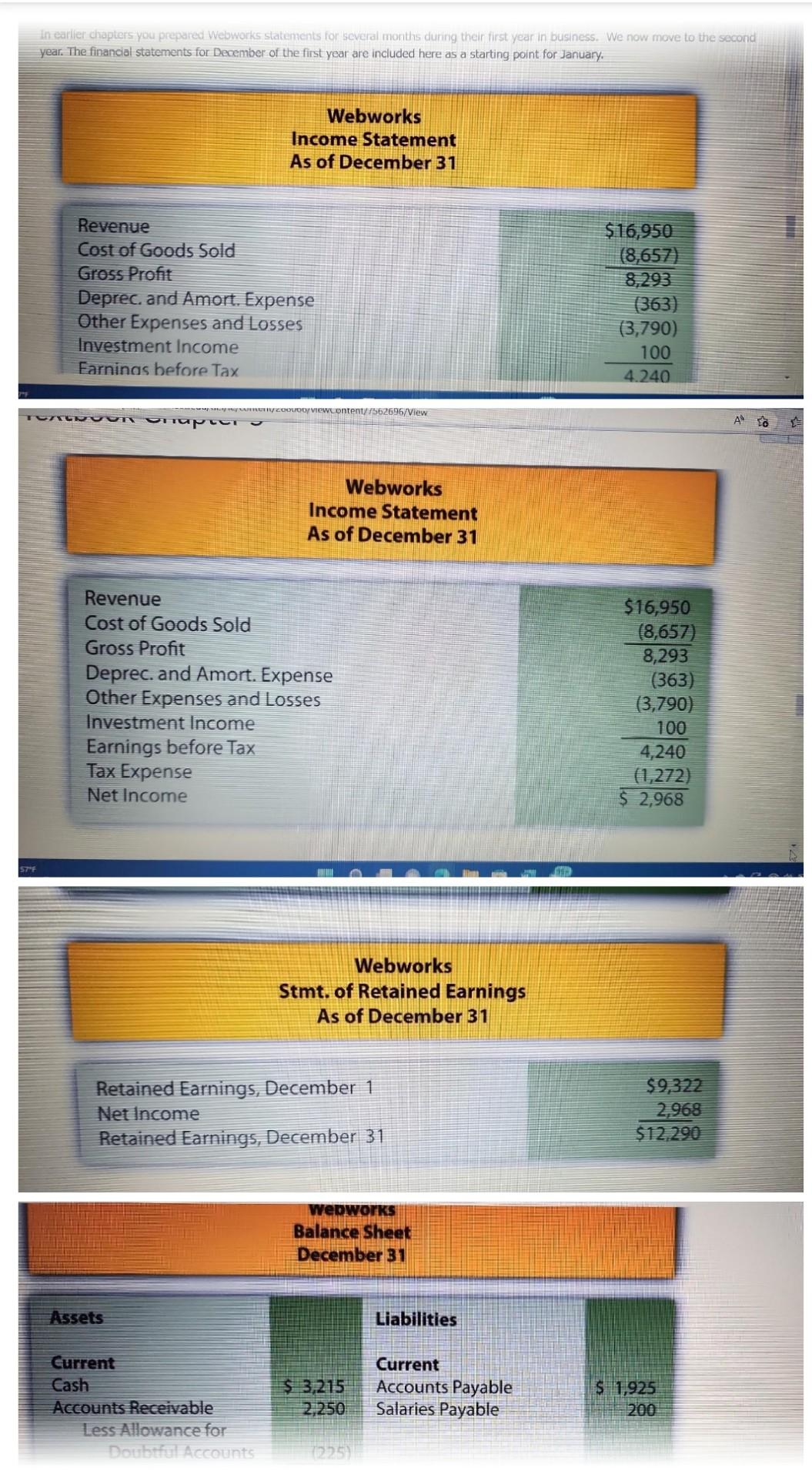

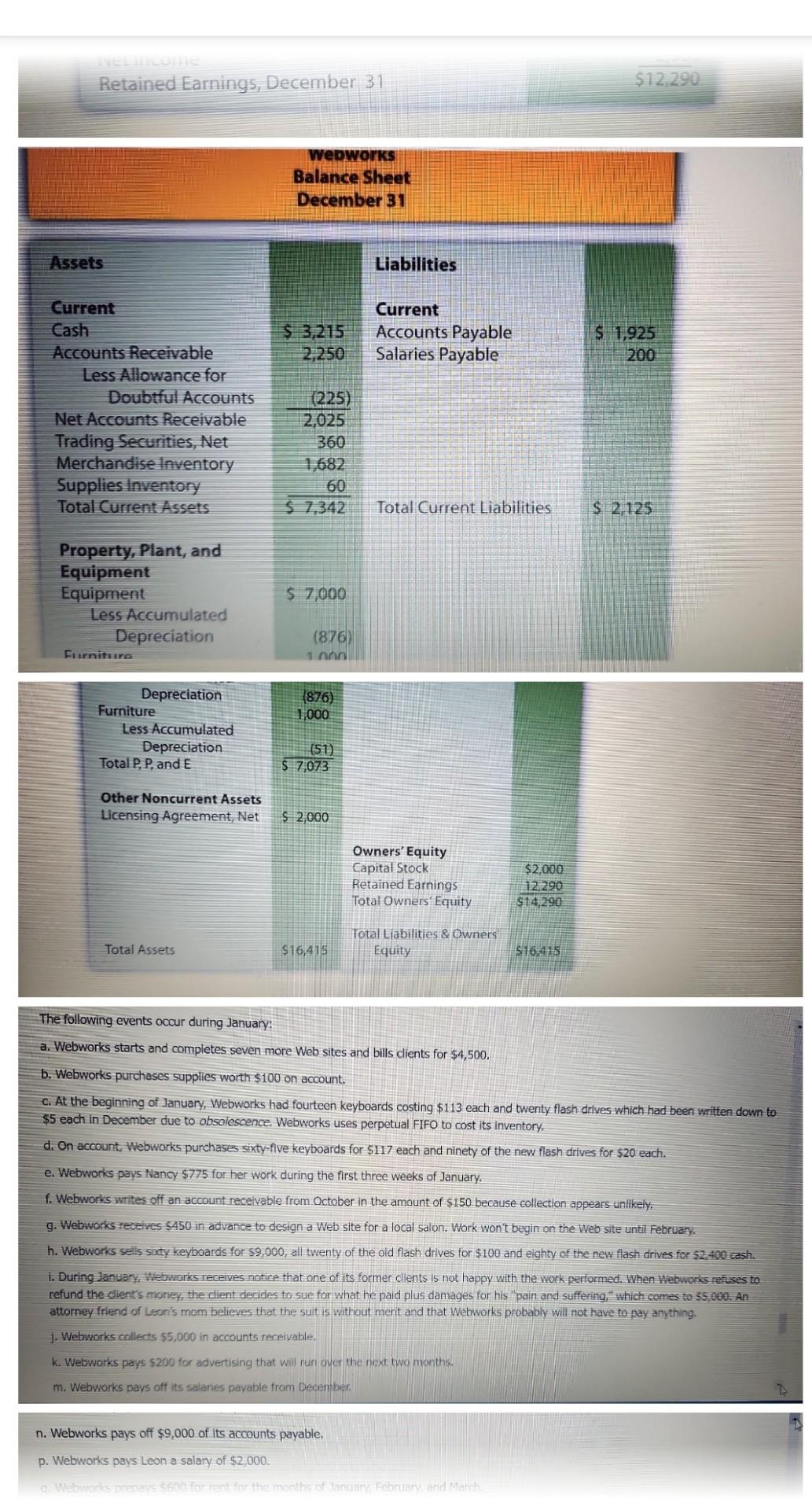

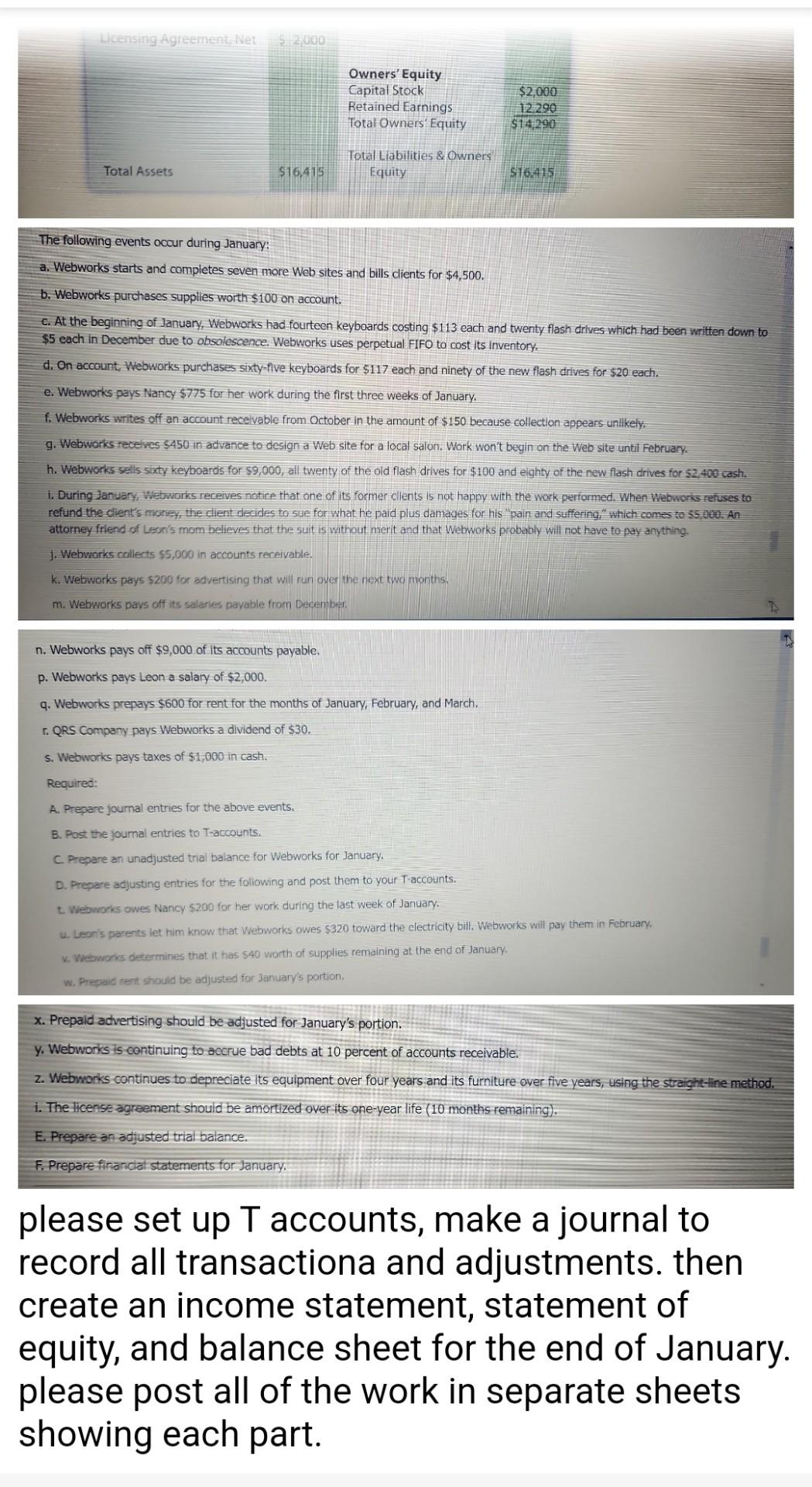

in earlier chapters you prepared Webworks statements for several months during their first year in business. We now move to the second year. The financial statements for December of the first year are included here as a starting point for January. Retained Earnings, December 31 $12,290 a. Webworks starts and completes seven more Web sites and bills clients for $4,500. b. Webworks purchases supplies worth $100 on account. c. At the beginning of January, Webworks had fourteen keyboards costing $113 each and twenty flash drives which had been written down to $5 each in December due to obsolescence. Webworks uses perpetual FIFO to cost its inventory. d. On account, Webworks purchases sixty-five keyboards for $117 each and ninety of the new flash drives for $20 each. e. Webworks pays Nancy $775 for her work during the first three weeks of January. f. Webworks writes off an account recelvable from October in the amount of $150 because collection appears unlikely, g. Webworks recelves $450 in advance to design a Web site for a local salon. Work won't begin on the web site until Februark h. Webworks sells sixty keyboards for $9,000, all twenty of the old flash drives for $100 and eighty of the new flash drives for $2,400 cash. 1. During January, webworks receives notice that one of its former clients is not happy with the work performed. When webworks refuses to refund the olient's money, the client decides to sue for what he paid plus damages for his "pain and suffering," which comes to 55 ,000, An attorney friend of Leon's mom believes that the suit is without mert and that webworks probably will not have to pay anything. 1. Webworks collects $5,000 in accounts receivable. k. Webworks pays $200 for advertising that will run oyer the next two months. m. Webworks pays off its salanes pavable from Decenber. The following events occur during January: a. Webworks starts and completes seven more Web sites and bills clients for $4,500. b. Webworks purchases supplies worth $100 on account. c. At the beginning of January, Webworks had fourteen keyboards costing $113 each and twenty flash drives which had been written down to $5 each in December due to obsolescence. Webworks uses perpetual FIFO to cost its inventory. d. On account Webworks purchases sixty-five keyboards for $117 each and ninety of the new flash drives for $20 each. e. Webworks pays Nancy $775 for her work during the first three weeks of January. f. Webworks writes off an account recelvable from October in the amount of $150 because collection appears unllkely. 9. Webworks recelves $450in advance to design a Web site for a local salon. Work won't begin on the Web site until February. h. Webworks sells suxty keyboards for $9,000, all twenty of the old flash drives for $100 and eighty of the new flash drives for $2,400 cash. i. During January, Webworks receives notice that one of its former clients is not happy with the work performed. When webworks refuses to refund the client's money, the client decides to sue for what he paid plus damages for his "pain and suffering," which comes to 55 , 000 . An attorney friend of Lesn's mom believes that the suit is without merit and that Webworks probably will not have to pay anything. 1. Webworks collects $5,000 in accounts receivable. k. Webworks pays $200 for advertising that will run over the next two months. m. Webworks pavs off its salanes pavable from December. n. Webworks pays off $9,000 of its accounts payable. p. Webworks pays Leon a salary of $2,000. q. Webworks prepays $600 for rent for the months of January, February, and March. r. QRS Company pays Webworks a dividend of $30. s. Webworks pays taxes of $1,000 in cash. Required: A. Prepare journal entries for the above events. B. Post the journal entries to T-accounts. C. Prepare an unadjusted trial balance for Webworks for January. D. Prepare adjusting entries for the following and post them to your T-accounts. t. Webworks owes Nancy $200 for her work during the last week of January. u. Leor's parents let him know that Webworks owes $320 toward the electricity bill. Webworks will pay them in february. v. Webworks determines that it has $40 worth of supplies remaining at the end of January. w. Prepaid rent should be adjusted for January's portion. x. Prepaid advertising should be adjusted for January's portion. y. Webworks is continuing to accrue bad debts at 10 percent of accounts receivable. z. Webworks continues to depreciate its equipment over four years and its furniture over five years, using the straight line method, The license agreement should be amortized over its one-year life ( 10 months remaining). Prepare an adjusted trial balance. F. Prepare financial statements for January. please set up T accounts, make a journal to record all transactiona and adjustments. then create an income statement, statement of equity, and balance sheet for the end of January. please post all of the work in separate sheets showing each partStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started