I need these done in Excel Please. They need to be labeled by the chapter as well at the bottom or done on different tabs.

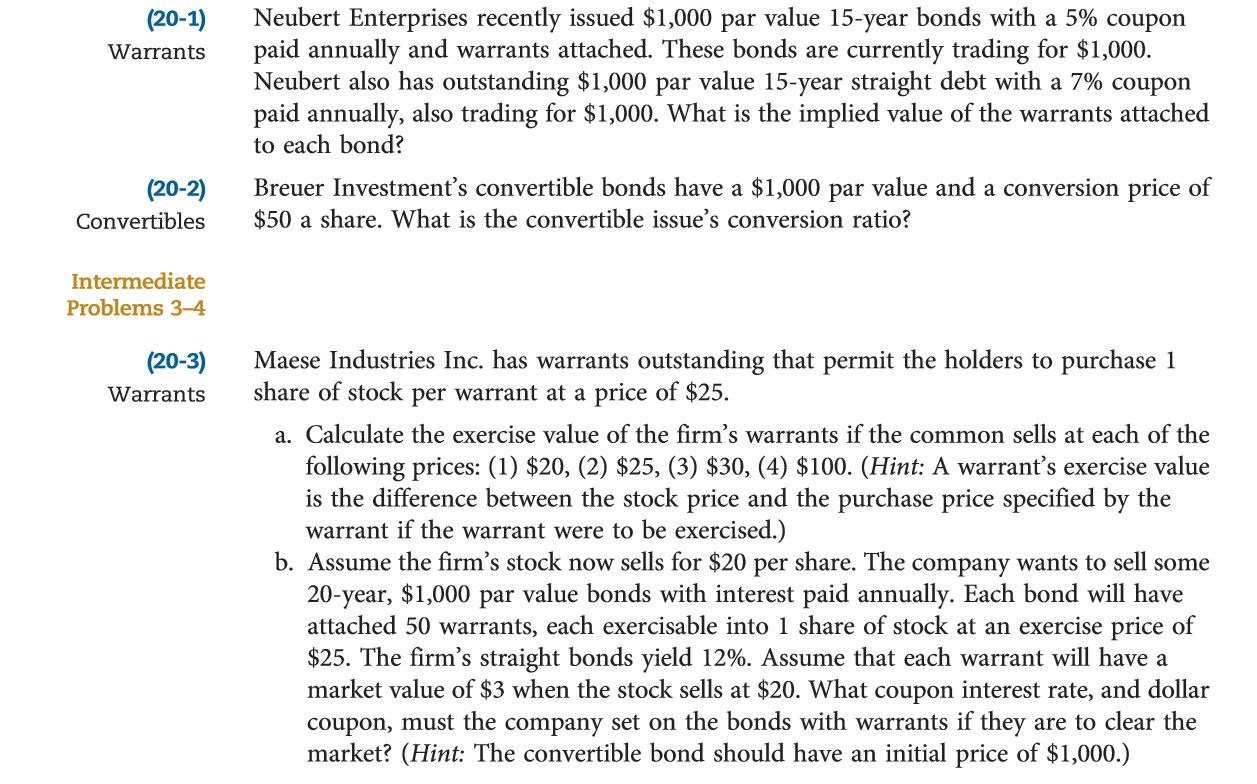

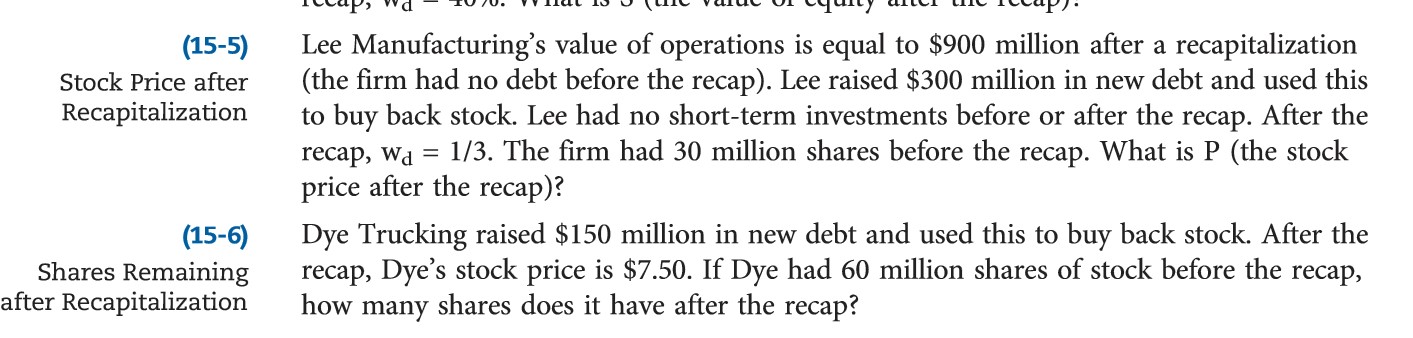

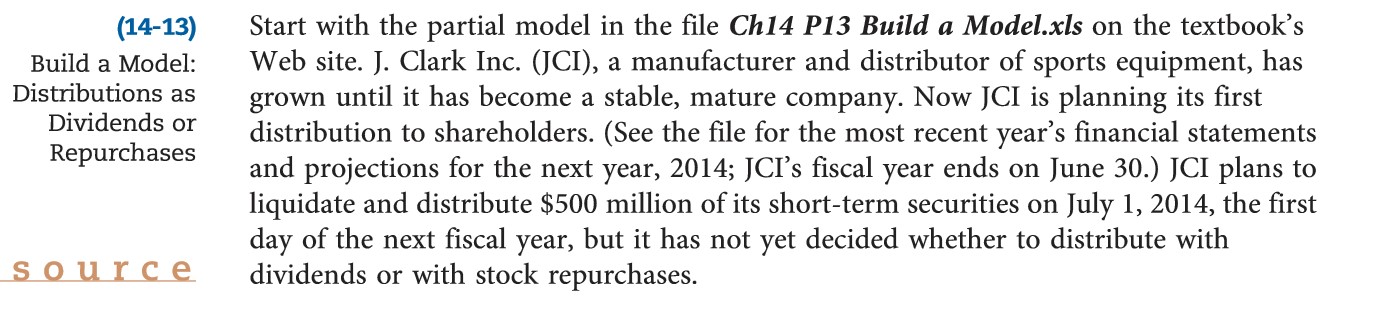

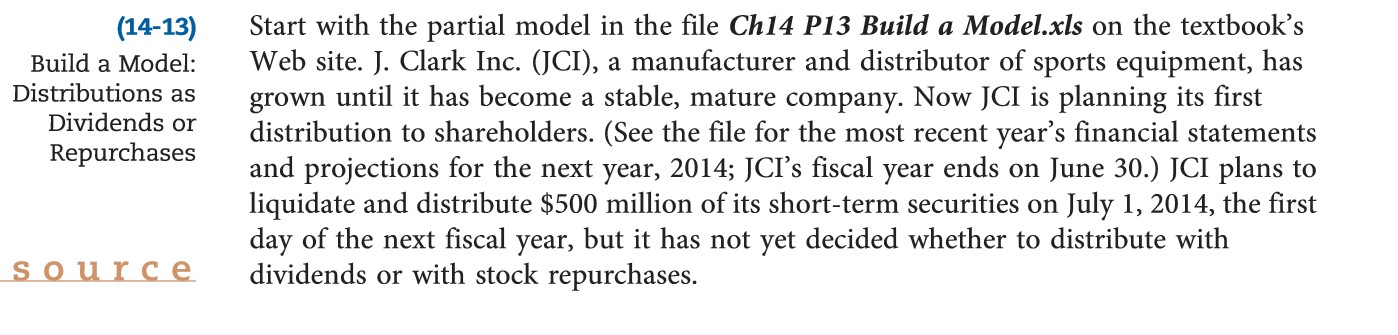

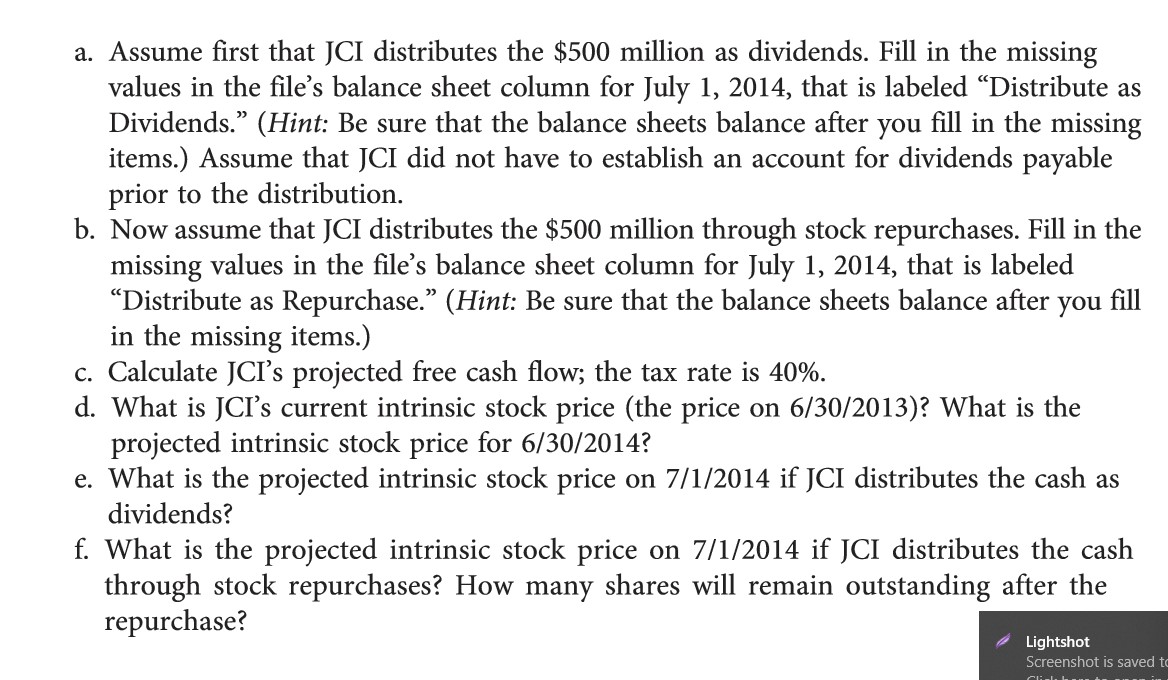

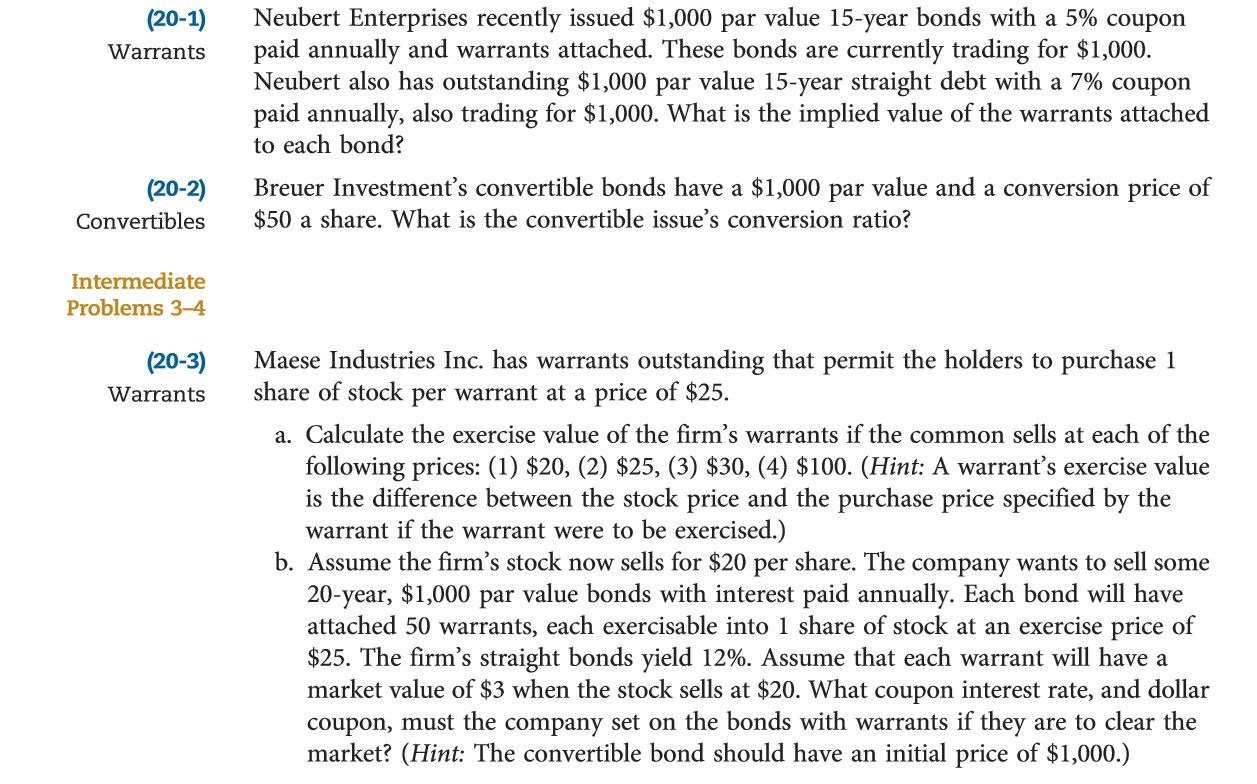

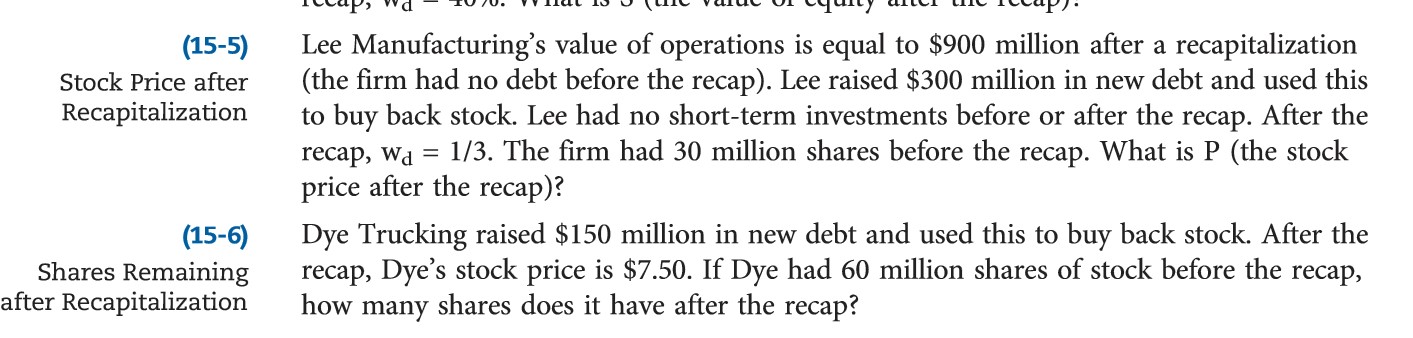

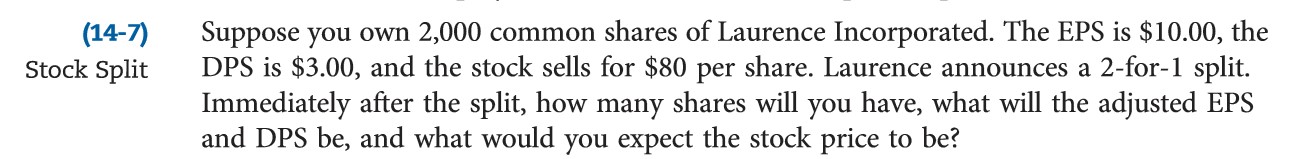

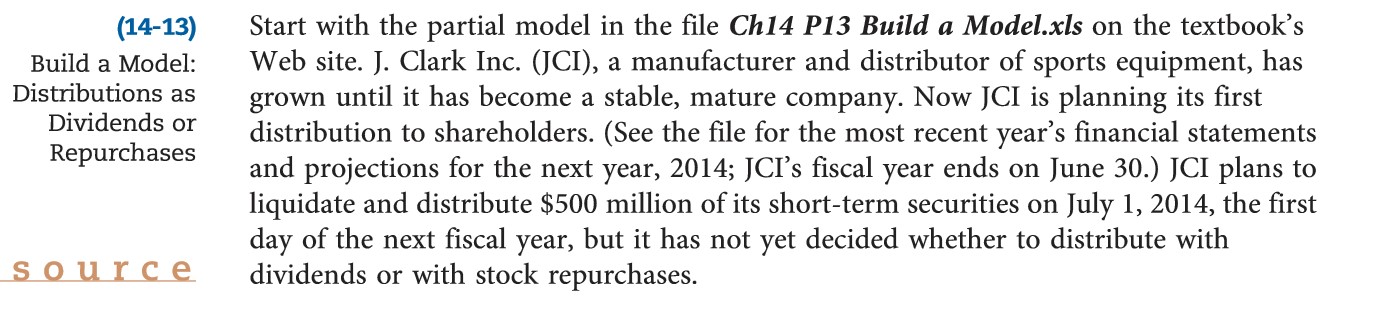

(20-1) Warrants (20-2) Convertibles Intermediate Problems 34 (20-3) Warrants Neubert Enterprises recently issued $1,000 par value 15-year bonds with a 5% coupon paid annually and warrants attached. These bonds are currently trading for $1,000. Neubert also has outstanding $1,000 par value 15-year straight debt with a 7% coupon paid annually, also trading for $1,000. What is the implied value of the warrants attached to each bond? Breuer Investment's convertible bonds have a $1,000 par value and a conversion price of $50 a share. What is the convertible issue's conversion ratio? Maese Industries Inc. has warrants outstanding that permit the holders to purchase 1 share of stock per warrant at a price of $25. a. Calculate the exercise value of the rm's warrants if the common sells at each of the following prices: (1) $20, (2) $25, (3) $30, (4) $100. (Hint: A warrant's exercise value is the difference between the stock price and the purchase price specied by the warrant if the warrant were to be exercised.) b. Assume the rm's stock now sells for $20 per share. The company wants to sell some 20year, $1,000 par value bonds with interest paid annually. Each bond will have attached 50 warrants, each exercisable into 1 share of stock at an exercise price of $25. The rm's straight bonds yield 12%. Assume that each warrant will have a market value of $3 when the stock sells at $20. What coupon interest rate, and dollar coupon, must the company set on the bonds with warrants if they are to clear the market? (Hint: The convertible bond should have an initial price of $1,000.) (15-2) Counts Accounting has a beta of 1.15. The tax rate is 40%, and Counts is nanced with Unlevered Beta 20% debt. What is Counts's unlevered beta? (155} Stock Price after Recapitalization (15-6) Shares Remaining after Recapitalization 15-56111, "(1 10' IU- I'IIAHL 10 u \ulh VlhI-L- Ul 'iull.' Gnu-l ulb lhhullfu Lee Manufacturing's value of operations is equal to $900 million after a recapitalization (the rm had no debt before the recap). Lee raised $300 million in new debt and used this to buy back stock. Lee had no shortterm investments before or after the recap. After the recap, wd = 1/3. The rm had 30 million shares before the recap. What is P (the stock price after the recap)? Dye Trucking raised $150 million in new debt and used this to buy back stock. After the recap, Dye's stock price is $7.50. If Dye had 60 million shares of stock before the recap, how many shares does it have after the recap? (14-7) Suppose you own 2,000 common shares of Laurence Incorporated. The EPS is $10.00, the Stock Split DPS is $3.00, and the stock sells for $80 per share. Laurence announces a 2-for-1 split. Immediately after the split, how many shares will you have, what will the adjusted EPS and DPS be, and what would you expect the stock price to be? .I ...... ._.I.J__.... .. """'.r""" .. I. (14-9) Harris Company must set its investment and dividend policies for the coming year. It has Residual Distribution three independent projects from which to choose, each of which requires a $3 million PDHCY investment. These projects have different levels of risk and therefore different costs of capital. Their projected IRRs and costs of capital are as follows: (14-13) Build a Model: Distributions as Dividends or Repurchases Start with the partial model in the le C1114 P13 Build a Model.xls on the textbooks Web site. I. Clark Inc. (ICI), a manufacturer and distributor of sports equipment, has grown until it has become a stable, mature company. Now JCI is planning its rst distribution to shareholders. (See the le for the most recent year's nancial statements and projections for the next year, 2014; ICI's scal year ends on June 30.) ICI plans to liquidate and distribute $500 million of its short-term securities on July 1, 2014, the rst day of the next scal year, but it has not yet decided whether to distribute with dividends or with stock repurchases. a. Assume rst that ICI distributes the $500 million as dividends. Fill in the missing values in the le's balance sheet column for July 1, 2014, that is labeled "Distribute as Dividends." (Hint: Be sure that the balance sheets balance after you ll in the missing items.) Assume that ICI did not have to establish an account for dividends payable prior to the distribution. b. Now assume that ICI distributes the $500 million through stock repurchases. Fill in the missing values in the le's balance sheet column for July 1, 2014, that is labeled "Distribute as Repurchase." (Hint: Be sure that the balance sheets balance after you ll in the missing items.) . Calculate JCI's projected free cash ow; the tax rate is 40%. d. What is ICI's current intrinsic stock price (the price on 6/ 30/2013)? What is the projected intrinsic stock price for 6/30/2014? e. What is the projected intrinsic stock price on 7/1/2014 if ICI distributes the cash as dividends? f. What is the projected intrinsic stock price on 7/1/2014 if ICI distributes the cash through stock repurchases? How many shares will remain outstanding after the repurChase? - -' Lightshot O