Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the solution to solve these problems. Question 7 Not answered Marked out of 2.00 You entered into a long pound forward position for

I need the solution to solve these problems.

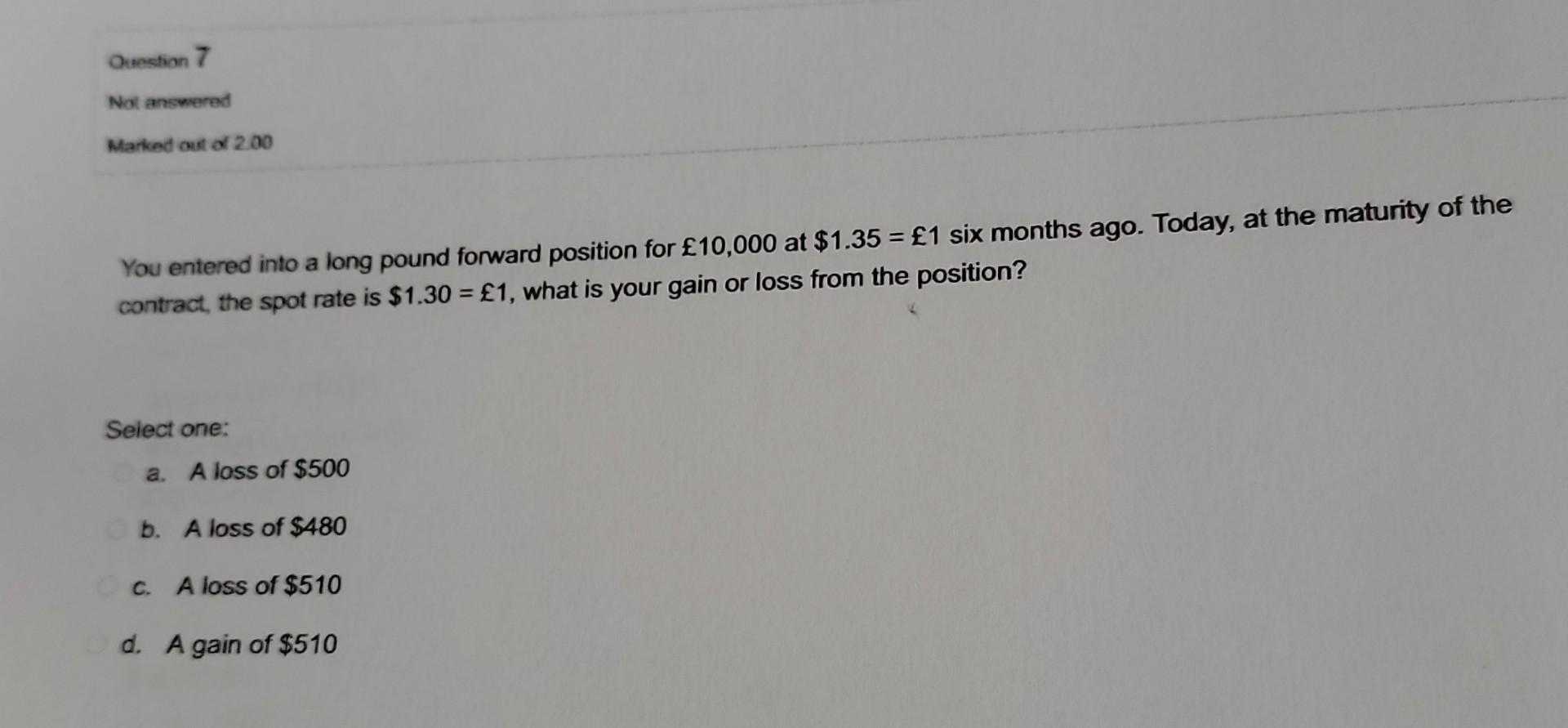

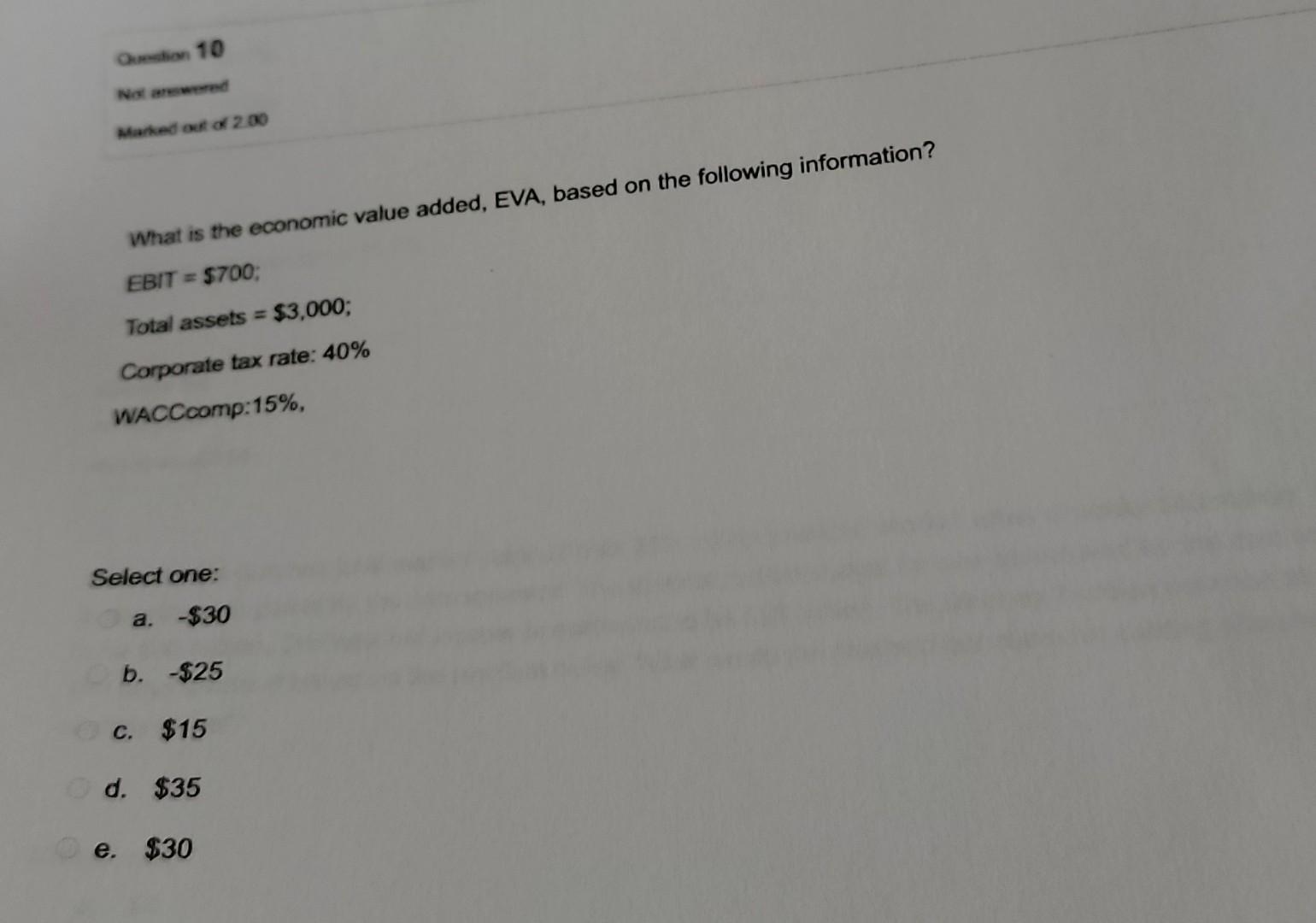

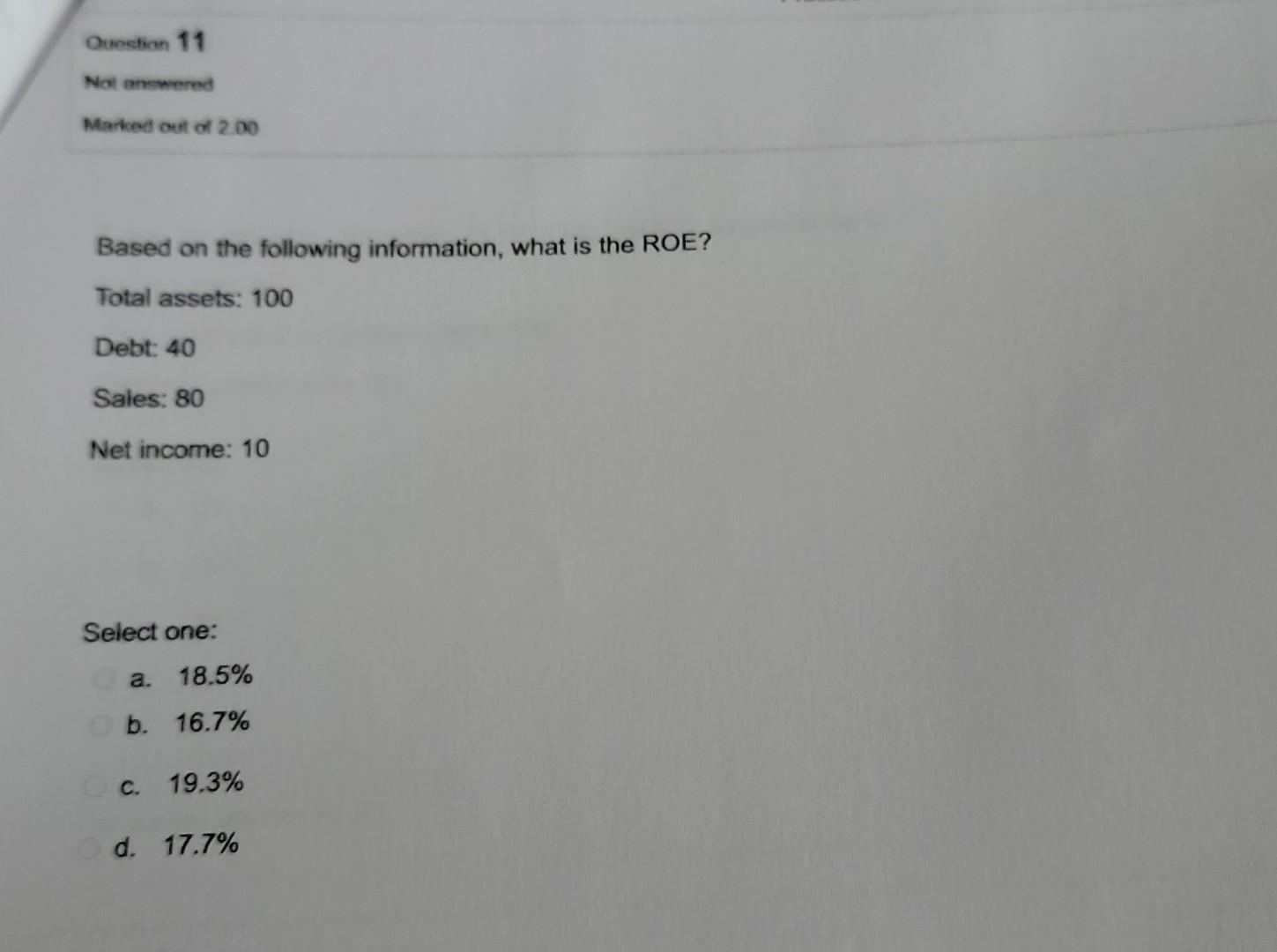

Question 7 Not answered Marked out of 2.00 You entered into a long pound forward position for 10,000 at $1.35 = 1 six months ago. Today, at the maturity of the contract, the spot rate is $1.30 = 1, what is your gain or loss from the position? Select one: a. A loss of $500 b. A loss of $480 c. A loss of $510 d. A gain of $510 Question 10 Marked out of 2.00 What is the economic value added, EVA, based on the following information? EBIT = $700; Total assets = $3,000; Corporate tax rate: 40% WACC comp:15%, Select one: a. -$30 b. -$25 c. $15 O d. $35 e. $30 Question 11 Not answered Marked out of 2.00 Based on the following information, what is the ROE? Total assets: 100 Debt: 40 Sales: 80 Net income: 10 Select one: a. 18.5% b. 16.7% OC. 19.3% Od. 17.7%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started