Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need this done in excel with formulas shown. The data is taken from WFM (Whole Foods Markert) Thanks! For this assignment, use WFM as

I need this done in excel with formulas shown. The data is taken from WFM (Whole Foods Markert) Thanks!

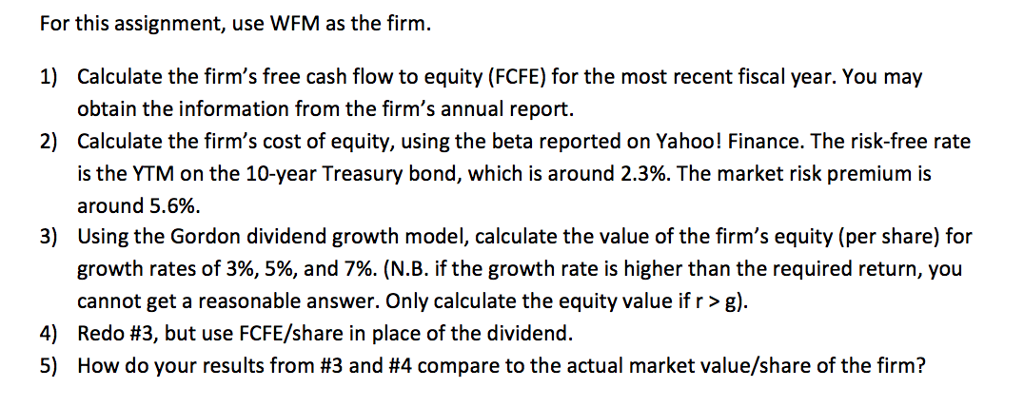

For this assignment, use WFM as the firm. 1) Calculate the firm's free cash flow to equity (FCFE) for the most recent fiscal year. You may obtain the information from the firm's annual report. 2) Calculate the firm's cost of equity, using the beta reported on Yahoo! Finance. The risk-free rate is the YTM on the 10-year Treasury bond, which is around 2.3%. The market risk premium is around 5.6% 3) Using the Gordon dividend growth model, calculate the value of the firm's equity (per share) for growth rates of 3%, 5%, and 7%. (N.B. if the growth rate is higher than the required return, you cannot get a reasonable answer. Only calculate the equity value if r g). 4) Redo #3, but use FCFE/share in place of the dividend. 5) How do your results from #3 and #4 compare to the actual market value/share of the firm? For this assignment, use WFM as the firm. 1) Calculate the firm's free cash flow to equity (FCFE) for the most recent fiscal year. You may obtain the information from the firm's annual report. 2) Calculate the firm's cost of equity, using the beta reported on Yahoo! Finance. The risk-free rate is the YTM on the 10-year Treasury bond, which is around 2.3%. The market risk premium is around 5.6% 3) Using the Gordon dividend growth model, calculate the value of the firm's equity (per share) for growth rates of 3%, 5%, and 7%. (N.B. if the growth rate is higher than the required return, you cannot get a reasonable answer. Only calculate the equity value if r g). 4) Redo #3, but use FCFE/share in place of the dividend. 5) How do your results from #3 and #4 compare to the actual market value/share of the firmStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started