Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need this answer for this question please. it's important and urgent. 1. From the list of firms with historical return data from January 2011

I need this answer for this question please. it's important and urgent.

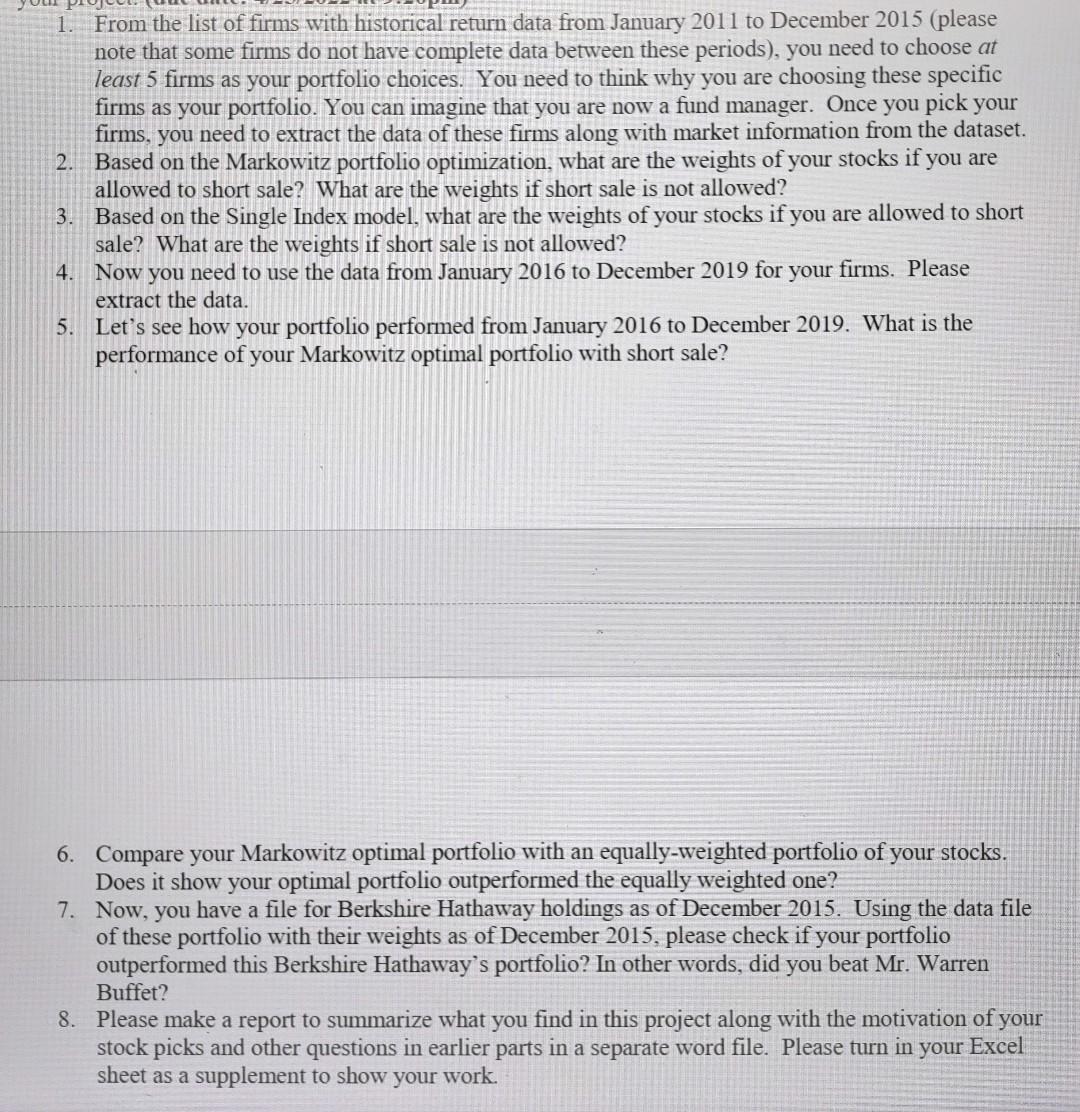

1. From the list of firms with historical return data from January 2011 to December 2015 (please note that some firms do not have complete data between these periods), you need to choose at least 5 firms as your portfolio choices. You need to think why you are choosing these specific firms as your portfolio. You can imagine that you are now a fund manager. Once you pick your firms, you need to extract the data of these firms along with market information from the dataset. 2. Based on the Markowitz portfolio optimization, what are the weights of your stocks if you are allowed to short sale? What are the weights if short sale is not allowed? 3. Based on the Single Index model, what are the weights of your stocks if you are allowed to short sale? What are the weights if short sale is not allowed? 4. Now you need to use the data from January 2016 to December 2019 for your firms. Please extract the data. 5. Let's see how your portfolio performed from January 2016 to December 2019. What is the performance of your Markowitz optimal portfolio with short sale? 6. Compare your Markowitz optimal portfolio with an equally-weighted portfolio of your stocks. Does it show your optimal portfolio outperformed the equally weighted one? 7. Now, you have a file for Berkshire Hathaway holdings as of December 2015. Using the data file of these portfolio with their weights as of December 2015. please check if your portfolio outperformed this Berkshire Hathaway's portfolio? In other words, did you beat Mr. Warren Buffet? 8. Please make a report to summarize what you find in this project along with the motivation of your stock picks and other questions in earlier parts in a separate word file. Please turn in your Excel sheet as a supplement to show your work. 1. From the list of firms with historical return data from January 2011 to December 2015 (please note that some firms do not have complete data between these periods), you need to choose at least 5 firms as your portfolio choices. You need to think why you are choosing these specific firms as your portfolio. You can imagine that you are now a fund manager. Once you pick your firms, you need to extract the data of these firms along with market information from the dataset. 2. Based on the Markowitz portfolio optimization, what are the weights of your stocks if you are allowed to short sale? What are the weights if short sale is not allowed? 3. Based on the Single Index model, what are the weights of your stocks if you are allowed to short sale? What are the weights if short sale is not allowed? 4. Now you need to use the data from January 2016 to December 2019 for your firms. Please extract the data. 5. Let's see how your portfolio performed from January 2016 to December 2019. What is the performance of your Markowitz optimal portfolio with short sale? 6. Compare your Markowitz optimal portfolio with an equally-weighted portfolio of your stocks. Does it show your optimal portfolio outperformed the equally weighted one? 7. Now, you have a file for Berkshire Hathaway holdings as of December 2015. Using the data file of these portfolio with their weights as of December 2015. please check if your portfolio outperformed this Berkshire Hathaway's portfolio? In other words, did you beat Mr. Warren Buffet? 8. Please make a report to summarize what you find in this project along with the motivation of your stock picks and other questions in earlier parts in a separate word file. Please turn in your Excel sheet as a supplement to show your workStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started