Answered step by step

Verified Expert Solution

Question

1 Approved Answer

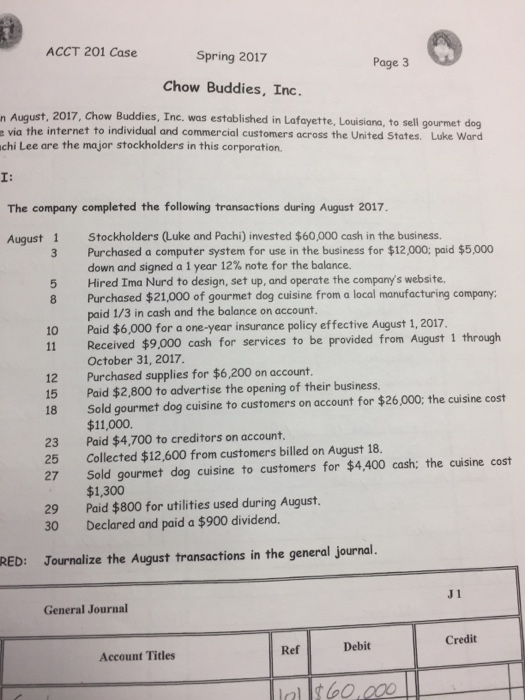

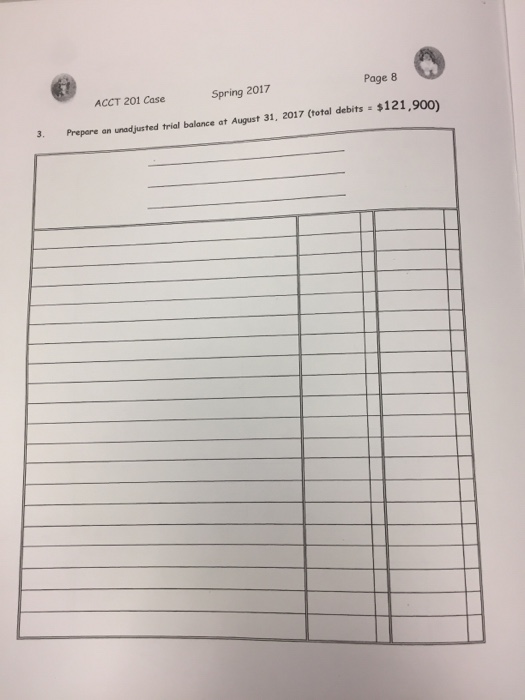

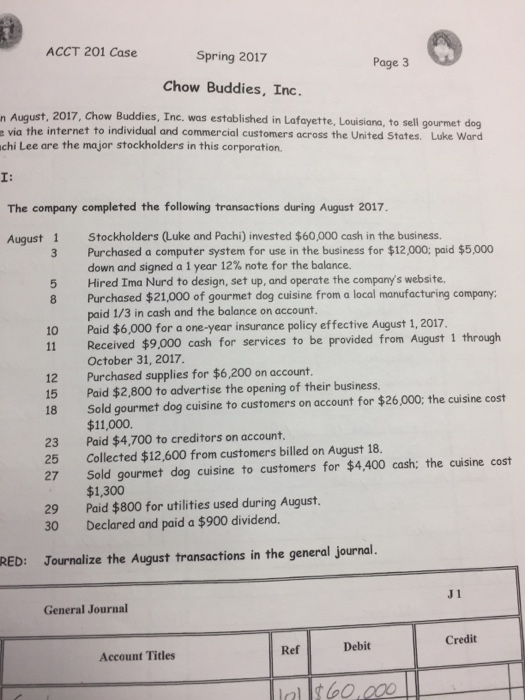

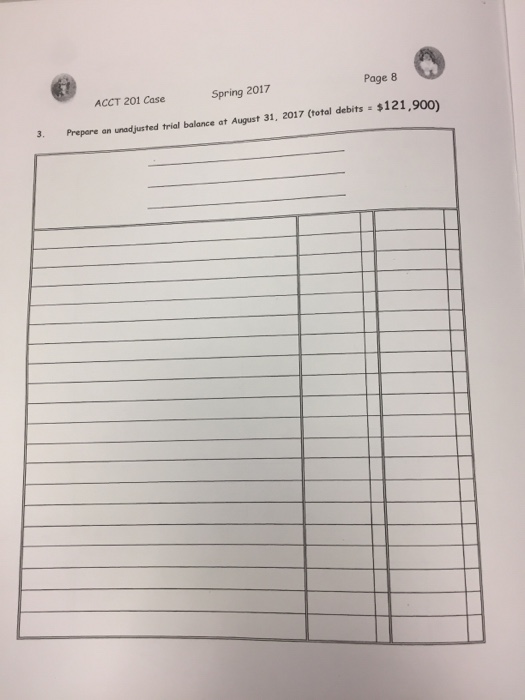

I need the unadjusted trial balance based off of page 3 of The 2017 Acct 201 Comprehensive case. (Page 8) ACCT 201 Case Spring 2017

I need the unadjusted trial balance based off of page 3 of The 2017 Acct 201 Comprehensive case. (Page 8)

ACCT 201 Case Spring 2017 Page 3 Chow Buddies, Inc. n August, 2017, Chow Buddies, Inc. was established in Lafayette, uisiana, to sell gourmet dog e via the internet to individual and commercial customers across the United States. Luke Ward chi Lee are the major stockholders in this corporation. The company completed the following transactions during August 2017. August 1 Stockholders Luke and Pachi) invested $60,000 cash in the business. 3 Purchased a computer system for use in the business for $12,000: paid $5.000 down and signed a 1 year 12% note for the balance. 5 Hired Ima Nurd to design, set up, and operate the company s website. 8 Purchased $21,000 of gourmet dog cuisine from a local manufacturing company: 10 paid 1/3 in cash and the balance on account. August 1, 2017 Paid $6,000 for a one-year insurance policy effective 11 Received $9.000 cash for services to be provided from August 1 through October 31, 2017. 12 Purchased supplies for $6,200 on account. 15 Paid $2,800 to advertise the opening of their business. the cuisine cost 18 Sold gourmet dog cuisine to customers on account for $26000: $11,000 23 Paid $4,700 to creditors on account. 25 collected $12,600 from customers billed on August 18. cash: the cuisine cost 27 sold gourmet dog cuisine to customers for $4,400 $1,300 29 Paid $800 for utilities used during August. 30 Declared and paid a $900 dividend. RED: Journal the August transactions in the general journal. General Journal Credit Debit Ref Account Titles

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started