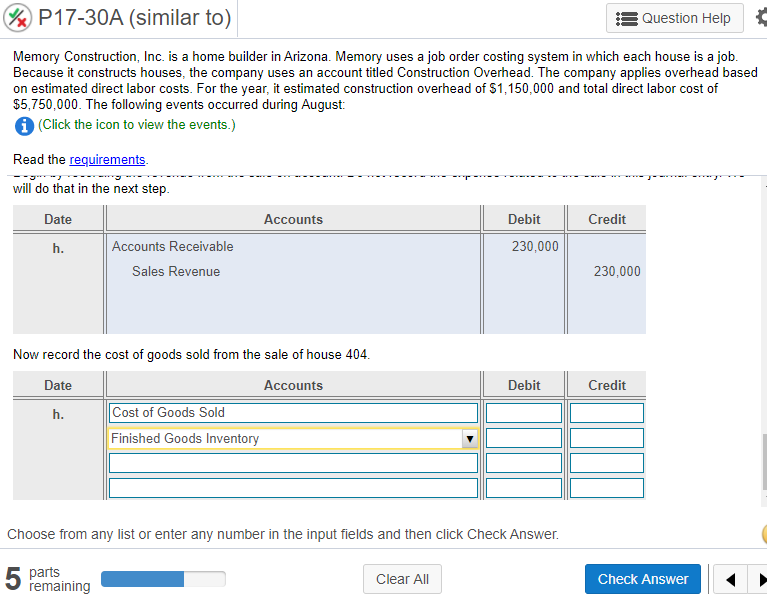

I need the remaining parts to this problem. I only have all the way to H solved

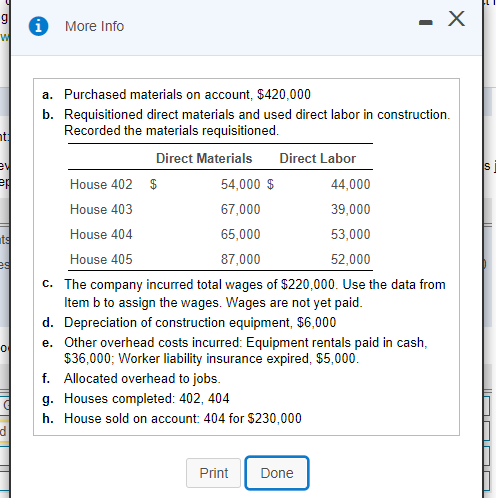

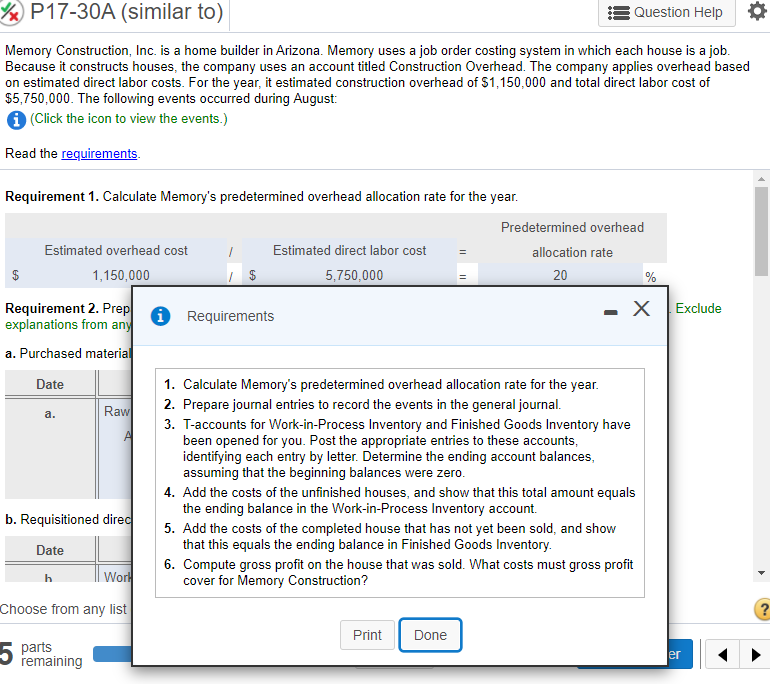

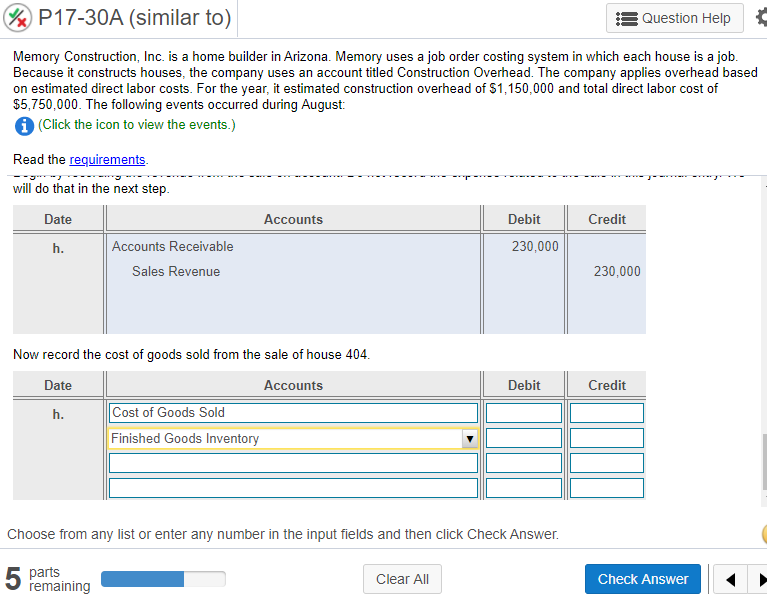

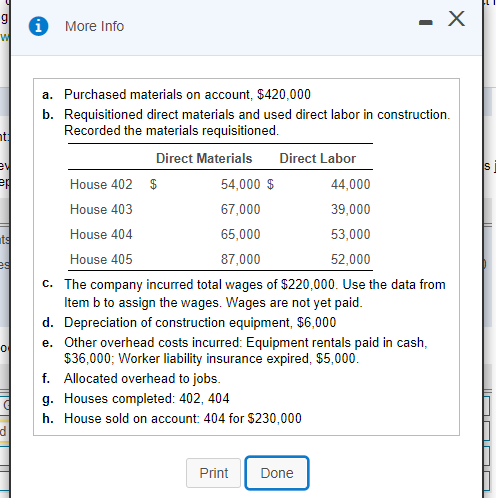

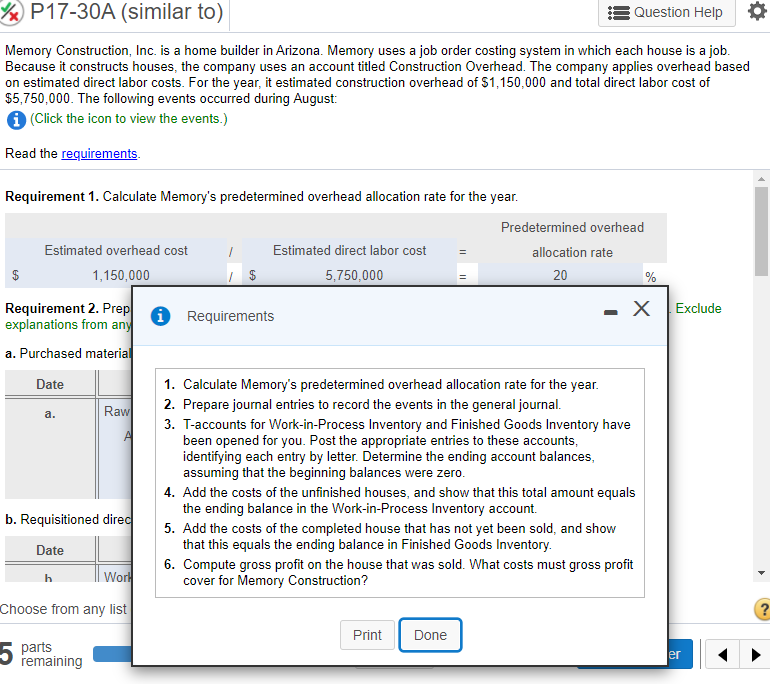

W P17-30A (similar to) Question Help Memory Construction, Inc. is a home builder in Arizona Memory uses a job order costing system in which each house is a job. Because it constructs houses, the company uses an account titled Construction Overhead. The company applies overhead based on estimated direct labor costs. For the year, it estimated construction overhead of $1,150,000 and total direct labor cost of $5,750,000. The following events occurred during August: (Click the icon to view the events.) Read the requirements will do that in the next step. J" Date Accounts Debit Credit h. 230,000 Accounts Receivable Sales Revenue 230,000 Debit Credit Now record the cost of goods sold from the sale of house 404. Date Accounts h. Cost of Goods Sold Finished Goods Inventory Choose from any list or enter any number in the input fields and then click Check Answer. 5 parts Clear All Check Answer remaining 9 w i . X More Info ti S ev ei ts a. Purchased materials on account, $420,000 b. Requisitioned direct materials and used direct labor in construction. Recorded the materials requisitioned. Direct Materials Direct Labor House 402 $ 54,000 $ 44,000 House 403 67,000 39,000 House 404 65,000 53,000 House 405 87,000 52,000 c. The company incurred total wages of $220,000. Use the data from Item b to assign the wages. Wages are not yet paid. d. Depreciation of construction equipment, $6,000 e. Other overhead costs incurred: Equipment rentals paid in cash, $36,000; Worker liability insurance expired, $5,000. f. Allocated overhead to jobs. g. Houses completed: 402, 404 h. House sold on account: 404 for $230,000 0 Print Done % P17-30A (similar to) Question Help Memory Construction, Inc. is a home builder in Arizona Memory uses a job order costing system in which each house is a job. Because it constructs houses, the company uses an account titled Construction Overhead. The company applies overhead based on estimated direct labor costs. For the year, it estimated construction overhead of $1,150,000 and total direct labor cost of $5,750,000. The following events occurred during August: Click the icon to view the events.) Read the requirements Requirement 1. Calculate Memory's predetermined overhead allocation rate for the year. Predetermined overhead Estimated overhead cost Estimated direct labor cost allocation rate 1,150,000 1 5,750,000 20 % II $ Il . X Exclude i Requirements Requirement 2. Prep| explanations from any a. Purchased material Date a. Raw 1. Calculate Memory's predetermined overhead allocation rate for the year. 2. Prepare journal entries to record the events in the general journal. 3. T-accounts for Work-in-Process Inventory and Finished Goods Inventory have been opened for you. Post the appropriate entries to these accounts, identifying each entry by letter. Determine the ending account balances, assuming that the beginning balances were zero. 4. Add the costs of the unfinished houses, and show that this total amount equals the ending balance in the Work-in-Process Inventory account. 5. Add the costs of the completed house that has not yet been sold, and show that this equals the ending balance in Finished Goods Inventory. 6. Compute gross profit on the house that was sold. What costs must gross profit cover for Memory Construction? b. Requisitioned dired Date Worl Choose from any list ? Print Done 5 parts er remaining