i need the whole answers

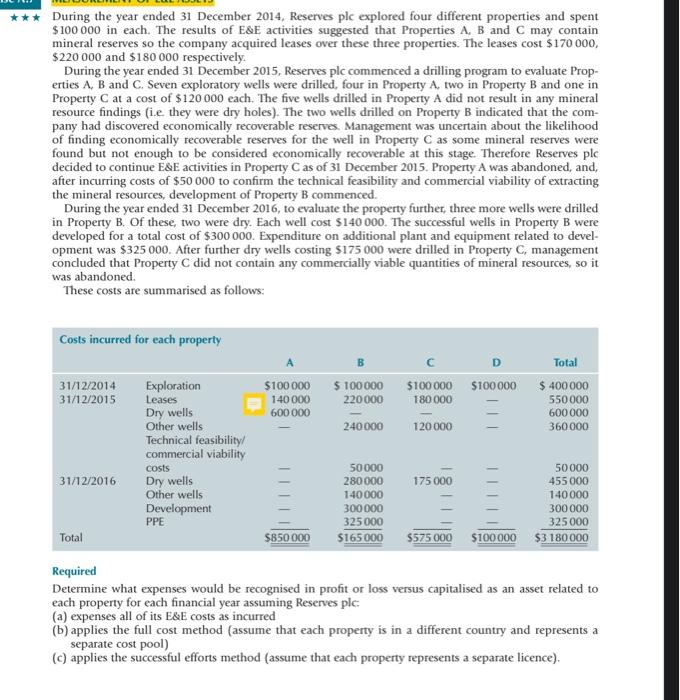

During the year ended 31 December 2014, Reserves ple explored four different properties and spent $ 100 000 in each. The results of E&E activities suggested that Properties A, B and C may contain mineral reserves so the company acquired leases over these three properties. The leases cost $170 000, $220 000 and $180 000 respectively. During the year ended 31 December 2015, Reserves plc commenced a drilling program to evaluate Prop- erties A, B and C. Seven exploratory wells were drilled, four in Property A, two in Property B and one in Property C at a cost of $120 000 each. The five wells drilled in Property A did not result in any mineral resource findings (ie they were dry holes). The two wells drilled on Property B indicated that the com- pany had discovered economically recoverable reserves. Management was uncertain about the likelihood of finding economically recoverable reserves for the well in Property C as some mineral reserves were found but not enough to be considered economically recoverable at this stage. Therefore Reserves plc decided to continue E&E activities in Property C as of 31 December 2015. Property A was abandoned, and, after incurring costs of $50 000 to confirm the technical feasibility and commercial viability of extracting the mineral resources, development of Property B commenced. During the year ended 31 December 2016, to evaluate the property further three more wells were drilled in Property B. Of these, two were dry. Each well cost $140 000. The successful wells in Property B were developed for a total cost of $300 000. Expenditure on additional plant and equipment related to devel- opment was $325 000. After further dry wells costing $175 000 were drilled in Property C, management concluded that Property C did not contain any commercially viable quantities of mineral resources, so it was abandoned These costs are summarised as follows: Costs incurred for each property 31/12/2014 31/12/2015 $100 000 140 000 600 000 $ 100 000 220000 240000 $100 000 $100 000 180 000 120 000 Total $ 400 000 550 000 600 000 360000 Exploration Leases Dry wells Other wells Technical feasibility commercial viability costs Dry wells Other wells Development PPE 31/12/2016 50000 280 000 140000 300000 325000 $165000 50000 175 000 455 000 140 000 300000 325000 $575 000 $100000 $3 180 000 Total $850 000 Required Determine what expenses would be recognised in profit or loss versus capitalised as an asset related to each property for each financial year assuming Reserves plc: (a) expenses all of its E&E costs as incurred (b) applies the full cost method (assume that each property is in a different country and represents a separate cost pool) (c) applies the successful efforts method (assume that each property represents a separate licence). During the year ended 31 December 2014, Reserves ple explored four different properties and spent $ 100 000 in each. The results of E&E activities suggested that Properties A, B and C may contain mineral reserves so the company acquired leases over these three properties. The leases cost $170 000, $220 000 and $180 000 respectively. During the year ended 31 December 2015, Reserves plc commenced a drilling program to evaluate Prop- erties A, B and C. Seven exploratory wells were drilled, four in Property A, two in Property B and one in Property C at a cost of $120 000 each. The five wells drilled in Property A did not result in any mineral resource findings (ie they were dry holes). The two wells drilled on Property B indicated that the com- pany had discovered economically recoverable reserves. Management was uncertain about the likelihood of finding economically recoverable reserves for the well in Property C as some mineral reserves were found but not enough to be considered economically recoverable at this stage. Therefore Reserves plc decided to continue E&E activities in Property C as of 31 December 2015. Property A was abandoned, and, after incurring costs of $50 000 to confirm the technical feasibility and commercial viability of extracting the mineral resources, development of Property B commenced. During the year ended 31 December 2016, to evaluate the property further three more wells were drilled in Property B. Of these, two were dry. Each well cost $140 000. The successful wells in Property B were developed for a total cost of $300 000. Expenditure on additional plant and equipment related to devel- opment was $325 000. After further dry wells costing $175 000 were drilled in Property C, management concluded that Property C did not contain any commercially viable quantities of mineral resources, so it was abandoned These costs are summarised as follows: Costs incurred for each property 31/12/2014 31/12/2015 $100 000 140 000 600 000 $ 100 000 220000 240000 $100 000 $100 000 180 000 120 000 Total $ 400 000 550 000 600 000 360000 Exploration Leases Dry wells Other wells Technical feasibility commercial viability costs Dry wells Other wells Development PPE 31/12/2016 50000 280 000 140000 300000 325000 $165000 50000 175 000 455 000 140 000 300000 325000 $575 000 $100000 $3 180 000 Total $850 000 Required Determine what expenses would be recognised in profit or loss versus capitalised as an asset related to each property for each financial year assuming Reserves plc: (a) expenses all of its E&E costs as incurred (b) applies the full cost method (assume that each property is in a different country and represents a separate cost pool) (c) applies the successful efforts method (assume that each property represents a separate licence)

i need the whole answers

i need the whole answers