Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need this ASAP. please state the answers clearly. showing the work on excel is fine. thank you! Benford Inc. is planning to open a

i need this ASAP. please state the answers clearly. showing the work on excel is fine. thank you!

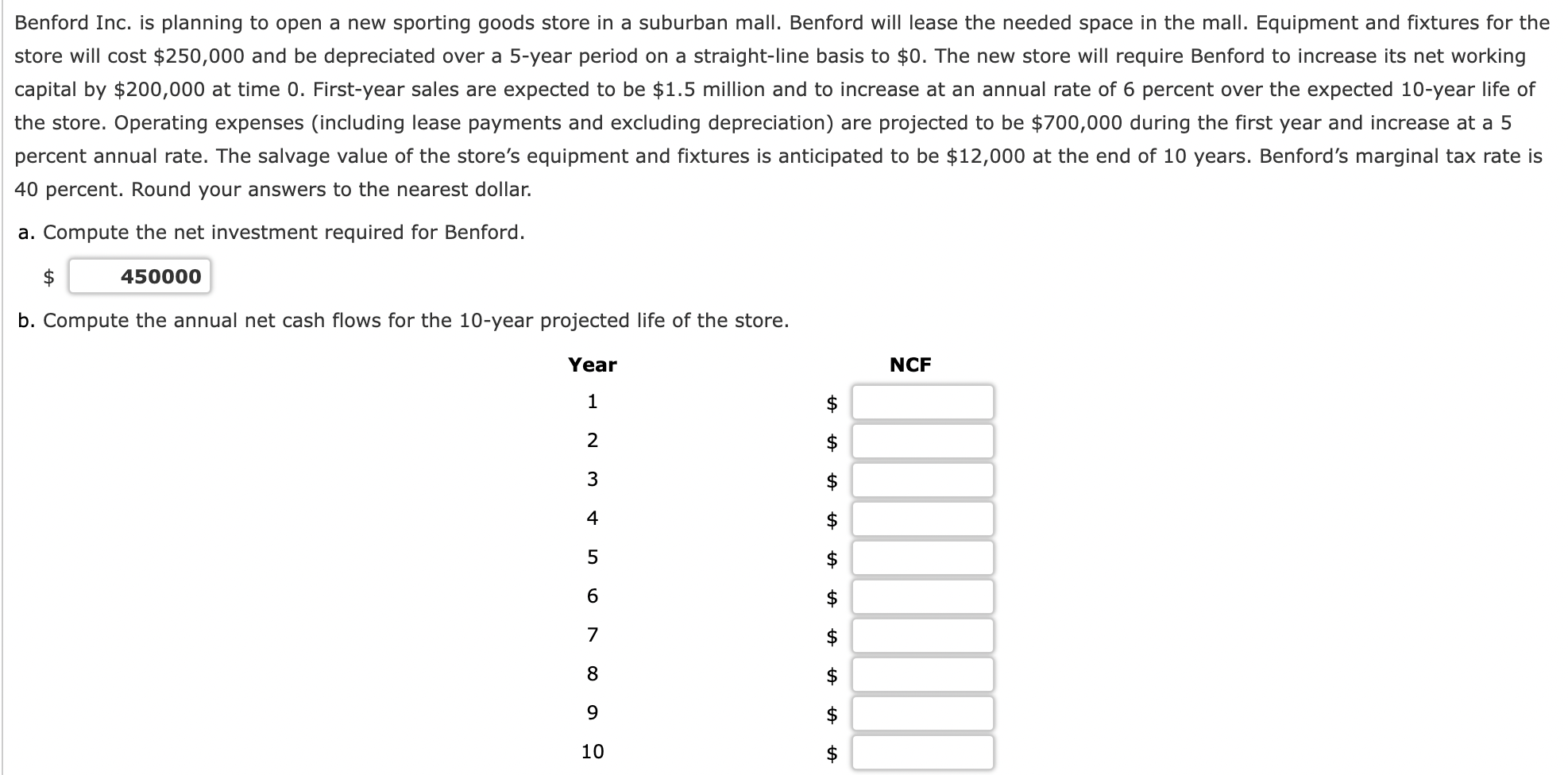

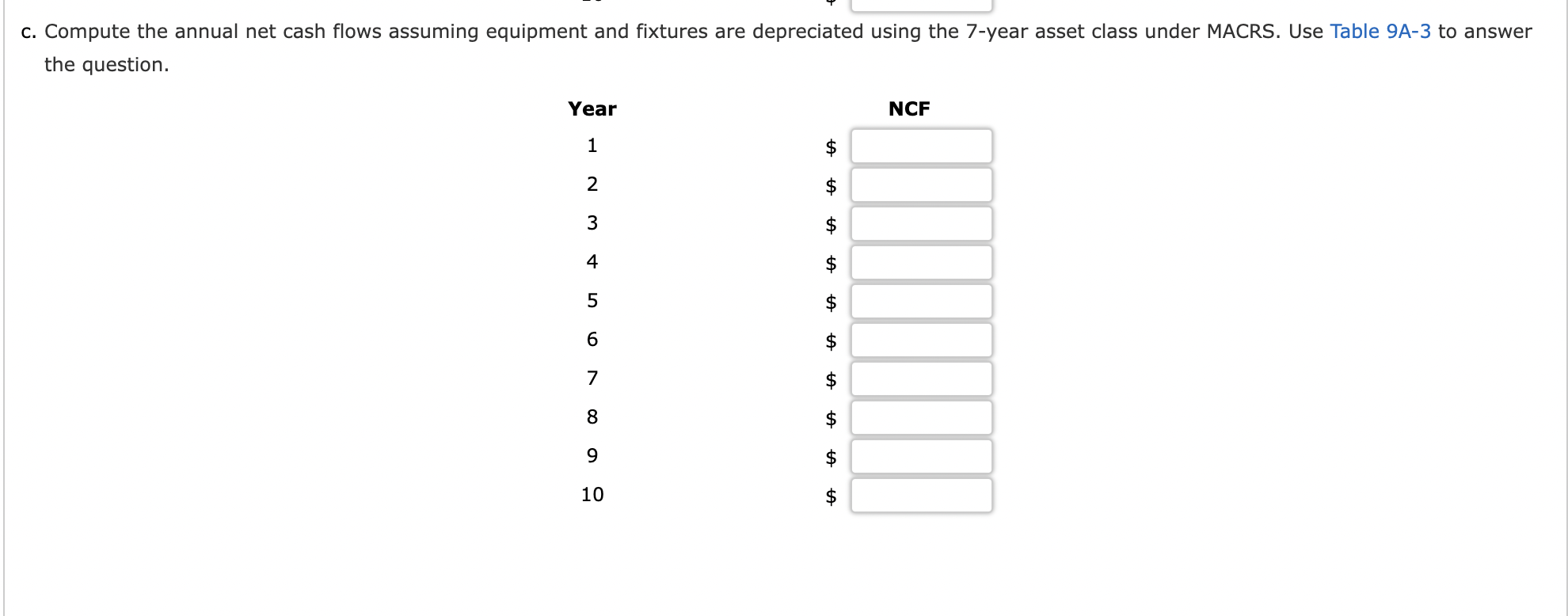

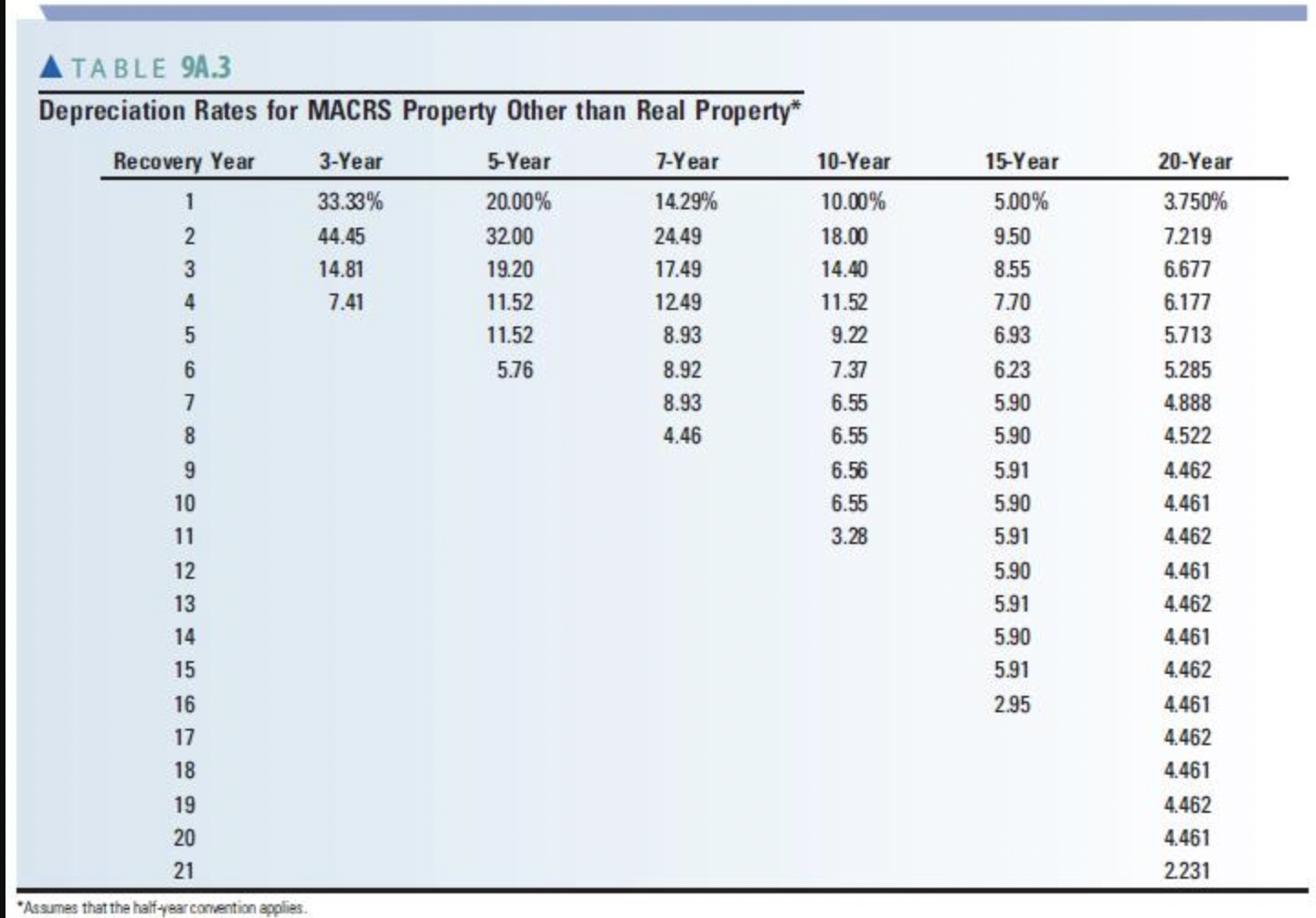

Benford Inc. is planning to open a new sporting goods store in a suburban mall. Benford will lease the needed space in the mall. Equipment and fixtures for the store will cost $250,000 and be depreciated over a 5-year period on a straight-line basis to $0. The new store will require Benford to increase its net working capital by $200,000 at time 0. First-year sales are expected to be $1.5 million and to increase at an annual rate of 6 percent over the expected 10-year life of the store. Operating expenses (including lease payments and excluding depreciation) are projected to be $700,000 during the first year and increase at a 5 percent annual rate. The salvage value of the store's equipment and fixtures is anticipated to be $12,000 at the end of 10 years. Benford's marginal tax rate is 40 percent. Round your answers to the nearest dollar. a. Compute the net investment required for Benford. $ 450000 b. Compute the annual net cash flows for the 10-year projected life of the store. Year 1 2 3 4 5 6700 8 9 10 A tA LA LA NCF c. Compute the annual net cash flows assuming equipment and fixtures are depreciated using the 7-year asset class under MACRS. Use Table 9A-3 to answer the question. Year 1 2 3 4 LO 5 6 7 8 9 10 $ $ $ $ tA tA $ LA VA HA NCF TABLE 9A.3 Depreciation Rates for MACRS Property Other than Real Property* Recovery Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 *Assumes that the half-year convention applies. 3-Year 33.33% 44.45 14.81 7.41 5-Year 20.00% 32.00 19.20 11.52 11.52 5.76 7-Year 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 10-Year 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 15-Year 5.00% 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 20-Year 3.750% 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started