I need the solution to this problem.

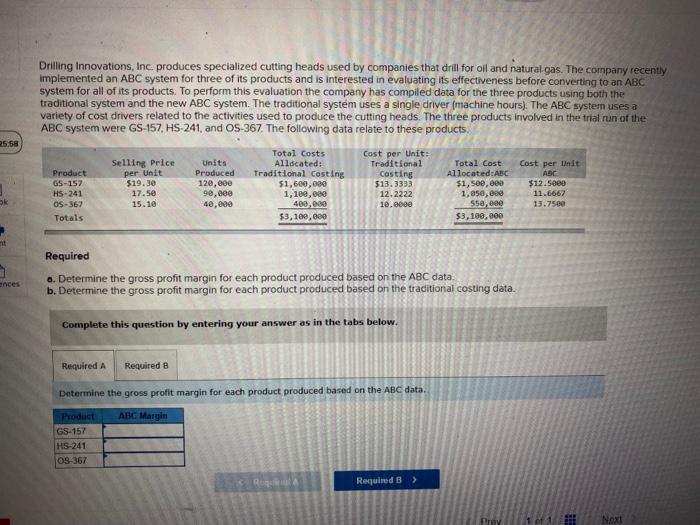

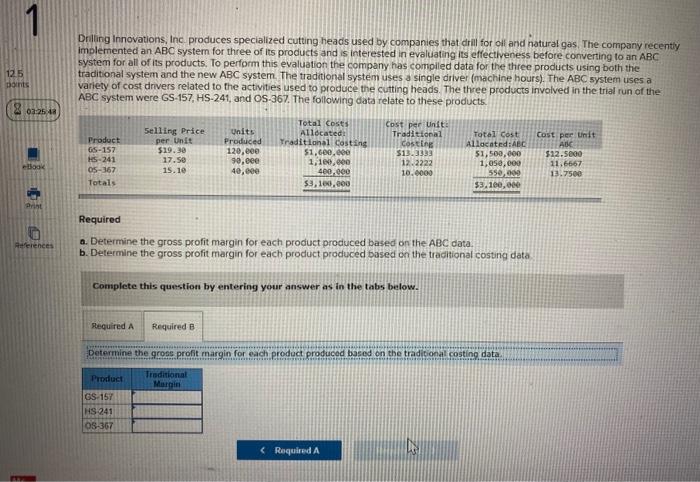

Drilling Innovations, Inc. produces specialized cutting heads used by companies that drill for oil and natural gas. The company recently implemented an ABC system for three of its products and is interested in evaluating its effectiveness before converting to an ABC system for all of its products. To perform this evaluation the company has compiled data for the three products using both the traditional system and the new ABC system. The traditional system uses a single driver (machine hours). The ABC system uses a variety of cost drivers related to the activities used to produce the cutting heads. The three products involved in the trial run of the ABC system were GS-157, HS 241, and OS-367. The following data relate to these products. 2558 Selling Price per Unit $19.30 17.50 15.10 Product GS-157 HS-241 05-367 Totals Units Produced 120, eee 90,000 40.000 . Total Costs Allocated: Traditional Costing 51,600,000 1,100,000 400.000 $3,100,000 Cost per Unit: Traditional Costing 513.3333 12.2222 10.000 Total Cost Allocated: ABC $1,500,000 1,050, ese 558,00 $3,100,000 Cost per Unit ABC $12.5eee 11.6667 13.7560 ok 2 Required a. Determine the gross profit margin for each product produced based on the ABC data. b. Determine the gross profit margin for each product produced based on the traditional costing data. ances Complete this question by entering your answer as in the tabs below. Required A Required B Determine the gross profit margin for each product produced based on the ABC data, ABC Margin Product GS-157 HS-241 OS-367 Qeqerta a Required) POV Nox: 1 Drilling Innovations, Inc produces specialized cutting heads used by companies that drill for oil and natural gas. The company recently implemented an ABC system for three of its products and is interested in evaluating its effectiveness before converting to an ABC system for all of its products. To perform this evaluation the company has compiled data for the three products using both the traditional system and the new ABC system. The traditional system uses a single driver (machine hours). The ABC system uses a variety of cost drivers related to the activities used to produce the cutting heads. The three products involved in the trial run of the ABC system were GS-157, HS-241, and OS-367. The following data relate to these products, 125 points 2 022548 Product 65-157 HS-241 05-167 Totals Selling Price per Unit $19.30 17.50 15.10 Units Produced 120.000 90,000 40,00 Total Costs Allocated: Traditional Costing 51, Gee.co 1,100,000 400.000 53.100.000 Cost per unit: Traditional Costing $13.3333 12.2222 Total Cost Allocated:ABC $1,500,000 1,050,000 550.000 $3.100,00 Cost per Unit ABC $12.5000 11.6667 13.7500 Bag 10.000 Prist Required a. Determine the gross profit margin for each product produced based on the ABC data. b. Determine the gross profit margin for each product produced based on the traditional costing data References Complete this question by entering your answer as in the tabs below. Required A Required B Determine the gross profit margin for each product produced based on the traditional costing data Product Traditional Mar GS-157 HS 241 OS-367