Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the solution to solve these problems. preferably excel or finance calculator solutions. 1. Given the following equation: Y=[a(1+g) Plug If Y=.20, a=3, and

I need the solution to solve these problems. preferably excel or finance calculator solutions.

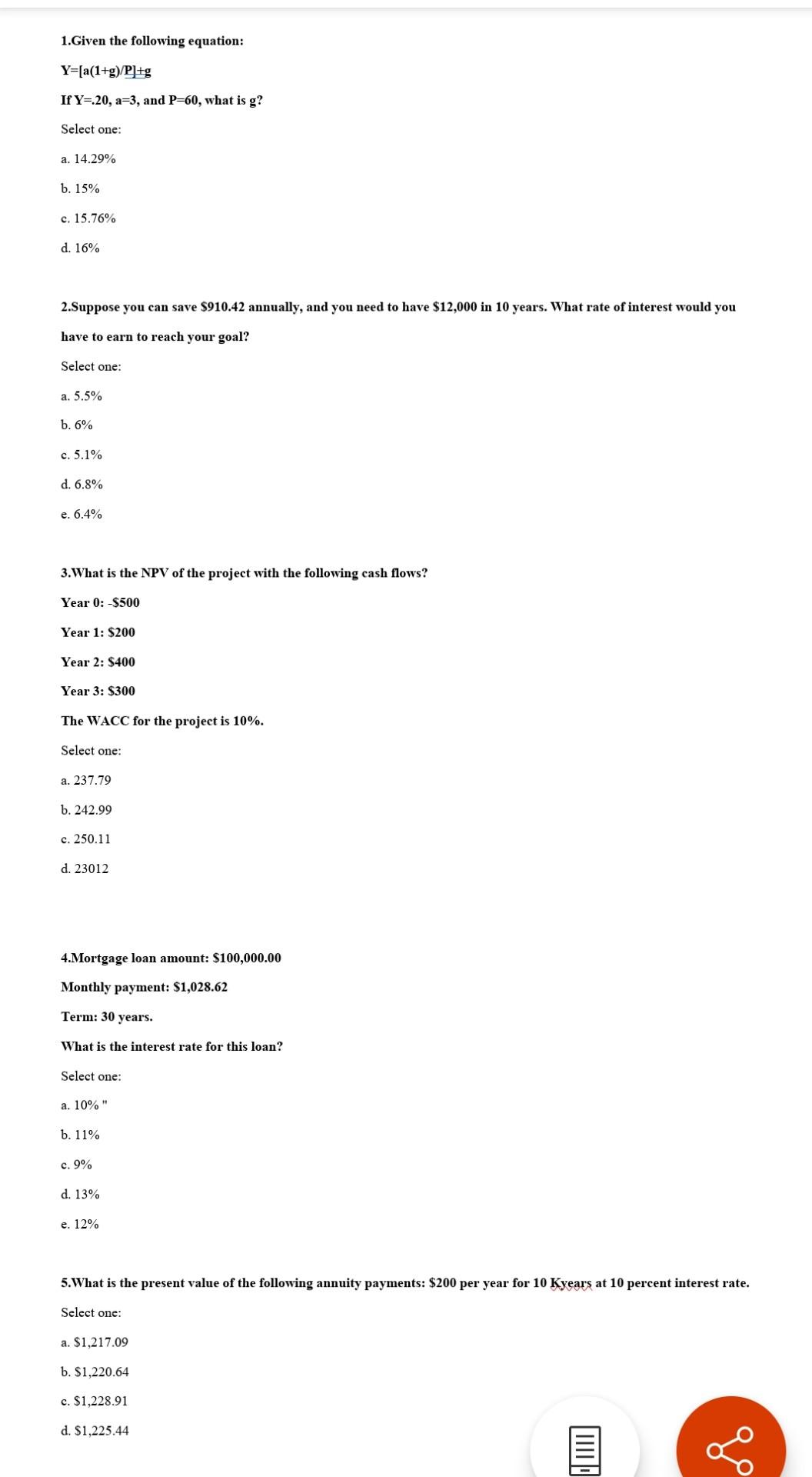

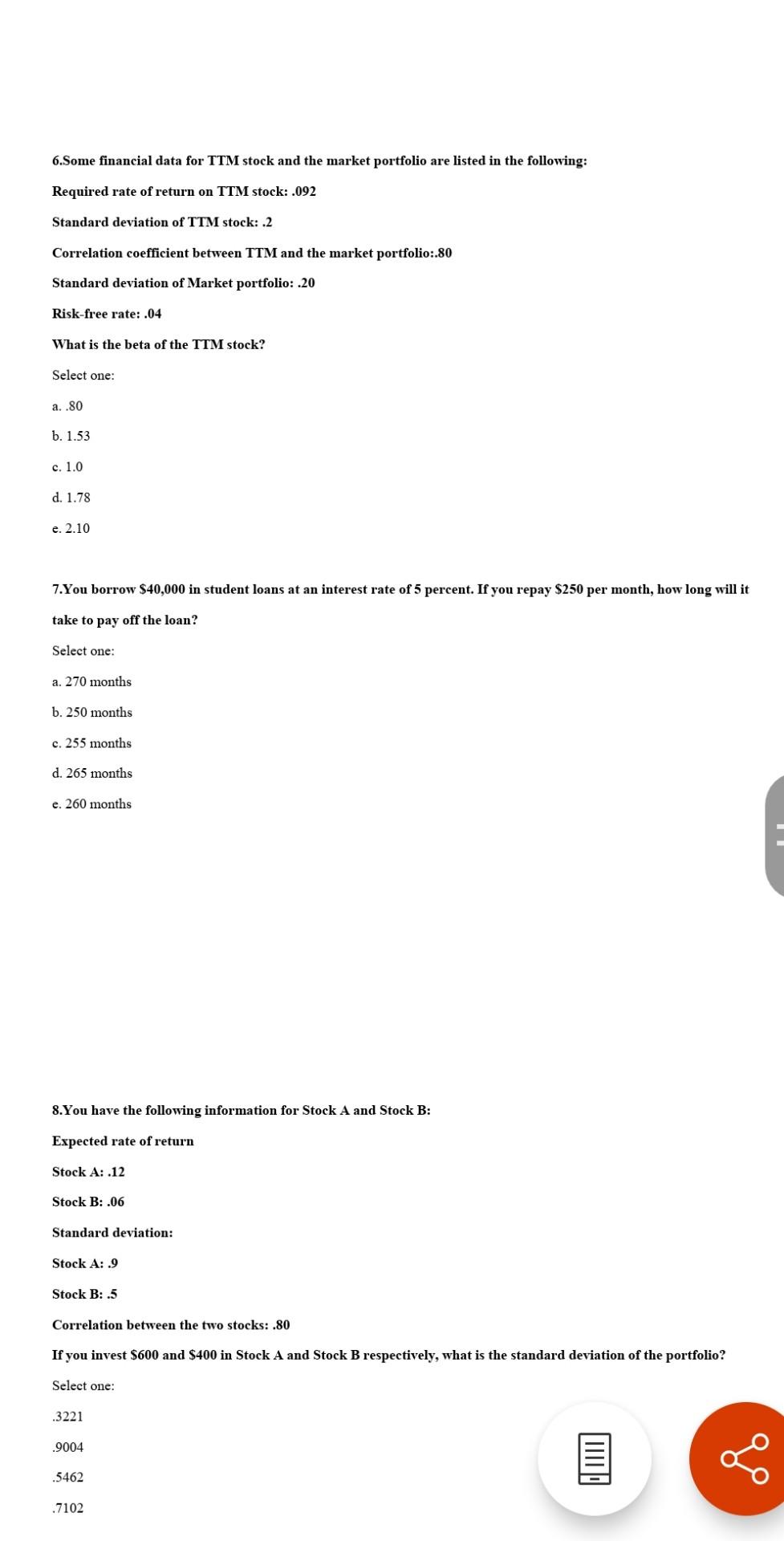

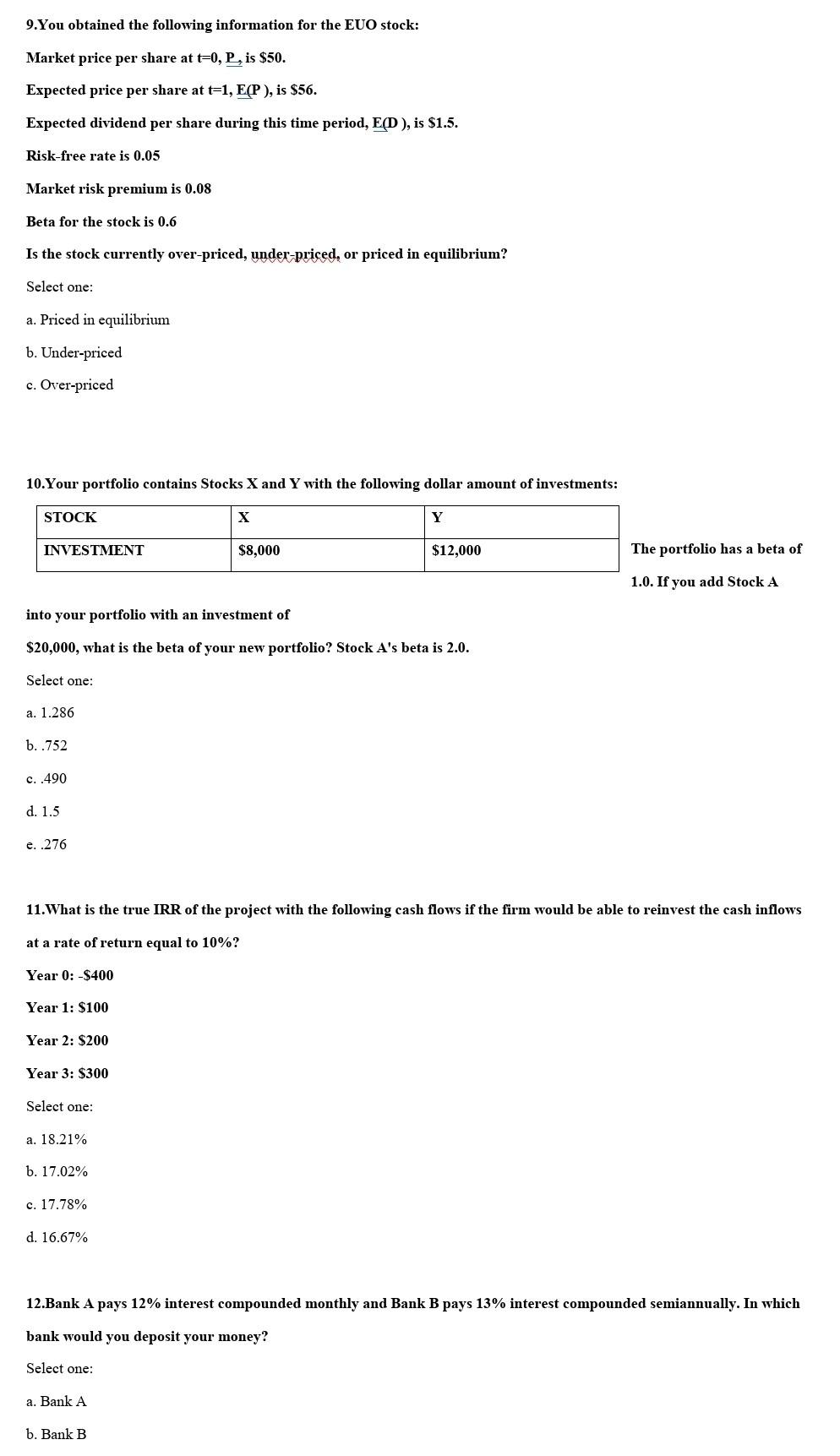

1. Given the following equation: Y=[a(1+g) Plug If Y=.20, a=3, and P=60, what is g? Select one: a. 14.29% b. 15% c. 15.76% d. 16% 2.Suppose you can save $910.42 annually, and you need to have $12,000 in 10 years. What rate of interest would you have to earn to reach your goal? Select one: a. 5.5% b. 6% c. 5.1% d. 6.8% e. 6.4% 3.What is the NPV of the project with the following cash flows? Year 0: -$500 Year 1: $200 Year 2: $400 Year 3: $300 The WACC for the project is 10%. Select one: a. 237.79 b. 242.99 c. 250.11 d. 23012 4.Mortgage loan amount: $100,000.00 Monthly payment: $1,028.62 Term: 30 years. What is the interest rate for this loan? Select one: a. 10%" b. 11% c. 9% d. 13% e. 12% 5. What is the present value of the following annuity payments: $200 per year for 10 Kyears at 10 percent interest rate. Select one: a. $1,217.09 b. $1,220.64 c. $1,228.91 d. $1,225.44 6.Some financial data for TTM stock and the market portfolio are listed in the following: Required rate of return on TTM stock: .092 Standard deviation of TTM stock: .2 Correlation coefficient between TTM and the market portfolio:.80 Standard deviation of Market portfolio: .20 Risk-free rate: .04 What is the beta of the TTM stock? Select one: a. .80 b. 1.53 c. 1.0 d. 1.78 e. 2.10 7.You borrow $40,000 in student loans at an interest rate of 5 percent. If you repay $250 per month, how long will it take to pay off the loan? Select one: a. 270 months b. 250 months c. 255 months d. 265 months e. 260 months 8.You have the following information for Stock A and Stock B: Expected rate of return Stock A: .12 Stock B: .06 Standard deviation: Stock A: .9 Stock B: .5 Correlation between the two stocks: .80 If you invest $600 and $400 in Stock A and Stock B respectively, what is the standard deviation of the portfolio? Select one: .3221 .9004 go .5462 .7102 9.You obtained the following information for the EUO stock: Market price per share at t=0, P, is $50. Expected price per share at t=1, E(P), is $56. Expected dividend per share during this time period, E(D), is $1.5. Risk-free rate is 0.05 Market risk premium is 0.08 Beta for the stock is 0.6 Is the stock currently over-priced, under-priced, or priced in equilibrium? Select one: a. Priced in equilibrium b. Under-priced c. Over-priced 10.Your portfolio contains Stocks X and Y with the following dollar amount of investments: STOCK Y INVESTMENT $8,000 $12,000 The portfolio has a beta of 1.0. If you add Stock A into your portfolio with an investment of $20,000, what is the beta of your new portfolio? Stock A's beta is 2.0. Select one: a. 1.286 b..752 c. .490 d. 1.5 e. .276 11. What is the true IRR of the project with the following cash flows if the firm would be able to reinvest the cash inflows at a rate of return equal to 10%? Year 0: -$400 Year 1: $100 Year 2: $200 Year 3: $300 Select one: a. 18.21% b. 17.02% c. 17.78% d. 16.67% 12.Bank A pays 12% interest compounded monthly and Bank B pays 13% interest compounded semiannually. In which bank would you deposit your money? Select one: a. Bank A b. Bank B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started