I need the most help wkth the Income Statement and the Balance Sheet!

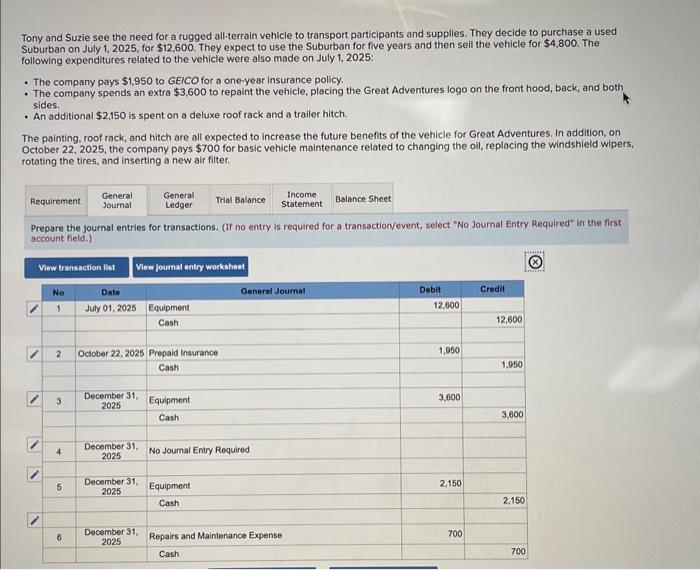

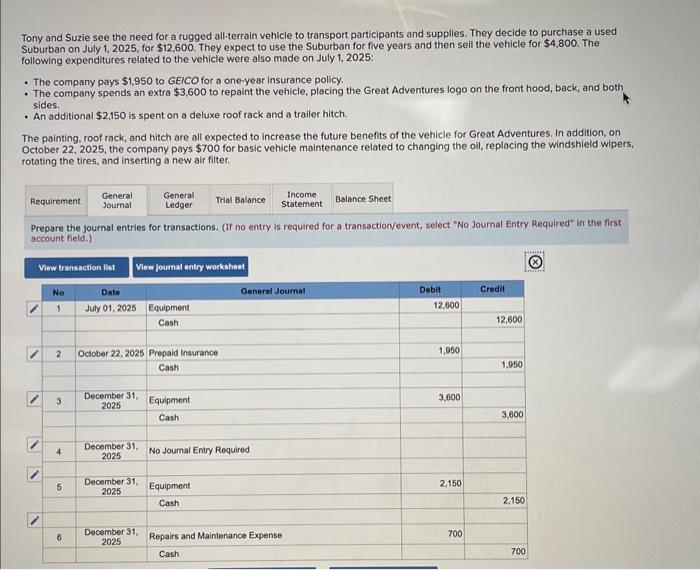

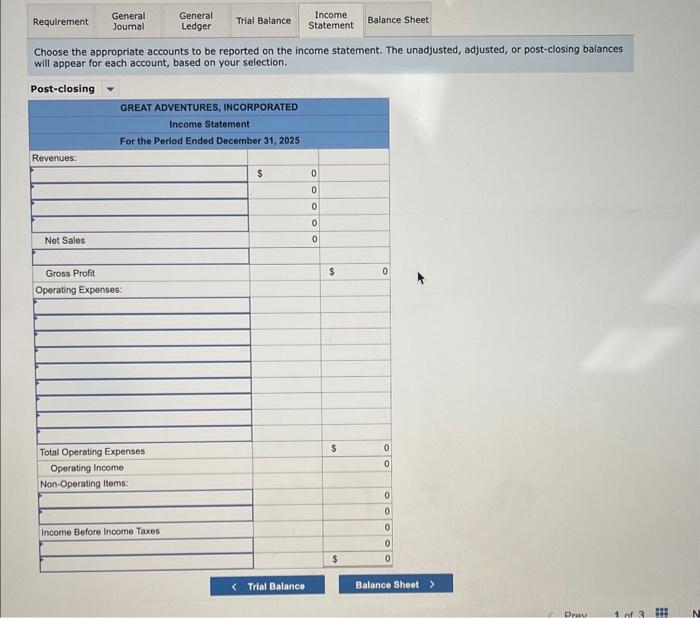

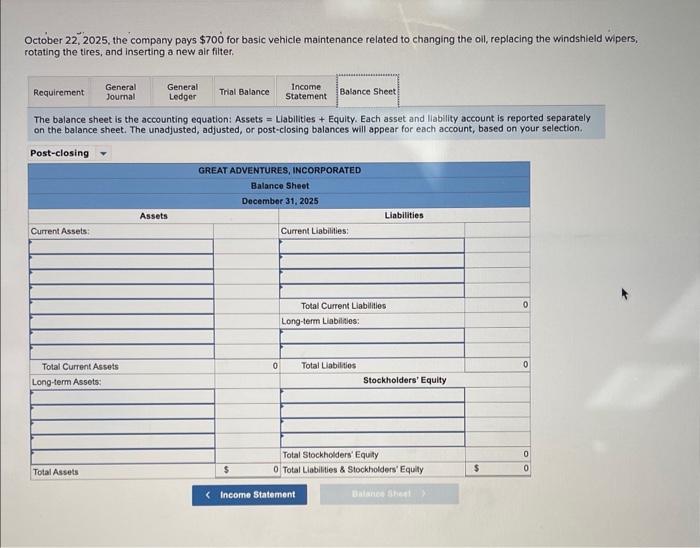

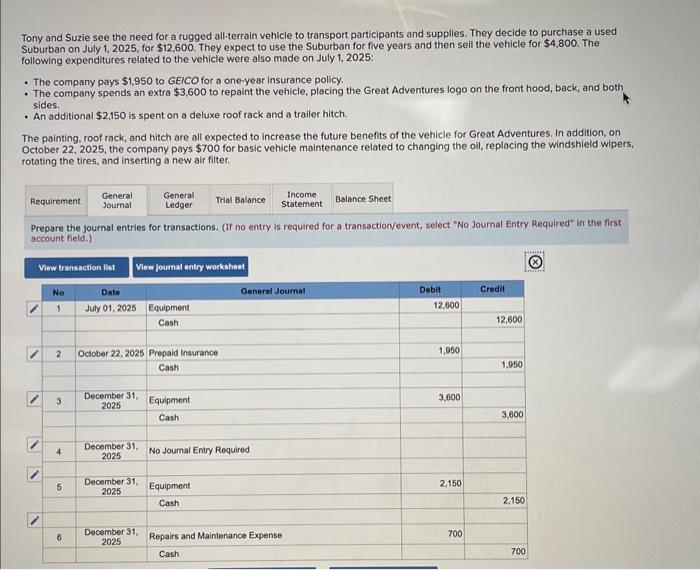

Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1,2025 , for $12,600. They expect to use the Suburban for five years and then sell the vehicle for $4,800. The following expenditures related to the vehicle were also made on July 1,2025: - The company pays $1,950 to GEICO for a one-year insurance policy. - The company spends an extra $3,600 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,150 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures, In addition, on October 22,2025 , the company pays $700 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. Prepare the journal entries for transactions. (If no entry is required for a transactionvevent, select "No Journal Entry Required" in the first. account field.) Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Detober 22,2025 , the company pays $700 for basic vehicle maintenance related to changing the oil, replacing the windshield wipe otating the tires, and inserting a new air filter. The balance sheet is the accounting equation: Assets = Liabilities + Equity. Each asset and liability account is reported separately on the balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1,2025 , for $12,600. They expect to use the Suburban for five years and then sell the vehicle for $4,800. The following expenditures related to the vehicle were also made on July 1,2025: - The company pays $1,950 to GEICO for a one-year insurance policy. - The company spends an extra $3,600 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,150 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures, In addition, on October 22,2025 , the company pays $700 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. Prepare the journal entries for transactions. (If no entry is required for a transactionvevent, select "No Journal Entry Required" in the first. account field.) Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Detober 22,2025 , the company pays $700 for basic vehicle maintenance related to changing the oil, replacing the windshield wipe otating the tires, and inserting a new air filter. The balance sheet is the accounting equation: Assets = Liabilities + Equity. Each asset and liability account is reported separately on the balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection