I need this asap

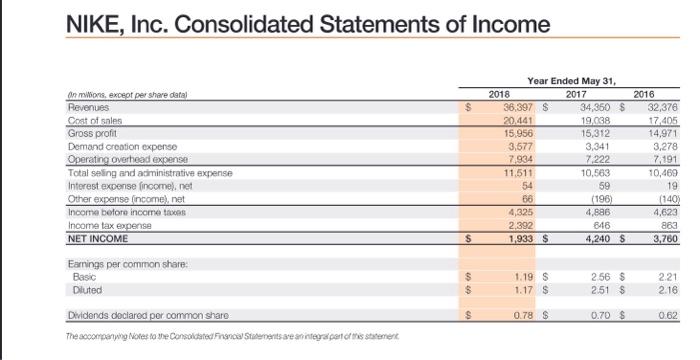

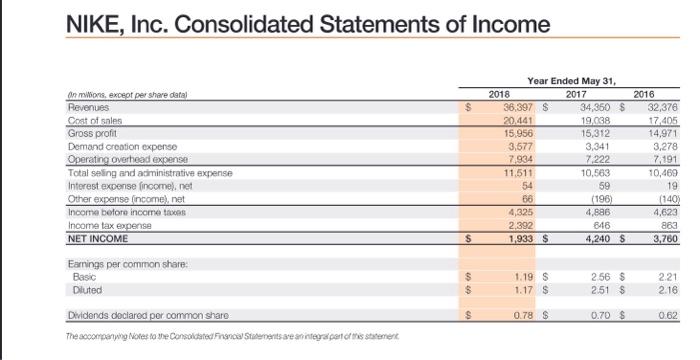

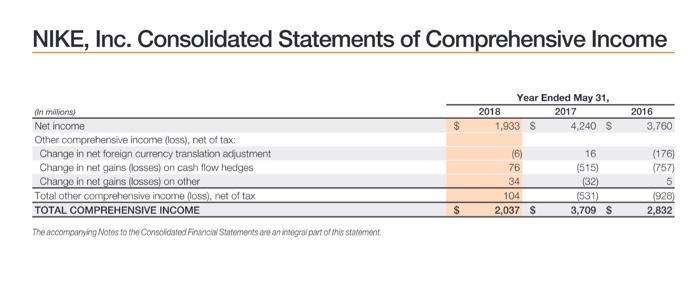

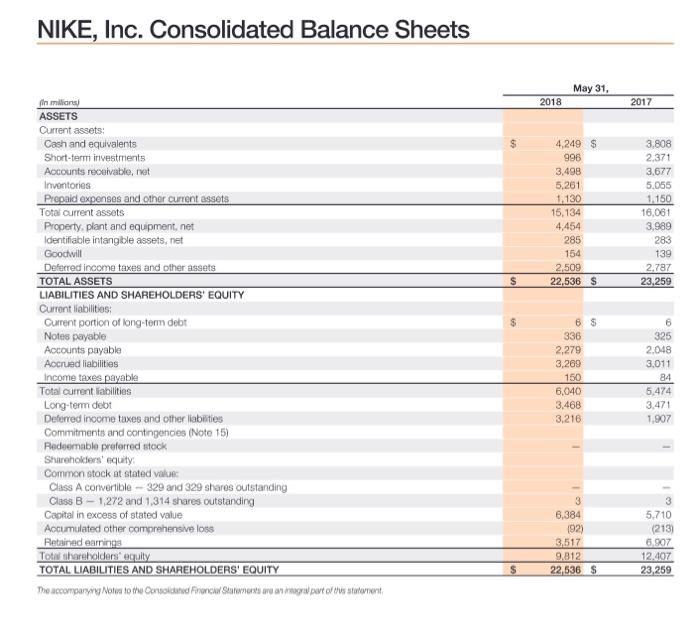

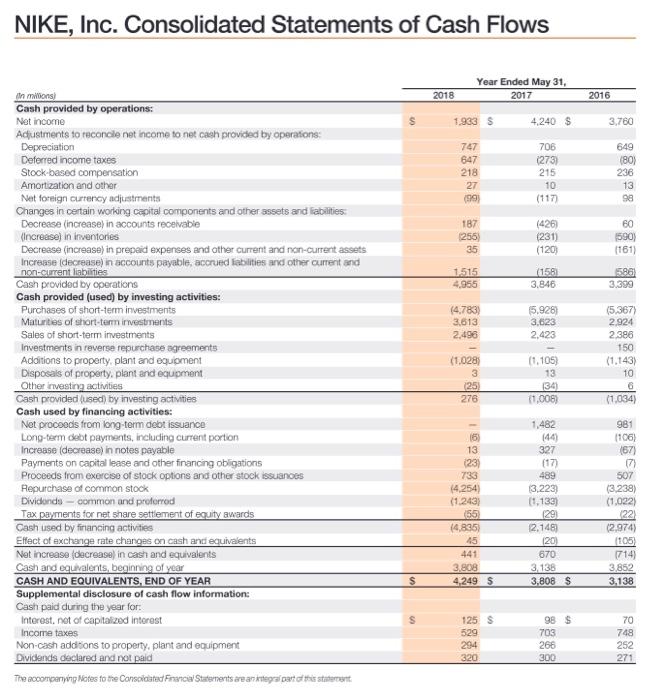

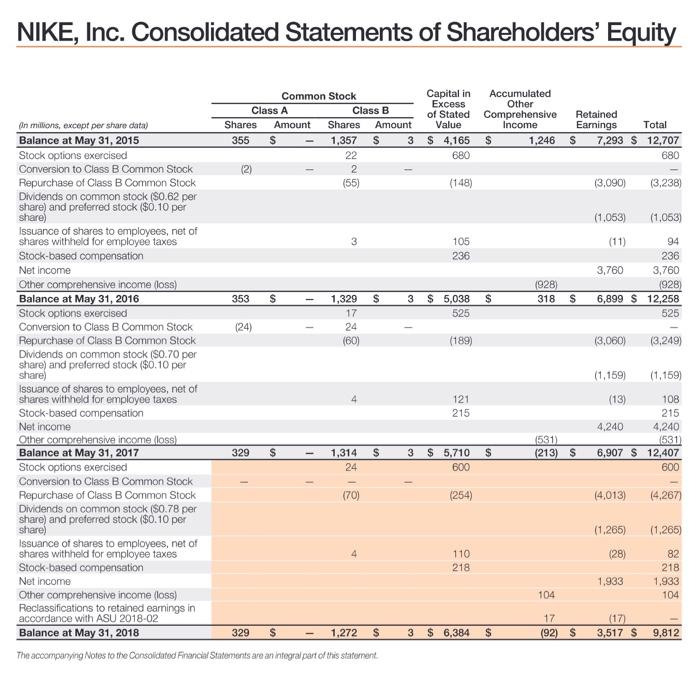

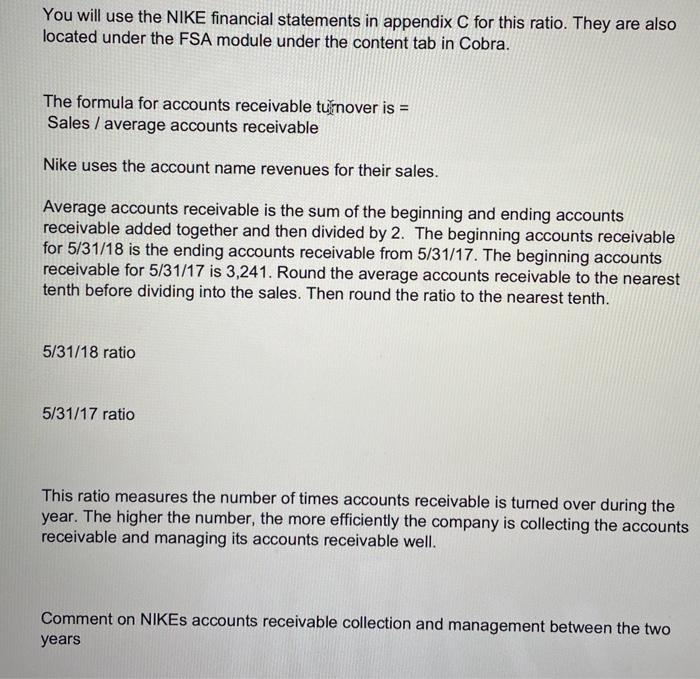

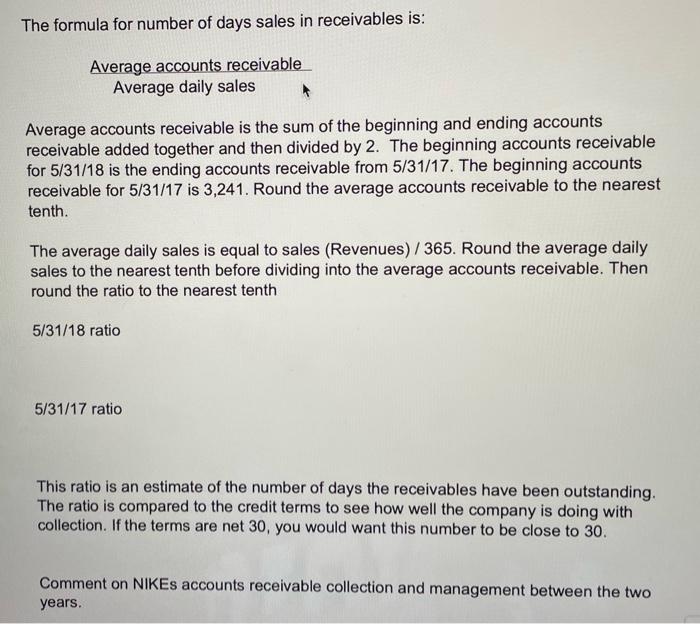

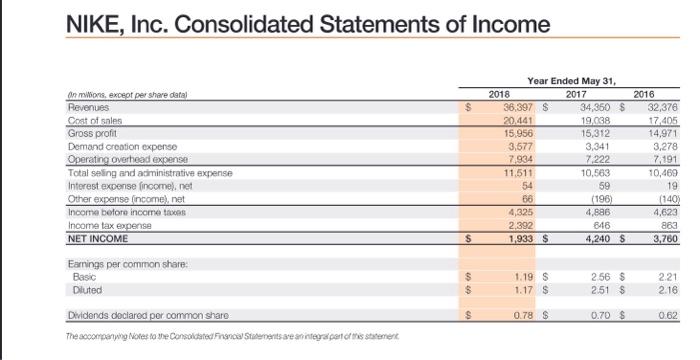

NIKE, Inc. Consolidated Statements of Income NIKE, Inc. Consolidated Statements of Comprehensive Income NIKE, Inc. Consolidated Balance Sheets NIKE, Inc. Consolidated Statements of Cash Flows NIKE, Inc. Consolidated Statements of Shareholders' Equity You will use the NIKE financial statements in appendix C for this ratio. They are also located under the FSA module under the content tab in Cobra. The formula for accounts receivable tnover is = Sales / average accounts receivable Nike uses the account name revenues for their sales. Average accounts receivable is the sum of the beginning and ending accounts receivable added together and then divided by 2 . The beginning accounts receivable for 5/31/18 is the ending accounts receivable from 5/31/17. The beginning accounts receivable for 5/31/17 is 3,241 . Round the average accounts receivable to the nearest tenth before dividing into the sales. Then round the ratio to the nearest tenth. 5/31/18 ratio 5/31/17 ratio This ratio measures the number of times accounts receivable is turned over during the year. The higher the number, the more efficiently the company is collecting the accounts receivable and managing its accounts receivable well. Comment on NIKEs accounts receivable collection and management between the two years The formula for number of days sales in receivables is: Average accounts receivable Average daily sales Average accounts receivable is the sum of the beginning and ending accounts receivable added together and then divided by 2 . The beginning accounts receivable for 5/31/18 is the ending accounts receivable from 5/31/17. The beginning accounts receivable for 5/31/17 is 3,241 . Round the average accounts receivable to the nearest tenth. The average daily sales is equal to sales (Revenues) /365. Round the average daily sales to the nearest tenth before dividing into the average accounts receivable. Then round the ratio to the nearest tenth 5/31/18 ratio 5/31/17 ratio This ratio is an estimate of the number of days the receivables have been outstanding. The ratio is compared to the credit terms to see how well the company is doing with collection. If the terms are net 30 , you would want this number to be close to 30 . Comment on NIKEs accounts receivable collection and management between the two years. NIKE, Inc. Consolidated Statements of Income NIKE, Inc. Consolidated Statements of Comprehensive Income NIKE, Inc. Consolidated Balance Sheets NIKE, Inc. Consolidated Statements of Cash Flows NIKE, Inc. Consolidated Statements of Shareholders' Equity You will use the NIKE financial statements in appendix C for this ratio. They are also located under the FSA module under the content tab in Cobra. The formula for accounts receivable tnover is = Sales / average accounts receivable Nike uses the account name revenues for their sales. Average accounts receivable is the sum of the beginning and ending accounts receivable added together and then divided by 2 . The beginning accounts receivable for 5/31/18 is the ending accounts receivable from 5/31/17. The beginning accounts receivable for 5/31/17 is 3,241 . Round the average accounts receivable to the nearest tenth before dividing into the sales. Then round the ratio to the nearest tenth. 5/31/18 ratio 5/31/17 ratio This ratio measures the number of times accounts receivable is turned over during the year. The higher the number, the more efficiently the company is collecting the accounts receivable and managing its accounts receivable well. Comment on NIKEs accounts receivable collection and management between the two years The formula for number of days sales in receivables is: Average accounts receivable Average daily sales Average accounts receivable is the sum of the beginning and ending accounts receivable added together and then divided by 2 . The beginning accounts receivable for 5/31/18 is the ending accounts receivable from 5/31/17. The beginning accounts receivable for 5/31/17 is 3,241 . Round the average accounts receivable to the nearest tenth. The average daily sales is equal to sales (Revenues) /365. Round the average daily sales to the nearest tenth before dividing into the average accounts receivable. Then round the ratio to the nearest tenth 5/31/18 ratio 5/31/17 ratio This ratio is an estimate of the number of days the receivables have been outstanding. The ratio is compared to the credit terms to see how well the company is doing with collection. If the terms are net 30 , you would want this number to be close to 30 . Comment on NIKEs accounts receivable collection and management between the two years