I NEED THE SOLUTION FOR THE NEXT SECTION.

The last solutions to this portfolio assignment I have so far is as follow:

1. Bond A: Coupon Bond B: Coupon= YTM, hence it is trading at par

Bond C: Coupon>YTM hence it is trading at a premium.

2. Price of Bond A= $827.52

3. Price of Bond B= $1000

4. Price of Bond C= $1103.49

I NEED THE SOLUTION FOR THE NEXT SECTION

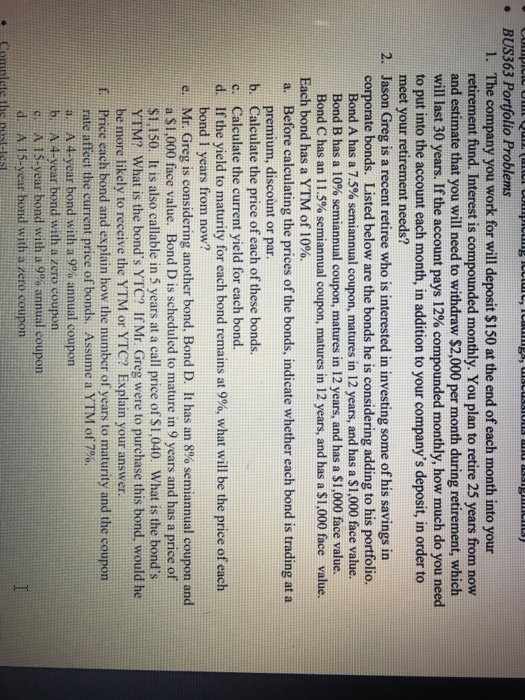

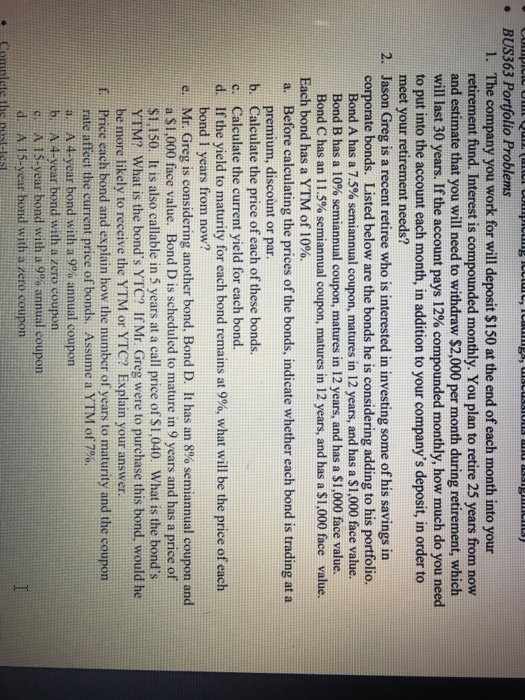

. BUS363 Portfolio Problems The company you work for will deposit $150 at the end of each month into your retirement fund. Interest is compounded monthly. You plan to retire 25 years from now and estimate that you will need to withdraw $2,000 per month during retirement, which will last 30 years. If the account pays 12% compounded monthly, how much do you need to put into the account each month, in addition to your company's deposit, in order to meet your retirement needs? Jason Greg is a recent retiree who is interested in investing some of his savings in corporate bonds. Listed below are the bonds he is considering adding to his portfolio. I. 2. Bond A has a 7.5% semiannual coupon, matures in 12 years, and has a $1,000 face value. Bond B has a 10% semiannual coupon, matures in 12 years, and has a $1,000 face value. Bond C has an 11.5% semiannual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a YTM of 10%. Before calculating the prices of the bonds, indicate whether each bond is trading at a premium, discount or par Calculate the price of each of these bonds. Calculate the current yield for each bond. If the yield to maturity for each bond remains at 9%, what will be the price of each bond 1 years from now? Mr. Greg is considering another bond, Bond D. It has an 8% semiannual coupon and a $1,000 face value. Bond D is scheduled to mature in 9 years and has a price of $1 150. It is also callable in 5 years at a call price of $1,040. What is the bond's YTM? What is the bond's YTC? If Mr. Greg were to purchase this bond, would he be more likely to receive the YTM or YTC? Explain your answer. Price each bond and explain how the number of years to maturity and the coupon rate affect the current price of bonds. Assume a YTM of 7% a. b. c. d. e, f. A 4-year bond with a 9% annual coupon b. A 4-year bond with a zero coupon C. A 1 5-year bond with a 9% annual coupon d. A 15-year bond with a zero coupon