Answered step by step

Verified Expert Solution

Question

1 Approved Answer

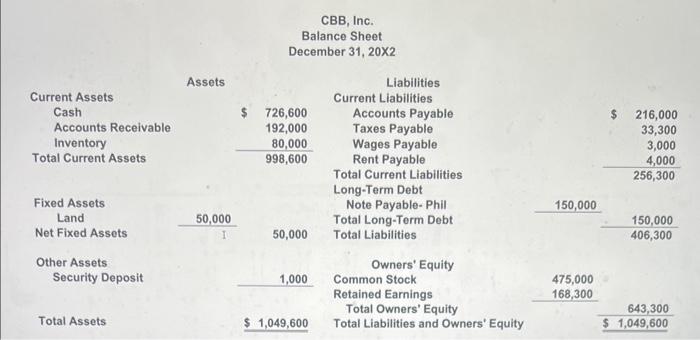

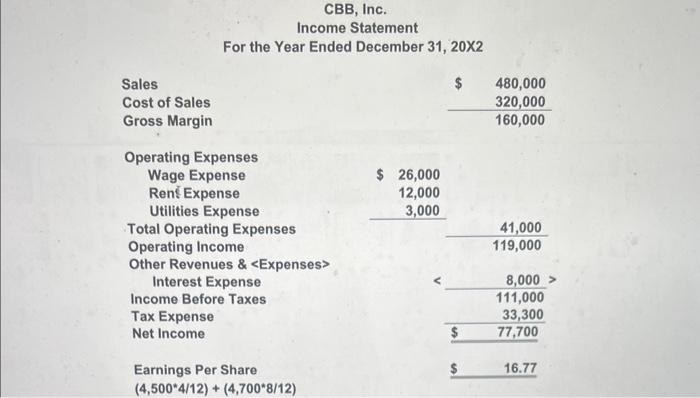

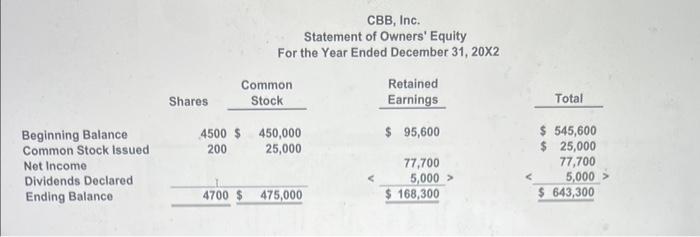

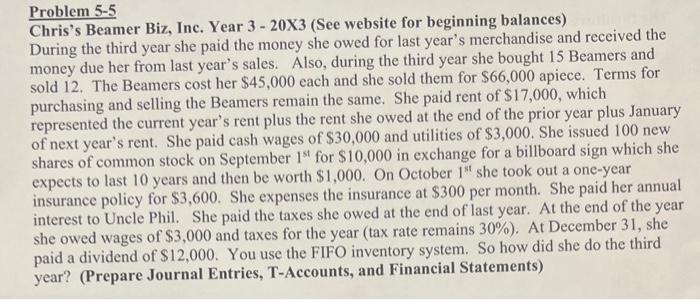

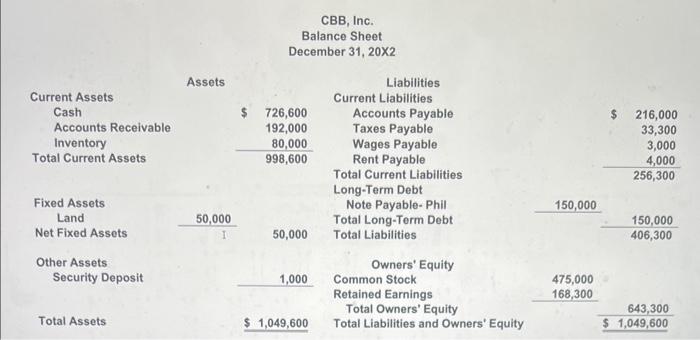

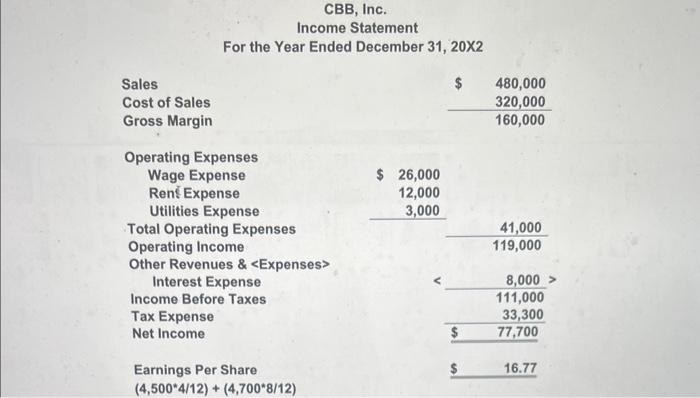

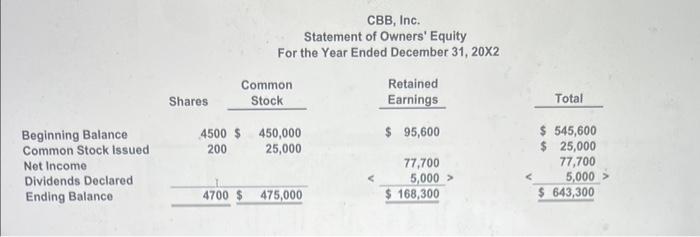

i need the journal entries, t-accounts, balamce sheet, income statement and statement of owners equity. the three images are the financial statements from the prior

i need the journal entries, t-accounts, balamce sheet, income statement and statement of owners

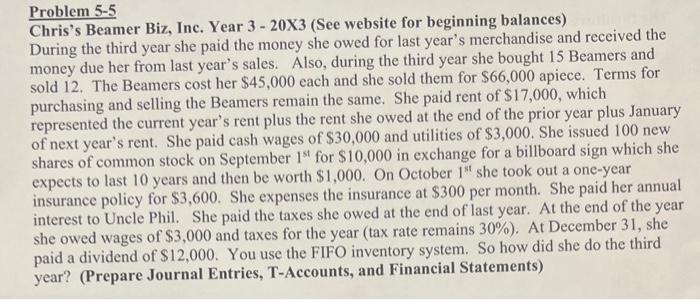

During the third year she paid the money she owed for last year's merchandise and received the money due her from last year's sales. Also, during the third year she bought 15 Beamers and sold 12. The Beamers cost her $45,000 each and she sold them for $66,000 apiece. Terms for purchasing and selling the Beamers remain the same. She paid rent of $17,000, which represented the current year's rent plus the rent she owed at the end of the prior year plus January of next year's rent. She paid cash wages of $30,000 and utilities of $3,000. She issued 100 new shares of common stock on September 1st for $10,000 in exchange for a billboard sign which she expects to last 10 years and then be worth $1,000. On October 1si she took out a one-year insurance policy for $3,600. She expenses the insurance at $300 per month. She paid her annual interest to Uncle Phil. She paid the taxes she owed at the end of last year. At the end of the year she owed wages of $3,000 and taxes for the year (tax rate remains 30% ). At December 31 , she paid a dividend of $12,000. You use the FIFO inventory system. So how did she do the third year? (Prepare Journal Entries, T-Accounts, and Financial Statements) CBB, Inc. Balance Sheet December 31,202 CBB, Inc. Income Statement For the Year Ended December 31, 202 CBB, Inc. Statement of Owners' Equity For the Year Ended December 31,202 equity.

the three images are the financial statements from the prior year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started