Question

I need the work completed within excel and showing all the calculations please Rolling Green Golf Course is member-owned golf club and contemplating expanding its

I need the work completed within excel and showing all the calculations please

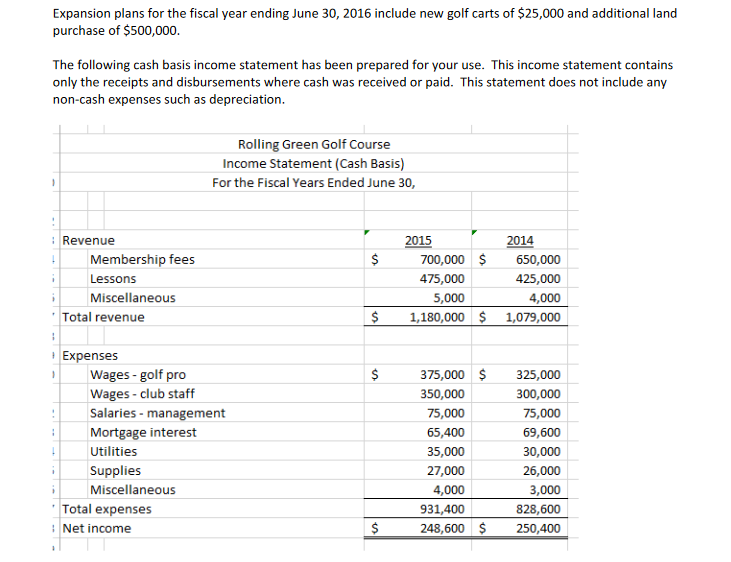

Rolling Green Golf Course is member-owned golf club and contemplating expanding its golf course in the upcoming year. Rolling Green operates on a fiscal year with a year ending daten of June 30th. You have been hired to evaluate their budgeted information for the fiscal year ending June 30, 2016 to see if their expansion plan is reasonable.Expansion plans for the fiscal year ending June 30, 2016 include new golf carts of $25,000 and additional land purchase of $500,000. The following cash basis income statement has been prepared for your use. This income statement contains only the receipts and disbursements where cash was received or paid. This statement does not include any non-cash expenses such as depreciation.

The following information is also provided for your use:

(1)Account balance as of June 30, 2015 include:

a.Cash in the bank of $12,500

b.Petty cash on hand of $500

c.Outstanding mortgage balance of $1,020,000

d.Accounts payable for supplies and utilities of $6,000 which will be paid in July 2015

(2)Some additional golf carts were purchased in June 2015 for $35,000. Of this, $10,000 was paid when the carts were delivered in June 2015. The balance owed of $25,000 will be paid in August 2015.This purchase does not affect the planned golf cart purchases for the upcoming fiscal year.

(3)The club purchased additional property to expand it course on June 1, 2011. The value of property at the time of purchase was $1,500,000. A down payment of $200,000 was made on this property at the time of purchase. A mortgage was taken for the remainder. Rolling Green pays $70,000 principal plus 6% interest annually on the previously unpaid loan balance each June 1st, beginning June 1, 2012.

(4)The following increases are expected for the fiscal year ending June 30, 2016:

a. Membership is expected to increase by 1%.

b.Membership fees are expected to increase by 5%.

c.Golf lesson fees are expected to increase the same amount for fiscal year ending June 30, 2016 as they did for fiscal year ended June 30, 2015.

d. Miscellaneous revenues are expected to increase the same amount for fiscal year ending June 30, 2016 as they did for fiscal year ended June 30, 2015.

e. Golf pro wages will increase to $500,000. The golf pro teaches all golf lessons.

f.Club staff wages will increase by 15% over the prior fiscal year.

g.Management salaries will increase by 20% over the prior fiscal year.

h.Utilities, Supplies, and Miscellaneous expenses will increase by 20% over the prior fiscal year.

Requirements:

(1) Prepare a cash basis budgeted income statement for the fiscal year ending June 30, 2016 (use the statement included above for a format example).

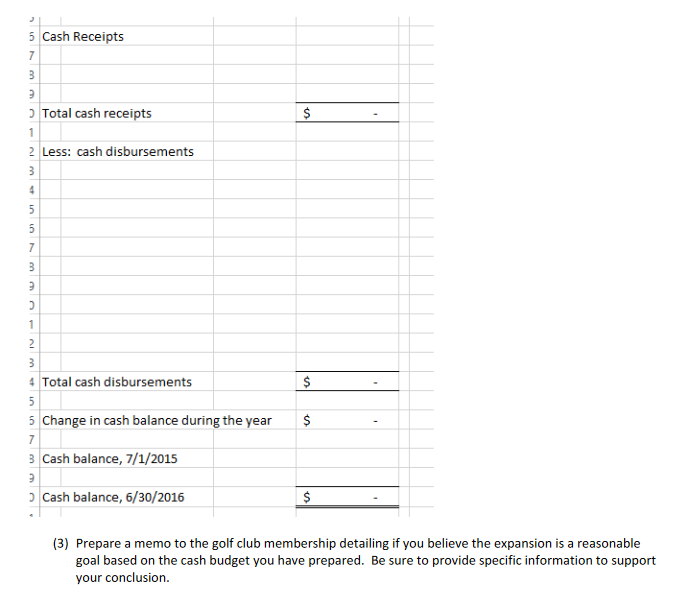

(2) Prepare a cash budget for the fiscal year ending June 30, 2016.

Your cash budget should be set up as follows:

(3) Prepare a memo to the golf club membership detailing if you believe the expansion is a reasonable

goal based on the cash budget you have prepared. Be sure to provide specific information to support

your conclusion.

Expansion plans for the fiscal year ending June 30, 2016 include new golf carts of $25,000 and additional land purchase of $500,000 The following cash basis income statement has been prepared for your use. This income statement contains only the receipts and disbursements where cash was received or paid. This statement does not include any non-cash expenses such as depreciation Rolling Green Golf Course Income Statement (Cash Basis) For the Fiscal Years Ended June 30, : Revenue 2014 2015 Membership fees Lessons Miscellaneous 700,000 650,000 425,000 4,000 $1,180,000 1,079,000 475,000 5,000 Total revenue Expenses Wages - golf pro Wages - club staff Salaries management Mortgage interest Utilities Supplies Miscellaneous 350,000 75,000 65,400 35,000 27,000 4,000 931,400 75,000 325,000 300,000 75,000 69,600 30,000 26,000 3,000 828,600 248,600 250,400 Total expenses Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started