Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need this ASAP please somebody -%20Spring%20Exam%202020.pdf 1. Makaveli AG, an outdoor retailer, has developed a new model of mountain climbing shoes, called Berg. The

i need this ASAP please somebody

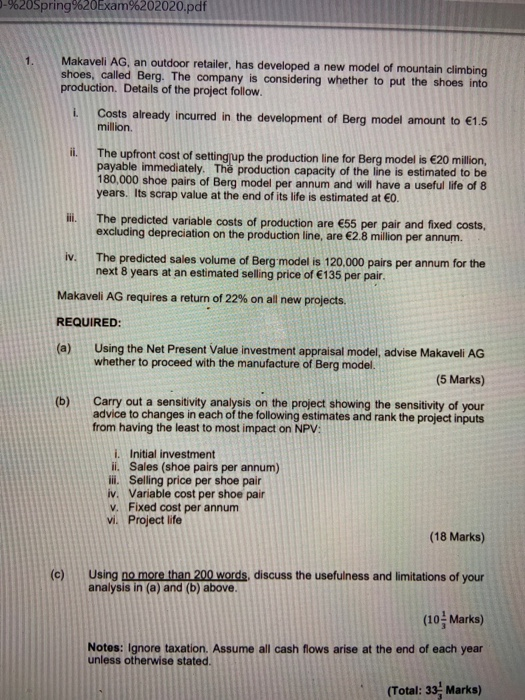

-%20Spring%20Exam%202020.pdf 1. Makaveli AG, an outdoor retailer, has developed a new model of mountain climbing shoes, called Berg. The company is considering whether to put the shoes into production. Details of the project follow. Costs already incurred in the development of Berg model amount to 1.5 million. i ii. The upfront cost of setting up the production line for Berg model is 20 million, payable immediately. The production capacity of the line is estimated to be 180,000 shoe pairs of Berg model per annum and will have a useful life of 8 years. Its scrap value at the end of its life is estimated at 0. iii. The predicted variable costs of production are 55 per pair and fixed costs, excluding depreciation on the production line, are 2.8 million per annum. iv. The predicted sales volume of Berg model is 120,000 pairs per annum for the next 8 years at an estimated selling price of 135 per pair Makaveli AG requires a return of 22% on all new projects. REQUIRED: (a) Using the Net Present Value investment appraisal model, advise Makaveli AG whether to proceed with the manufacture of Berg model. (5 Marks) (b) Carry out a sensitivity analysis on the project showing the sensitivity of your advice to changes in each of the following estimates and rank the project inputs from having the least to most impact on NPV: i. Initial investment ii. Sales (shoe pairs per annum) iii. Selling price per shoe pair iv. Variable cost per shoe pair V. Fixed cost per annum vi. Project life (18 Marks) (c) Using no more than 200 words, discuss the usefulness and limitations of your analysis in (a) and (b) above. (10 Marks) Notes: Ignore taxation. Assume all cash flows arise at the end of each year unless otherwise stated (Total: 33 Marks) -%20Spring%20Exam%202020.pdf 1. Makaveli AG, an outdoor retailer, has developed a new model of mountain climbing shoes, called Berg. The company is considering whether to put the shoes into production. Details of the project follow. Costs already incurred in the development of Berg model amount to 1.5 million. i ii. The upfront cost of setting up the production line for Berg model is 20 million, payable immediately. The production capacity of the line is estimated to be 180,000 shoe pairs of Berg model per annum and will have a useful life of 8 years. Its scrap value at the end of its life is estimated at 0. iii. The predicted variable costs of production are 55 per pair and fixed costs, excluding depreciation on the production line, are 2.8 million per annum. iv. The predicted sales volume of Berg model is 120,000 pairs per annum for the next 8 years at an estimated selling price of 135 per pair Makaveli AG requires a return of 22% on all new projects. REQUIRED: (a) Using the Net Present Value investment appraisal model, advise Makaveli AG whether to proceed with the manufacture of Berg model. (5 Marks) (b) Carry out a sensitivity analysis on the project showing the sensitivity of your advice to changes in each of the following estimates and rank the project inputs from having the least to most impact on NPV: i. Initial investment ii. Sales (shoe pairs per annum) iii. Selling price per shoe pair iv. Variable cost per shoe pair V. Fixed cost per annum vi. Project life (18 Marks) (c) Using no more than 200 words, discuss the usefulness and limitations of your analysis in (a) and (b) above. (10 Marks) Notes: Ignore taxation. Assume all cash flows arise at the end of each year unless otherwise stated (Total: 33 Marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started