Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED THIS ANSWER TO BE SHOWN IN A FLOW CHART. Covered Interest Arbitrage in Both Directions The following information is available: You have $500,000

I NEED THIS ANSWER TO BE SHOWN IN A FLOW CHART.

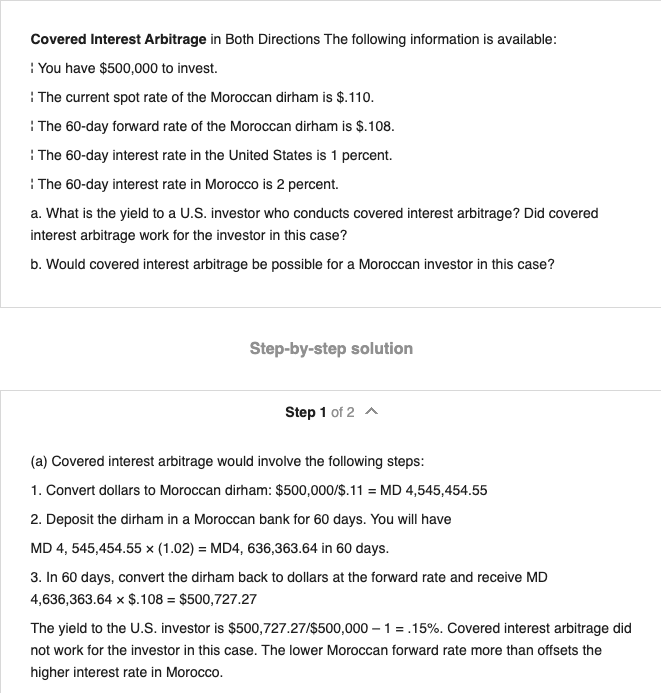

Covered Interest Arbitrage in Both Directions The following information is available: You have $500,000 to invest. : The current spot rate of the Moroccan dirham is $. 110. : The 60-day forward rate of the Moroccan dirham is $.108. The 60-day interest rate in the United States is 1 percent. : The 60-day interest rate in Morocco is 2 percent. a. What is the yield to a U.S. investor who conducts covered interest arbitrage? Did covered interest arbitrage work for the investor in this case? b. Would covered interest arbitrage be possible for a Moroccan investor in this case? Step-by-step solution Step 1 of 2 A (a) Covered interest arbitrage would involve the following steps: 1. Convert dollars to Moroccan dirham: $500,000/$.11 = MD 4,545,454.55 2. Deposit the dirham in a Moroccan bank for 60 days. You will have MD 4, 545,454.55 % (1.02) = MD4, 636,363.64 in 60 days. 3. In 60 days, convert the dirham back to dollars at the forward rate and receive MD 4,636,363.64 x $.108 = $500,727.27 The yield to the U.S. investor is $500,727.27/$500,000 - 1 = .15%. Covered interest arbitrage did not work for the investor in this case. The lower Moroccan forward rate more than offsets the higher interest rate in Morocco. Covered Interest Arbitrage in Both Directions The following information is available: You have $500,000 to invest. : The current spot rate of the Moroccan dirham is $. 110. : The 60-day forward rate of the Moroccan dirham is $.108. The 60-day interest rate in the United States is 1 percent. : The 60-day interest rate in Morocco is 2 percent. a. What is the yield to a U.S. investor who conducts covered interest arbitrage? Did covered interest arbitrage work for the investor in this case? b. Would covered interest arbitrage be possible for a Moroccan investor in this case? Step-by-step solution Step 1 of 2 A (a) Covered interest arbitrage would involve the following steps: 1. Convert dollars to Moroccan dirham: $500,000/$.11 = MD 4,545,454.55 2. Deposit the dirham in a Moroccan bank for 60 days. You will have MD 4, 545,454.55 % (1.02) = MD4, 636,363.64 in 60 days. 3. In 60 days, convert the dirham back to dollars at the forward rate and receive MD 4,636,363.64 x $.108 = $500,727.27 The yield to the U.S. investor is $500,727.27/$500,000 - 1 = .15%. Covered interest arbitrage did not work for the investor in this case. The lower Moroccan forward rate more than offsets the higher interest rate in MoroccoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started