I need them all done, but if youre only going to do 1 I need 11, I will give 1 upvote for every question done. Thanks!

I need them all done, but if youre only going to do 1 I need 11, I will give 1 upvote for every question done. Thanks!

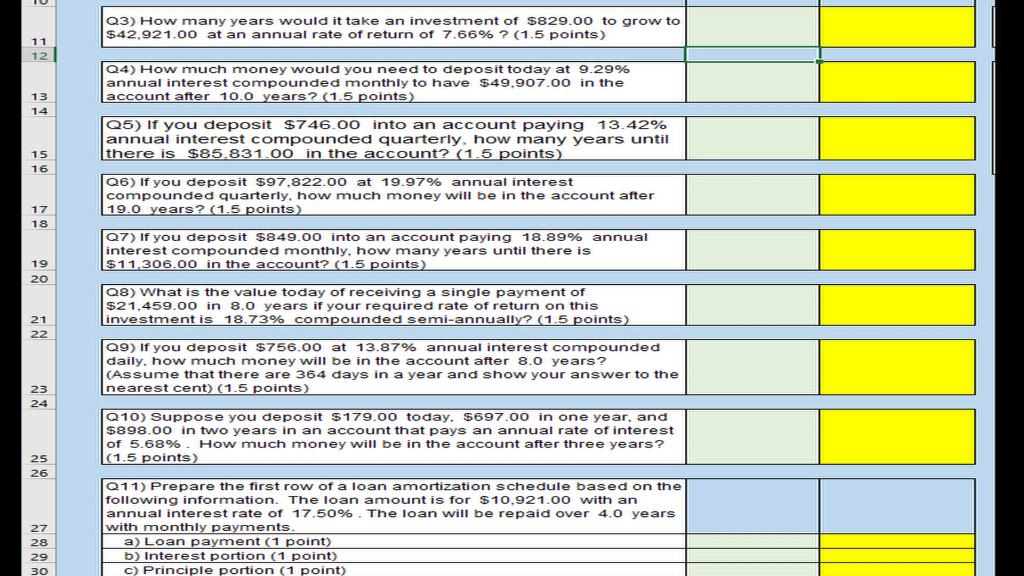

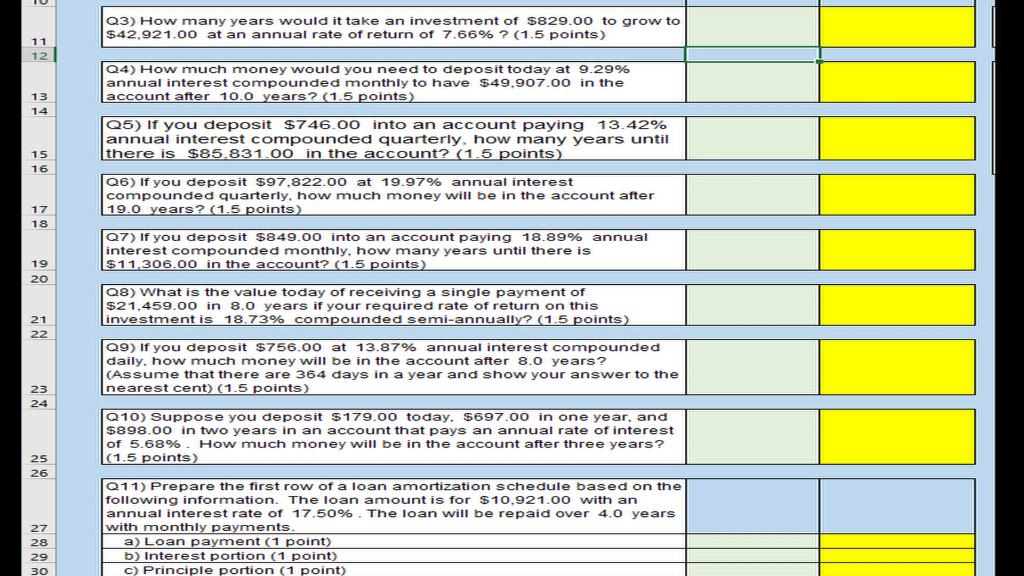

Q3) How many years would it take an investment of $829.00 to grow to $42.921.00 at an annual rate of return of 7.66% ? (1.5 points) 11 12 Q4) How much money would you need to deposit today at 9.29% annual interest compounded monthly to have $49.907.00 in the account after 10.0 years? (1.5 points) 13 14 Q5) If you deposit $746.00 into an account paying 13.42% annual interest compounded quarterly, how many years until there is $85.831.00 in the account? (1.5 points) 15 16 Q6) If you deposit $97,822.00 at 19.97% annual interest compounded quarterly, how much money will be in the account after 19.0 years? (1.5 points) 17 18 Q7) If you deposit $849.00 into an account paying 18.89% annual interest compounded monthly, how many years until there is $11.306.00 in the account? (1.5 points) 19 20 08) What is the value today of receiving a single payment of $21.459.00 in 8.0 years if your required rate of return on this investment is 18.73% compounded semi-annually? (1.5 points) 21 22 Q9) If you deposit $756.00 at 13.87% annual interest compounded daily, how much money will be in the account after 8.0 years? (Assume that there are 364 days in a year and show your answer to the nearest cent) (1.5 points) 23 24 Q10) Suppose you deposit $179.00 today. $697.00 in one year, and $898.00 in two years in an account that pays an annual rate of interest of 5.68%. How much money will be in the account after three years? (1.5 points) 25 26 27 28 29 30 Q11) Prepare the first row of a loan amortization schedule based on the following information. The loan amount is for $10.921.00 with an annual interest rate of 17.50%. The loan will be repaid over 4.0 years with monthly payments a) Loan payment (1 point) b) Interest portion (1 point) c) Principle portion (1 point) Q3) How many years would it take an investment of $829.00 to grow to $42.921.00 at an annual rate of return of 7.66% ? (1.5 points) 11 12 Q4) How much money would you need to deposit today at 9.29% annual interest compounded monthly to have $49.907.00 in the account after 10.0 years? (1.5 points) 13 14 Q5) If you deposit $746.00 into an account paying 13.42% annual interest compounded quarterly, how many years until there is $85.831.00 in the account? (1.5 points) 15 16 Q6) If you deposit $97,822.00 at 19.97% annual interest compounded quarterly, how much money will be in the account after 19.0 years? (1.5 points) 17 18 Q7) If you deposit $849.00 into an account paying 18.89% annual interest compounded monthly, how many years until there is $11.306.00 in the account? (1.5 points) 19 20 08) What is the value today of receiving a single payment of $21.459.00 in 8.0 years if your required rate of return on this investment is 18.73% compounded semi-annually? (1.5 points) 21 22 Q9) If you deposit $756.00 at 13.87% annual interest compounded daily, how much money will be in the account after 8.0 years? (Assume that there are 364 days in a year and show your answer to the nearest cent) (1.5 points) 23 24 Q10) Suppose you deposit $179.00 today. $697.00 in one year, and $898.00 in two years in an account that pays an annual rate of interest of 5.68%. How much money will be in the account after three years? (1.5 points) 25 26 27 28 29 30 Q11) Prepare the first row of a loan amortization schedule based on the following information. The loan amount is for $10.921.00 with an annual interest rate of 17.50%. The loan will be repaid over 4.0 years with monthly payments a) Loan payment (1 point) b) Interest portion (1 point) c) Principle portion (1 point)

I need them all done, but if youre only going to do 1 I need 11, I will give 1 upvote for every question done. Thanks!

I need them all done, but if youre only going to do 1 I need 11, I will give 1 upvote for every question done. Thanks!