Answered step by step

Verified Expert Solution

Question

1 Approved Answer

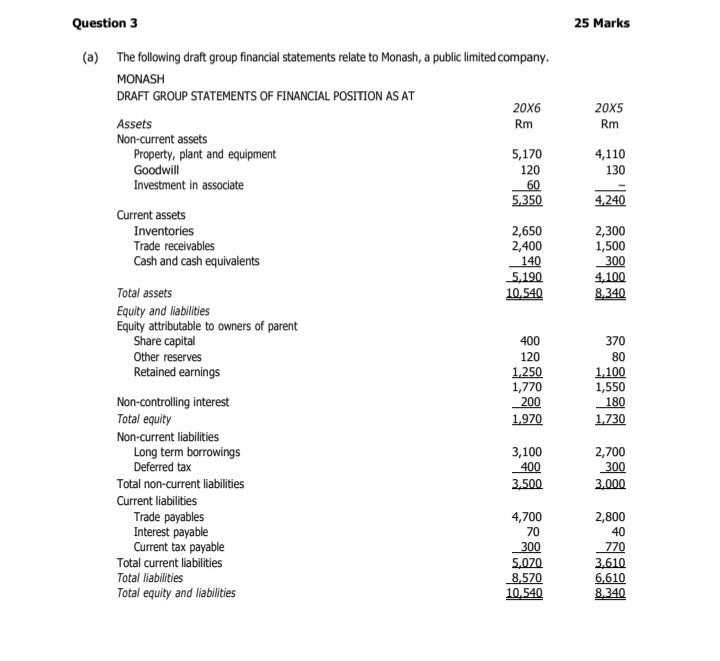

Question 3 25 Marks (a) The following draft group financial statements relate to Monash, a public limited company. MONASH DRAFT GROUP STATEMENTS OF FINANCIAL POSITION

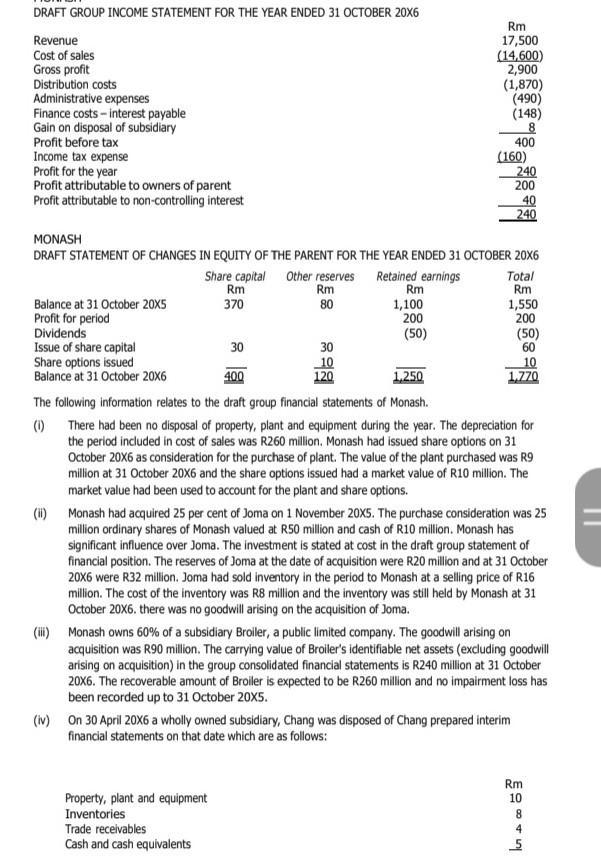

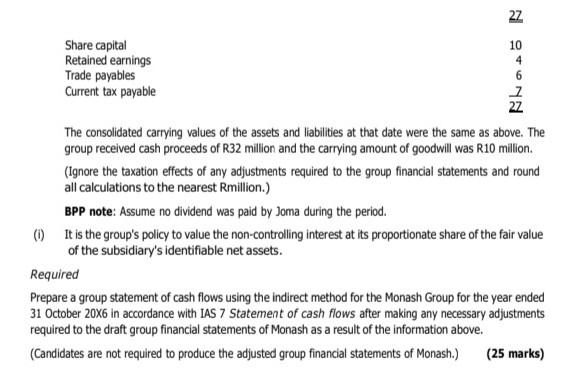

Question 3 25 Marks (a) The following draft group financial statements relate to Monash, a public limited company. MONASH DRAFT GROUP STATEMENTS OF FINANCIAL POSITION AS AT Assets Non-current assets Property, plant and equipment Goodwill Investment in associate MONASH DRAFT STATEMENT OF CHANGES IN EQUITY OF THE PARENT FOR THE YEAR ENDED 31 OCTOBER 206 The following information relates to the draft group financial statements of Monash. (i) There had been no disposal of property, plant and equipment during the year. The depreciation for the period included in cost of sales was R260 million. Monash had issued share options on 31 October 206 as consideration for the purchase of plant. The value of the plant purchased was R9 million at 31 October 206 and the share options issued had a market value of R10 million. The market value had been used to account for the plant and share options. (ii) Monash had acquired 25 per cent of Joma on 1 November 205. The purchase consideration was 25 million ordinary shares of Monash valued at R50 million and cash of R10 million. Monash has significant influence over Joma. The investment is stated at cost in the draft group statement of financial position. The reserves of Joma at the date of acquisition were R20 million and at 31 October 206 were R32 million. Joma had sold inventory in the period to Monash at a selling price of R16 million. The cost of the inventory was R8 million and the inventory was still held by Monash at 31 October 206. there was no goodwill arising on the acquisition of Joma. (iii) Monash owns 60% of a subsidiary Broiler, a public limited company. The goodwill arising on acquisition was R90 million. The carrying value of Broiler's identifiable net assets (excluding goodwill arising on acquisition) in the group consolidated financial statements is R240 million at 31 October 20x6. The recoverable amount of Broiler is expected to be R260 million and no impairment loss has been recorded up to 31 October 205. (iv) On 30 April 206 a wholly owned subsidiary, Chang was disposed of Chang prepared interim financial statements on that date which are as follows: Share capital Retained earnings 10 Trade payables Current tax payable The consolidated carrying values of the assets and liabilities at that date were the same as above. The group received cash proceeds of R32 million and the carrying amount of goodwill was R10 million. (Ignore the taxation effects of any adjustments required to the group financial statements and round all calculations to the nearest Rmillion.) BPP note: Assume no dividend was paid by Joma during the period. (i) It is the group's policy to value the non-controlling interest at its proportionate share of the fair value of the subsidiary's identifiable net assets. Required Prepare a group statement of cash flows using the indirect method for the Monash Group for the year ended 31 October 206 in accordance with IAS 7 Statement of cash flows after making any necessary adjustments required to the draft group financial statements of Monash as a result of the information above. (Candidates are not required to produce the adjusted group financial statements of Monash.) (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started