I need this in 30 min. Thank you !

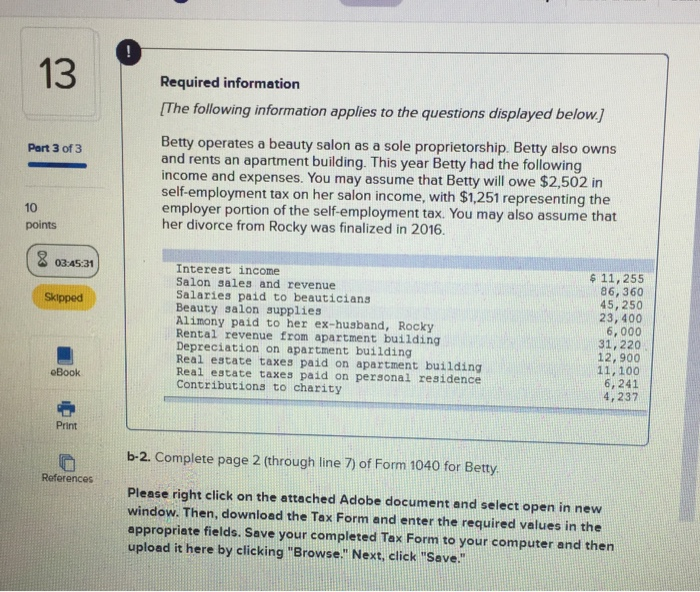

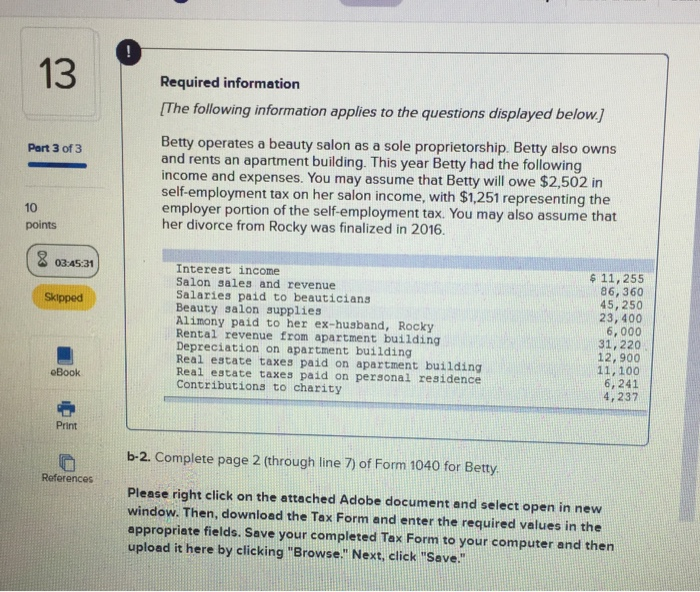

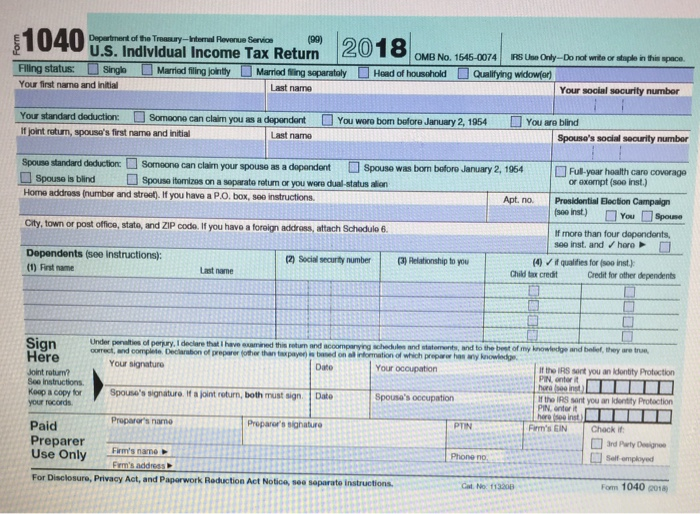

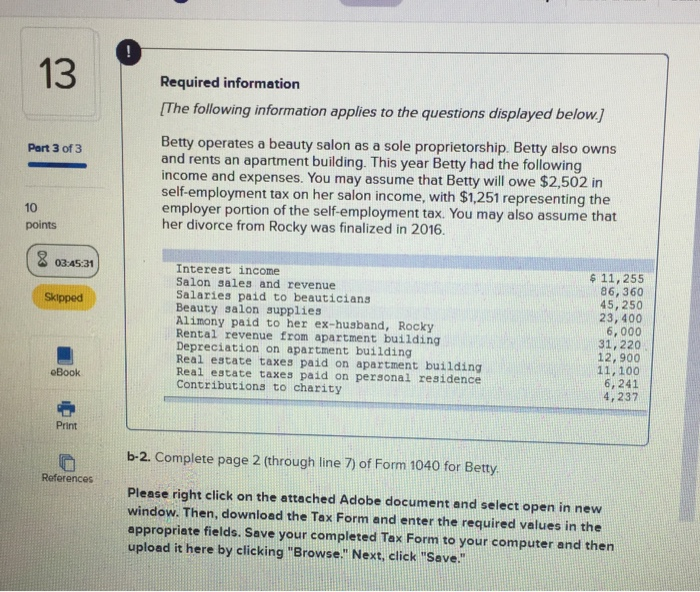

13 Required information [The following information applies to the questions displayed below.] Betty operates a beauty salon as a sole proprietorship. Betty also owns and rents an apartment building. This year Betty had the following income and expenses. You may assume that Betty will owe $2,502 in self-employment tax on her salon income, with $1,251 representing the employer portion of the self-employment tax. You may also assume that her divorce from Rocky was finalized in 2016. Part 3 of 3 10 points 03:45:31 Interest income Salon sales and revenue Salaries paid to beauticians Beauty salon supplies Alimony paid to her ex-husband, Rocky Rental revenue from apartment building Depreciation on apartment building Real estate taxes paid on apartment building Real estate taxes paid on personal residence Contributions to charity $ 11,255 6, 360 45, 250 23, 400 6,000 31,220 12, 900 11,100 6, 241 4,237 Skipped oBook Print b-2. Complete page 2 (through line 7) of Form 1040 for Betty References Please right click on the attached Adobe document and select open in new window. Then, download the Tax Form and enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save." 1040 Department of the Treasay-Intemal Revenue Servic (99) 2018 U.S. Indlvidual Income Tax Return OMB No. 1646-0074 RS Use Only-Do not write or stople in this space. Filling status: Singla Marriod filing jointly Married ling soparatoly Head of housohold Qualifying widowfor) Your first name and initial Last name Your social socurity numbor Your standard docuction: Somoone can claim you as a depandant You woro bom before January 2, 1954 You are blind If joint rotun, spouse's first nama and initial Last name Spouse's social security number Spouse standard doduction Someone can claim your spouso as a dopondant Spouse was bom boforo January 2, 1954 Full-yoar hoalth care coverage or axempt (soo inst.) Spouse is blind Home addross (number and stroot). If you have a P.O. box, seo instructions. Spouse itomizes on a soparate rotum or you were dual-status alion Apt. no. Prosidontial Election Campaign (soo inst) You Spouse City, town or post office, stato, and ZIP code. If you have a foraign addross, attach Schedule 6 If more than four dopandants, see inst. and horo Dependents (see instructions): (2) Social securty number (3) Relationship to you (4) qualfies for (soo inst) (1) First name Last name Child tax credit Credit for other dependents Sign Here Under penalties of perjury, I declare that I have axamined this return and acoomparying schedules and statements, and to the best of my knowledge and belief, they are true oorect, and oomplete. Declaabion of preparer (other than taxpayer) is baned on all infomation of which preparor has any knowledge, Your signature Date Your occupation If the IRS sent you an kdontity Protection PIN, anter it hae see inst ) Joint ratum? See instructions. Koop a copy for your rocords Spouse's signature. If a joint roturn, both must sign Date Spousa's occupation If the IRS sant you an ldentity Protaction PIN, anter it hare (see inst) Firm's EIN Proparor's namo Proparor's sighature Paid PTIN Chack if Preparer Use Only 3rd Party Deeignoe Firm's name Phone no Self omployed Firrm's address For Disclosure, Privacy Act, and Paporwork Reduction Act Notica, see separate instructions Fom 1040 a018 Cat No: f13208