I need this asap please. thank you

I need this asap please. thank you

2.

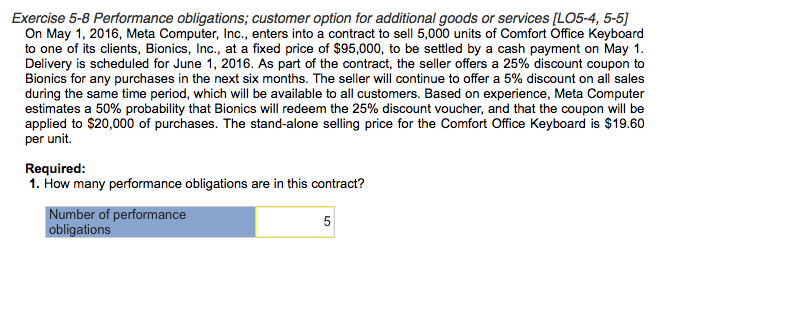

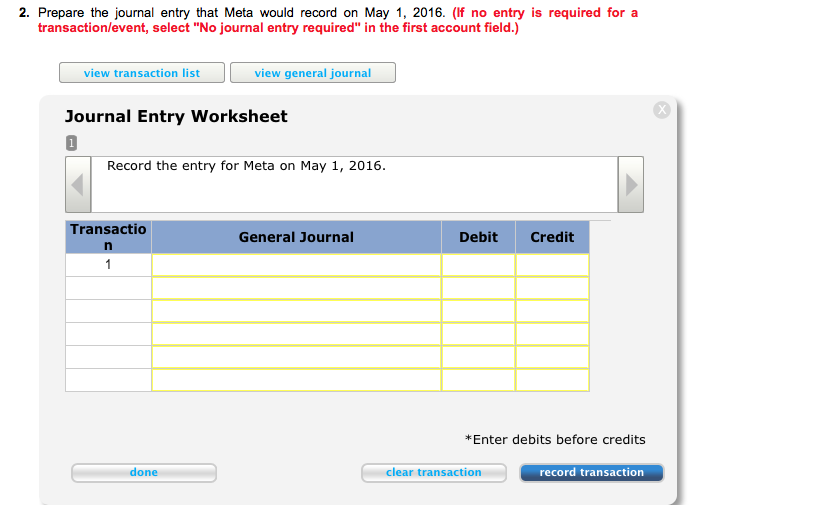

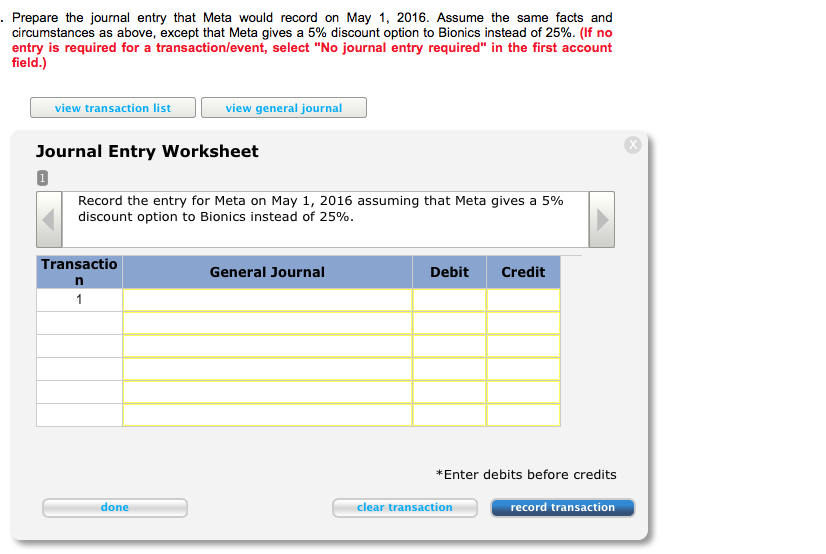

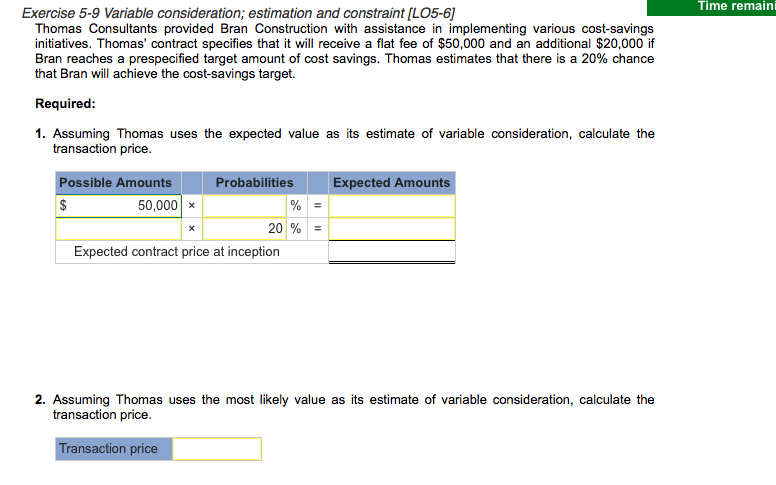

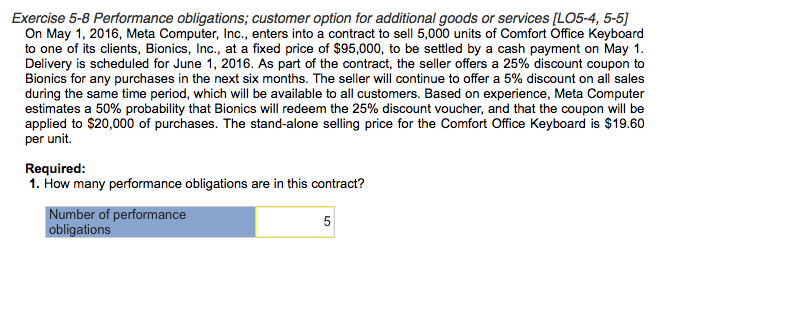

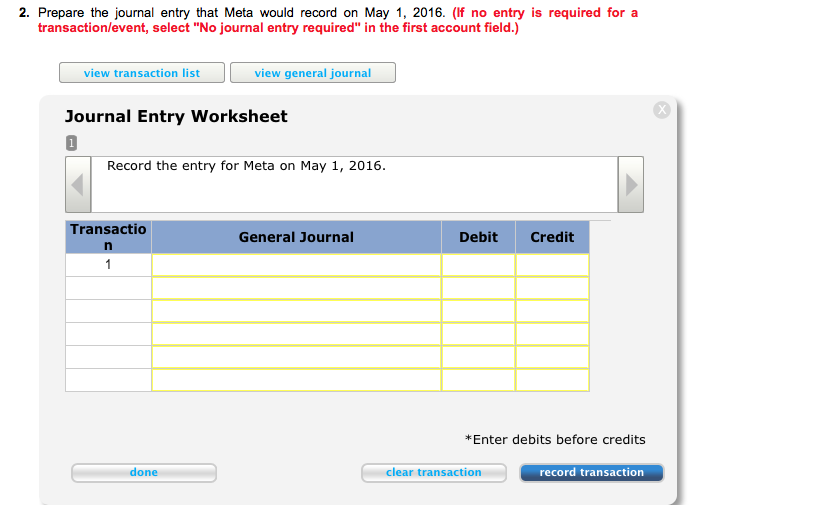

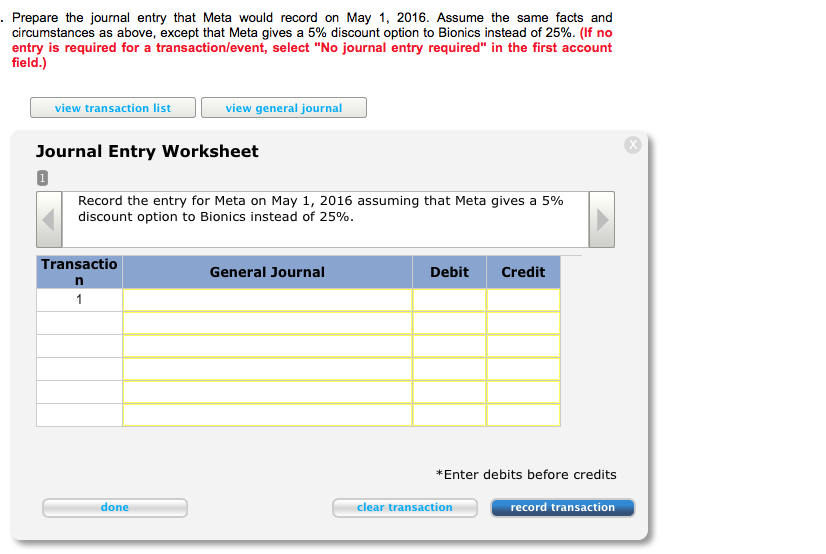

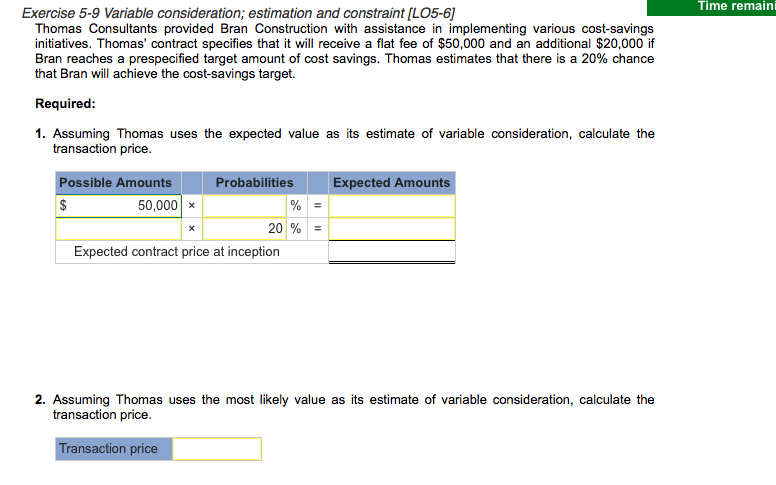

Exercise 5-9 Variable consideration; estimation and constraint [LO5-6] Thomas Consultants provided Bran Construction with assistance in implementing various cost-savings initiatives. Thomas' contract specifies that it will receive a flat fee of $50,000 and an additional $20,000 if Bran reaches a prespecified target amount of cost savings. Thomas estimates that there is a 20% chance that Bran will achieve the cost-savings target. Required: Assuming Thomas uses the expected value as its estimate of variable consideration, calculate the transaction price. Assuming Thomas uses the most likely value as its estimate of variable consideration, calculate the transaction price. Exercise 5-8 Performance obligations; customer option for additional goods or services [LO5-4, 5-5] On May 1, 2016, Meta Computer, Inc., enters into a contract to sell 5,000 units of Comfort Office Keyboard to one of its clients, Bionics, Inc., at a fixed price of $95,000, to be settled by a cash payment on May 1. Delivery is scheduled for June 1, 2016. As part of the contract, the seller offers a 25% discount coupon to Bionics for any purchases in the next six months. The seller will continue to offer a 5% discount on all sales during the same time period, which will be available to all customers. Based on experience, Meta Computer estimates a 50% probability that Bionics will redeem the 25% discount voucher, and that the coupon will be applied to $20,000 of purchases. The stand-alone selling price for the Comfort Office Keyboard is $19.60 per unit. Required: How many performance obligations are in this contract? Prepare the journal entry that Meta would record on May 1, 2016. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal Entry Worksheet Record the entry for Meta on May 1, 2016. * Enter debits before credits Prepare the journal entry that Meta would record on May 1, 2016. Assume the same facts and circumstances as above, except that Meta gives a 5% discount option to Bionics instead of 25%. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal Entry Worksheet Record the entry for Meta on May 1, 2016 assuming that Meta gives a 5% discount option to Bionics instead of 25%. * Enter debits before credits Exercise 5-9 Variable consideration; estimation and constraint [LO5-6] Thomas Consultants provided Bran Construction with assistance in implementing various cost-savings initiatives. Thomas' contract specifies that it will receive a flat fee of $50,000 and an additional $20,000 if Bran reaches a prespecified target amount of cost savings. Thomas estimates that there is a 20% chance that Bran will achieve the cost-savings target. Required: Assuming Thomas uses the expected value as its estimate of variable consideration, calculate the transaction price. Assuming Thomas uses the most likely value as its estimate of variable consideration, calculate the transaction price. Exercise 5-8 Performance obligations; customer option for additional goods or services [LO5-4, 5-5] On May 1, 2016, Meta Computer, Inc., enters into a contract to sell 5,000 units of Comfort Office Keyboard to one of its clients, Bionics, Inc., at a fixed price of $95,000, to be settled by a cash payment on May 1. Delivery is scheduled for June 1, 2016. As part of the contract, the seller offers a 25% discount coupon to Bionics for any purchases in the next six months. The seller will continue to offer a 5% discount on all sales during the same time period, which will be available to all customers. Based on experience, Meta Computer estimates a 50% probability that Bionics will redeem the 25% discount voucher, and that the coupon will be applied to $20,000 of purchases. The stand-alone selling price for the Comfort Office Keyboard is $19.60 per unit. Required: How many performance obligations are in this contract? Prepare the journal entry that Meta would record on May 1, 2016. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal Entry Worksheet Record the entry for Meta on May 1, 2016. * Enter debits before credits Prepare the journal entry that Meta would record on May 1, 2016. Assume the same facts and circumstances as above, except that Meta gives a 5% discount option to Bionics instead of 25%. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal Entry Worksheet Record the entry for Meta on May 1, 2016 assuming that Meta gives a 5% discount option to Bionics instead of 25%. * Enter debits before credits

I need this asap please. thank you

I need this asap please. thank you