Answered step by step

Verified Expert Solution

Question

1 Approved Answer

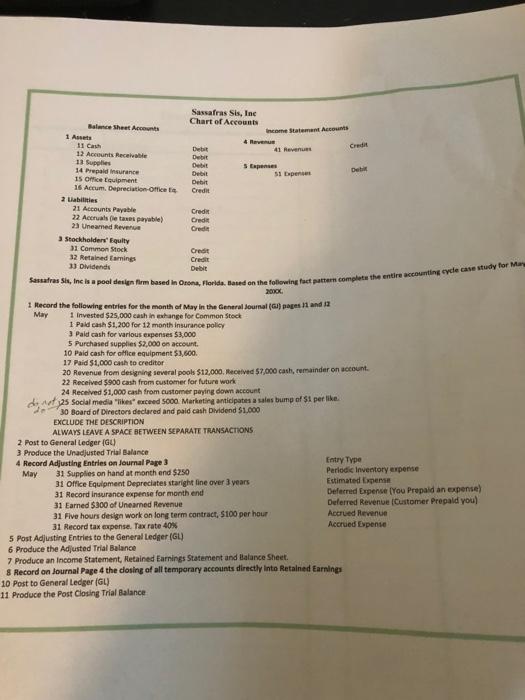

Debit Debit Balance Sheet Accounts 1 Assets 11 Cash 12 Accounts Receivable Sassafras Sis, Inc Chart of Accounts Income Statement Accounts 4 Revenue Credit

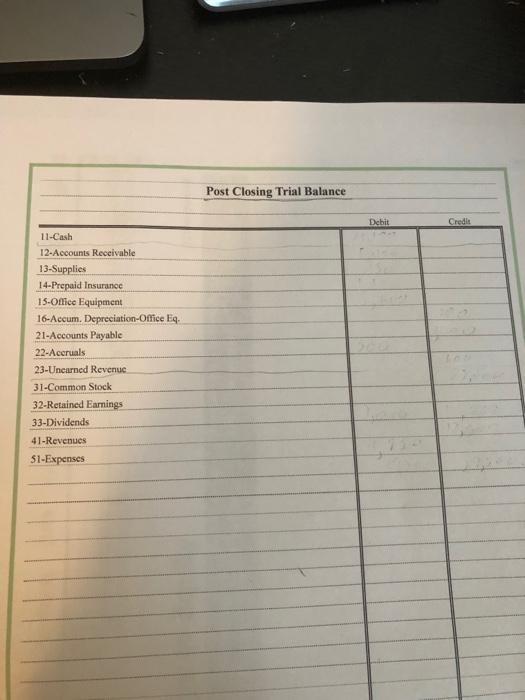

Debit Debit Balance Sheet Accounts 1 Assets 11 Cash 12 Accounts Receivable Sassafras Sis, Inc Chart of Accounts Income Statement Accounts 4 Revenue Credit 41 Revenues 13 Supplies Debit 5 Expenses Debit 14 Prepaid Insurance Debit 51 Expenses 15 Office Equipment Debit 16 Accum. Depreciation-Office E Credit 2 Liabilities 21 Accounts Payable Credit 22 Accruals (le taxes payable) Credit 23 Uneamed Revenue Credit 3 Stockholders' Equity 31 Common Stock 32 Retained Earnings 33 Dividends Credit Credit Debit Sassafras Sis, Inc is a pool design firm based in Orona, Florida. Based on the following fact pattern complete the entire accounting cycle case study for Ma 20XX 1 Record the following entries for the month of May in the General Journal (GI) pages 11 and 12 May 1 Invested $25,000 cash in exhange for Common Stock 1 Paid cash $1,200 for 12 month insurance policy 3 Paid cash for various expenses $3,000 5 Purchased supplies $2,000 on account. 10 Paid cash for office equipment $3,600. 17 Paid $1,000 cash to creditor 20 Revenue from designing several pools $12,000. Received $7,000 cash, remainder on account. 22 Received $900 cash from customer for future work 24 Received $1,000 cash from customer paying down account det 25 Social media "likes" exceed 5000. Marketing anticipates a sales bump of $1 per like. de 30 Board of Directors declared and paid cash Dividend $1,000 EXCLUDE THE DESCRIPTION ALWAYS LEAVE A SPACE BETWEEN SEPARATE TRANSACTIONS 2 Post to General Ledger (GL) 3 Produce the Unadjusted Trial Balance 4 Record Adjusting Entries on Journal Page 3 May 31 Supplies on hand at month end $250 31 Office Equipment Depreciates staright line over 3 years 31 Record insurance expense for month end 31 Earned $300 of Unearned Revenue 31 Five hours design work on long term contract, $100 per hour i 31 Record tax expense. Tax rate 40% 5 Post Adjusting Entries to the General Ledger (GL) 6 Produce the Adjusted Trial Balance 7 Produce an Income Statement, Retained Earnings Statement and Balance Sheet. Entry Type Periodic Inventory expense Estimated Expense Deferred Expense (You Prepaid an expense) Deferred Revenue (Customer Prepaid you) Accrued Revenue Accrued Expense 8 Record on Journal Page 4 the closing of all temporary accounts directly into Retained Earnings 10 Post to General Ledger (GL) 11 Produce the Post Closing Trial Balance 11-Cash 12-Accounts Receivable 13-Supplies 14-Prepaid Insurance 15-Office Equipment 16-Accum. Depreciation-Office Eq. 21-Accounts Payable 22-Accruals 23-Unearned Revenue, 31-Common Stock 32-Retained Earnings 33-Dividends 41-Revenues 51-Expenses Post Closing Trial Balance Debit Credis 500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the task follow these steps Step 1 Record Journal Entries 1 Investment for Common Stock Debit Cash 25000 Credit Common Stock 25000 2 Insur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started